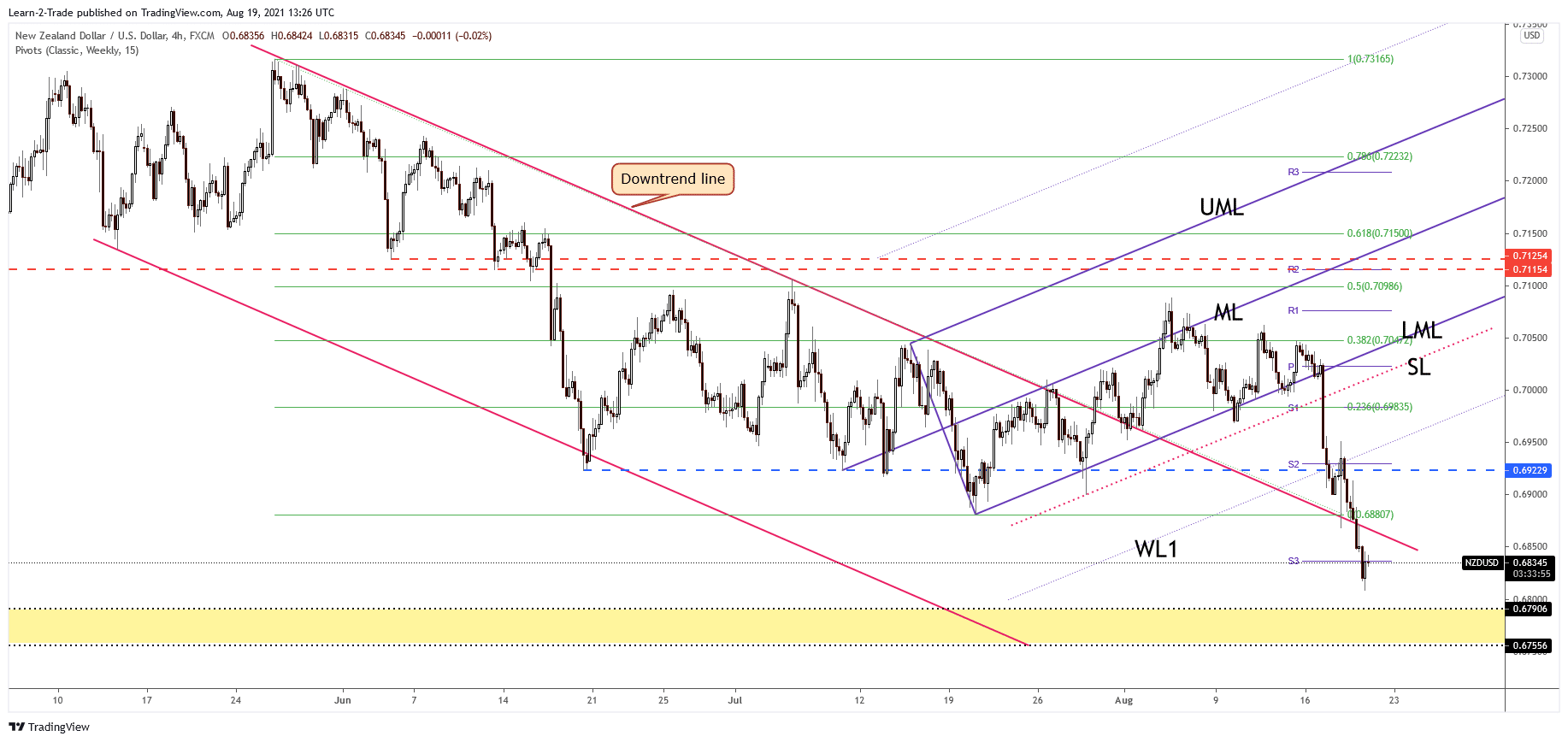

- The NZD/USD pair is under massive selling pressure, so it could drop deeper in the short term.

- The price could rebound if the Dollar Index resumes its current decline.

- Unfortunately, the bullish reversal was invalidated after making a new lower low.

The NZD/USD price maintains a bearish outlook, so a further drop is favored. It’s trading at 0.6836 level at the moment of writing, above key support of 0.6808. The price is fighting hard to rebound after the last days’ fall.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

It has ignored several strong downside obstacles signaling strong sellers. DXY’s amazing rally forced the pair to drop way deeper. The NZD/USD pair is vulnerable to resume its fall as the US Unemployment Claims have dropped unexpectedly lower in the last week.

Unfortunately for the USD, the Philly Fed Manufacturing Index was reported lower at 19.4 points below the 23.2 forecast compared to 21.9 points in the previous reporting period.

As you already know, the Kiwi was punished by RBNZ’s decision to keep its monetary policy on hold. As a result, the Official Cash Rate was kept at 0.25% even if the specialists had expected a rate hike.

