- NZD/USD bears are lurking ahead of the GDP event.

- Kiwi is higher following the Fed, but bearish technicals prevail.

Ahead of the Gross Domestic Product, NZD/USD is in bullish company, but the longterm outlook is not so rosy.

The following is a top-down analysis pre-data that illustrates where bulls will need to step cautiously no matter the outcome.

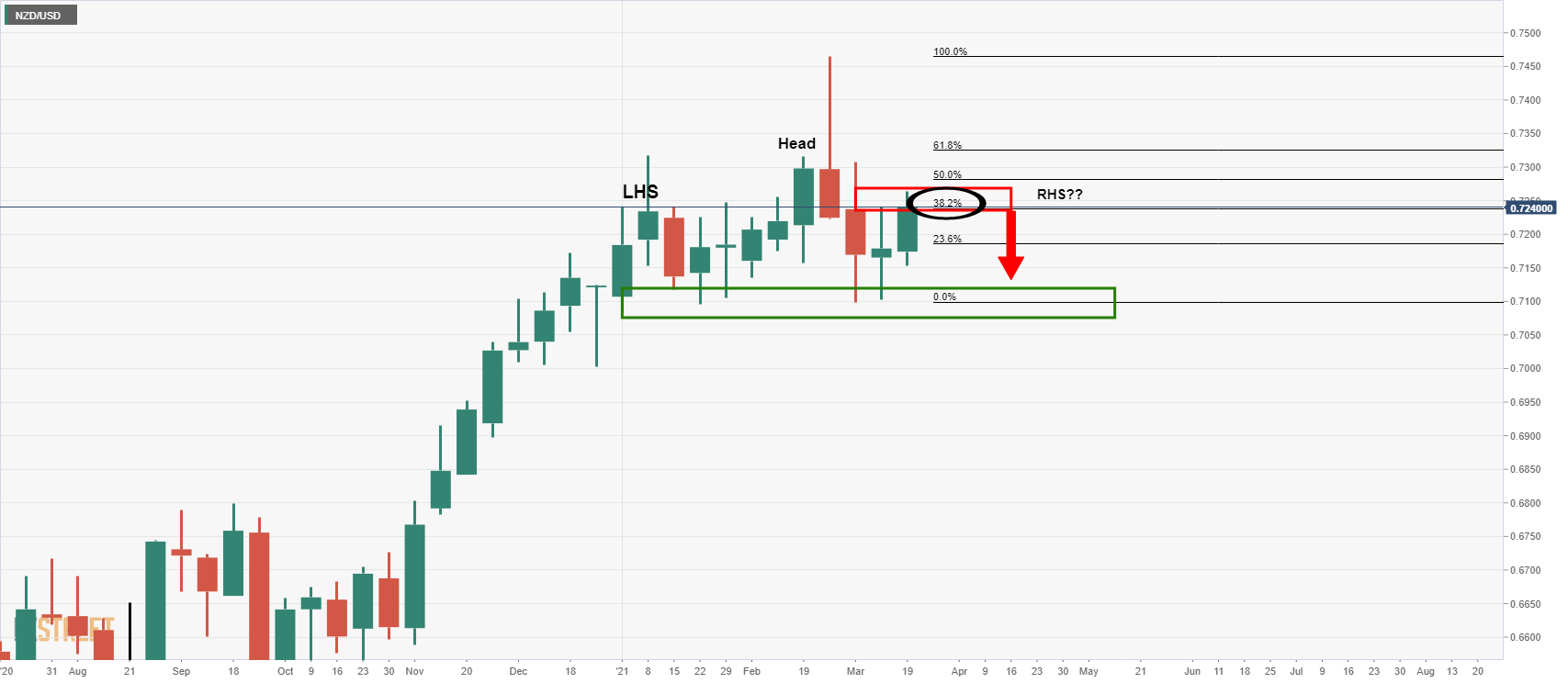

Weekly chart

A bearish topping pattern could be in the making on the weekly chart.

