- NZD/USD refreshes intraday high while resisting the previous day’s downtrend.

- Monthly resistance line, previous support, adds extra upside filters to the 0.7100 threshold.

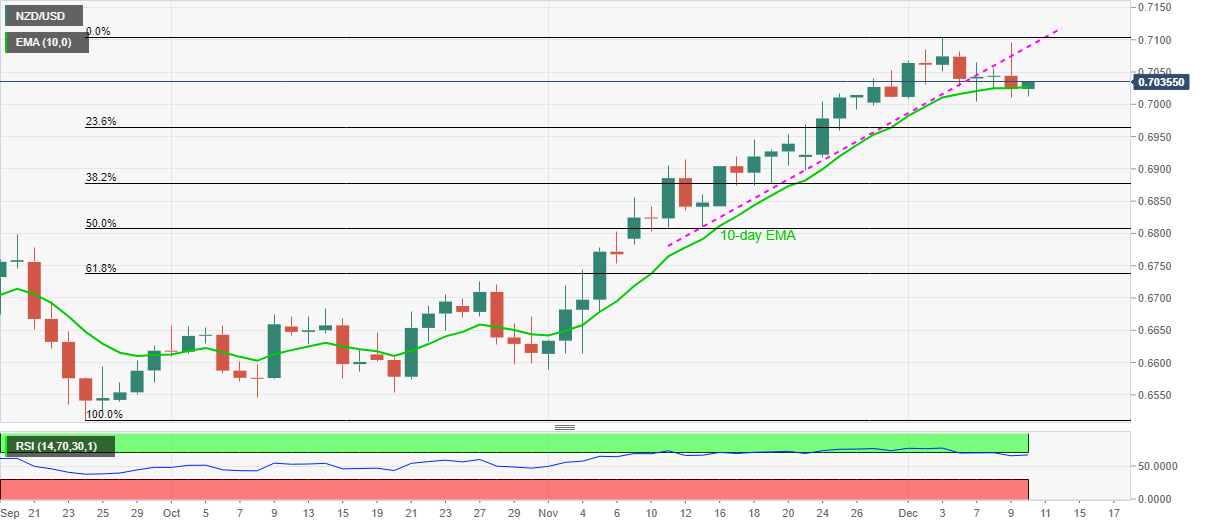

NZD/USD prints mild gains while taking the bids near the intraday high of 0.7035 during early Thursday. The kiwi pair marked the weekly heaviest losses on Wednesday after taking a U-turn from a one-week high of 0.7095. The resulted declines justify Monday’s downside below an ascending support line from November 13 and nearly overbought RSI conditions.

Even so, the quote bounces off 10-day EMA support, currently around 0.7026, with eyes on the previous support line, at 0.7088 now.

While RSI conditions and the stated resistance line can challenge NZD/USD buyers below 0.7100, any further upside will be challenged by the monthly peak near 0.7104.

Alternatively, a daily closing below the 10-day EMA level of 0.7026 will attack the 0.7000 round-figure whereas November 18 high near 0.6945 can entertain kiwi buyers afterward.

In a case where the NZD/USD bears keep the reins past-0.6945, 50% Fibonacci retracement of September-November upside near 0.6805 will be the key.

NZD/USD daily chart

Trend: Further upside expected