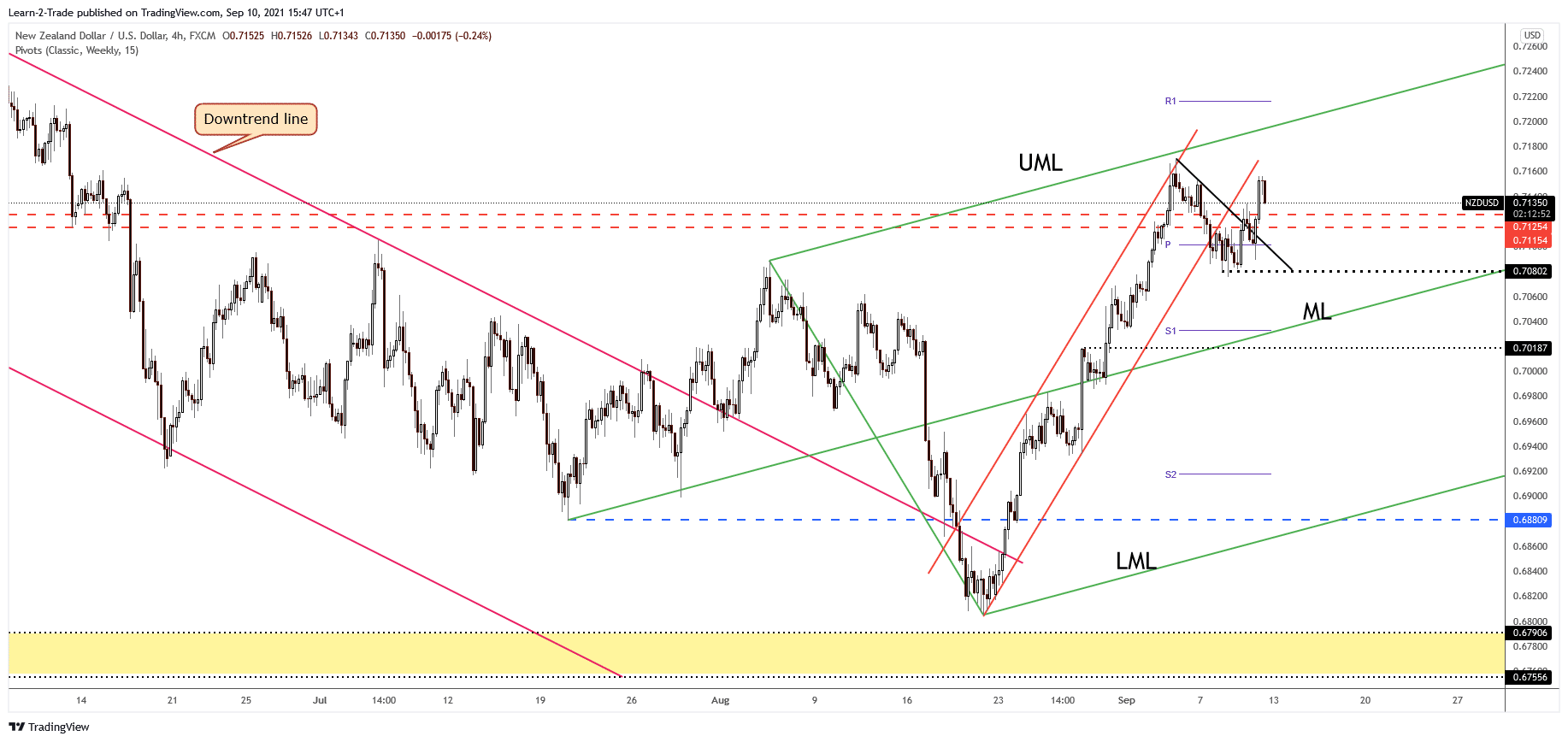

- The NZD/USD has invalidated a deeper correction, so an upside movement is favored.

- The upper median line (UML) could attract the pair as long as it stays above the support zone.

- Only dropping and consolidating low the weekly pivot point could invalidate the upside scenario.

The NZD/USD price drops at the time of writing, located around 0.7135. However, the bias is still bullish. This could only be a temporary decline.

-Are you looking for automated trading? Check our detailed guide-

The price could come back to test the broken levels before jumping higher. Technically, the pair has slipped lower as the Dollar Index has maintained a price of around 92.47 support level.

Fundamentally, the US data has come better than expected earlier, lifting the Greenback. The PPI registered a 0.7% growth in August versus 0.6% expected compared to a 1.0% rise in July, while the Core PPI rose by 0.6%, beating the 0.5% expected and versus 1.0% in the previous reporting period. Also, the Final Wholesale Inventories has come in line with expectations, registering a 0.6% growth.

The NZD/USD pair has jumped higher, invalidating a major downside movement. It has retreated a little, but the bias remains bullish. The pair may extend its rally if the Dollar Index drops further. The price has ignored the positive US data reported in the last two days.

NZD/USD price technical analysis: Upside breakout imminent

As you can see on the 4-hour chart, the NZD/USD pair has slipped lower after failing to reach the ascending pitchfork’s upper median line (UML). As a result, it has escaped from the up channel, but the sellers weren’t strong enough to keep the rate below the weekly pivot point (0.7101).

-If you are interested in forex day trading then have a read of our guide to getting started-

It has managed to come back above the pivot point. The pair has gained as much as 0.7156 today, where it met a strong supply area. Now it drops only because the DXY is trading in the green. So, the NZD/USD pair may come back to test and retest the 0.7115 – 0.7125 support zone.

From the technical point of view, the outlook is bullish as long as it stays above this area. The ascending pitchfork’s upper median line (UML) is seen as an upside target. Fall back to test the median line (ML) signaled that the pair can still approach the upper median line (UML).

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.