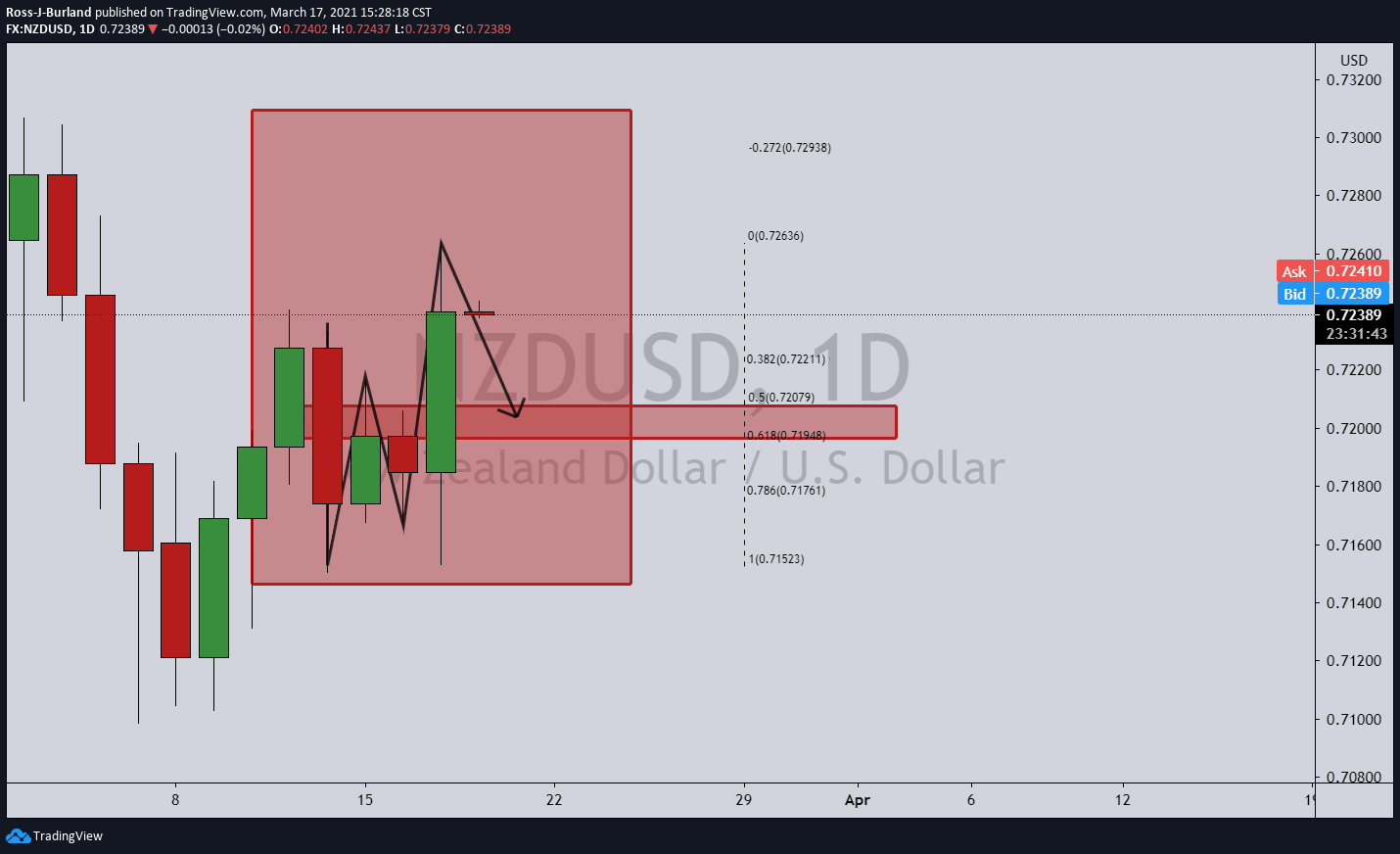

Daily chart

The W-formation is a bearish pattern and the 61.8% Fibo is a keen target to the downside as it meets prior resistance.

At least a 50% mean reversion can be expected at this juncture.

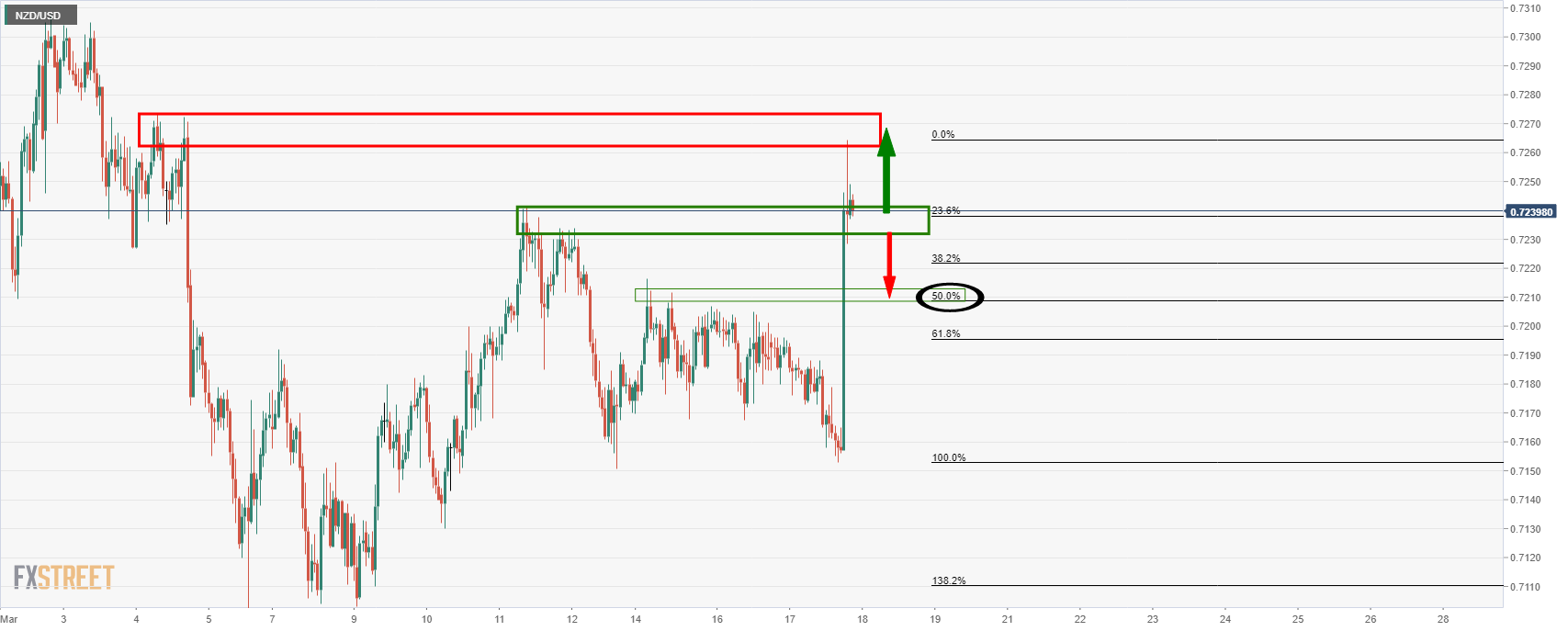

1-hour chart

Meanwhile, the data event has the above levels as targets depending on the outcome.

However, following the Federal Reserve, there is some correction required following such a large move in the US dollar and a 50% mean reversion aligns with the prior resistance structure.