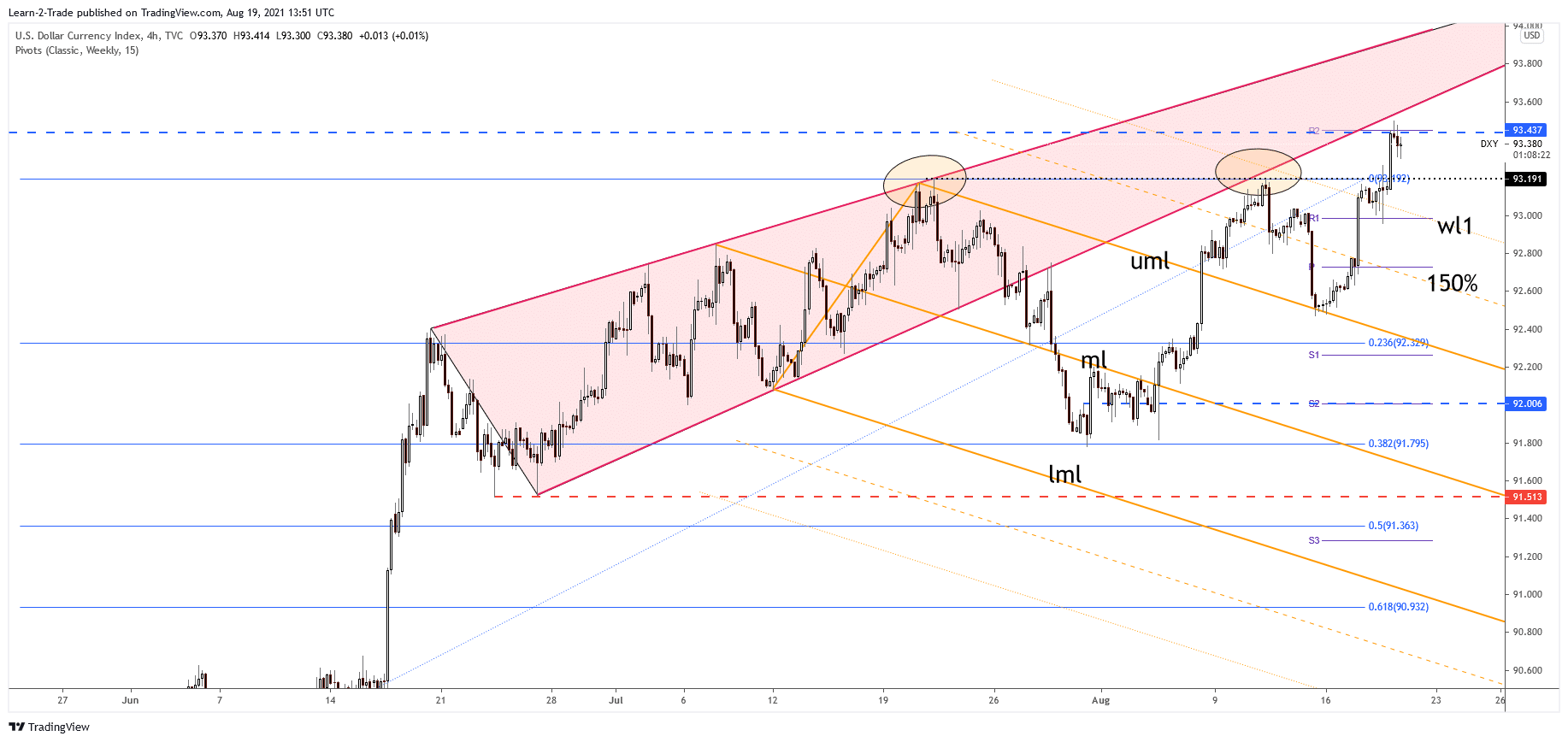

DXY price technical analysis: Mid-93.00 to provide resistance

The DXY Dollar Index has raised as much as 93.50, where it has found strong resistance. Its strong rally helped the greenback to appreciate versus all its rivals, not only versus the NZD. 93.43 level, a higher high, represents strong static resistance.

The current retreat could help the NZD/USD pair to increase a little. The Dollar Index is bullish. It could only register a minor decline before passing above the 93.43 obstacle.

NZD/USD price technical analysis: Bears to keep dominance

The NZD/USD price is hovering below the downtrend line and far below 0.6880 former low. The next major downside target obstacle is seen around 0.6790 – 0.6755 area. Technically, the NZD/USD pair could come back to test and retest the downtrend line in the short term before dropping deeper towards the mentioned support zone.

–Are you interested to learn more about forex signals? Check our detailed guide-

As you can see on the 4-hour chart, the price has invalidated a bullish reversal after registering a new lower low. A temporary rebound is natural after the current massive drop. Coming back towards the immediate resistance levels (support levels have turned into resistance) could help us catch a new downside movement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.