TThe NZD/USD price rises, and it seems poised to jump towards new highs. The price action signaled that the downside is limited and that the buyers could take the lead again. The pair moves somehow sideways in the short term. A new higher high could activate an important leg higher.

–Are you interested to learn more about forex trading apps? Check our detailed guide-

DXY’s further drop should help the NZD to drag the pair higher. Technically, if the Dollar Index makes a new lower low, it could activate a larger decline to drop and close below 91.78. This scenario could validate USD’s further depreciation versus all its rivals and not only against the Kiwi.

The pair needs strong support to be able to really activate an upward momentum. Today, the US is to release the Factory Orders and its Wards Total Vehicle Sales. So let’s wait and see how the pair reacts after these economic figures.

Starting from tomorrow, the volatility could be high. The New Zealand Unemployment Rate is expected to drop from 4.7% to 4.4%, while the Employment Change could increase by 0.7% versus 0.6% in the previous reporting period.

The US ADP Non-Farm Employment Change and the ISM Services PMI high-impact indicators will be released as well.

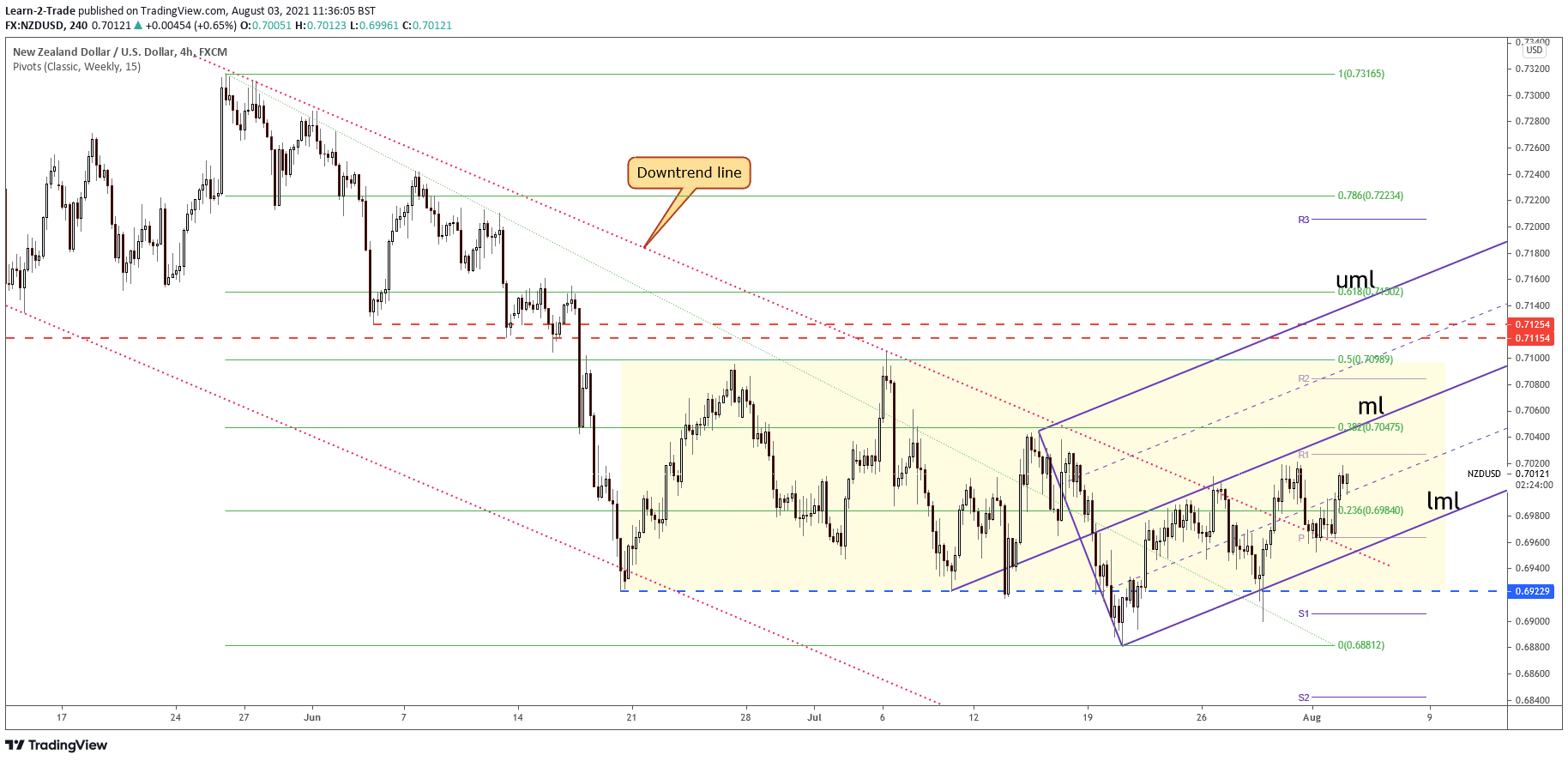

NZD/USD price technical analysis: Median line is the key

The NZD/USD pair has declined after failing to retest the median line (ml). However, it has retested the downtrend line, and now it seems strong enough to make a new higher high. Therefore, the bias is bullish in the short term after failing to stabilize under the weekly pivot point (0.6963).

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Technically, its failure to retest the ascending pitchfork’s lower median line (LML) signaled strong buyers in the short term. The 0.7021 high serves as immediate resistance. A new higher high signals a potential growth at least until the median line (ml).

A valid breakout above the median line may announce sharp growth towards the 50% retracement level. As you can see on the H4 chart, we have a major range, so the pair could come back higher towards the pattern’s resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.