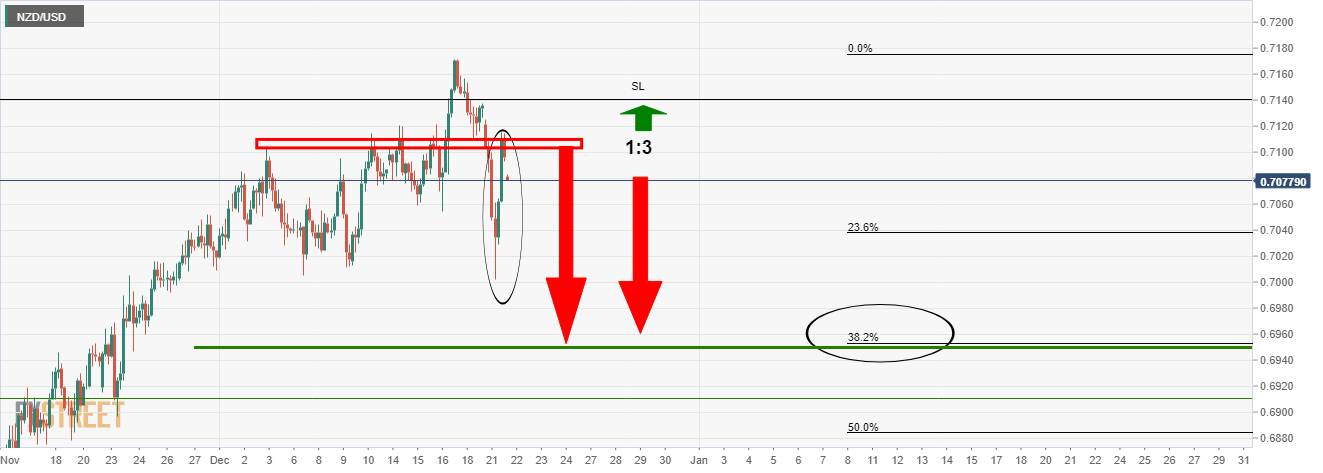

- NZD/USD is offering a 1:3 risk to reward high probability trade setup.

- The US dollar has picked up a bid of late and there could be some juice left in the bullish case.

NZD/USD has been in favour and highly overextended in the positioning data of late.

The recent fundamentals have been baked into the cake which has spurred on a recovery attempt in the greenback.

The following is a top-down analysis that takes these considerations and targets a weekly 38.2% Fibonacci retracement of the W-formation’s impulse.

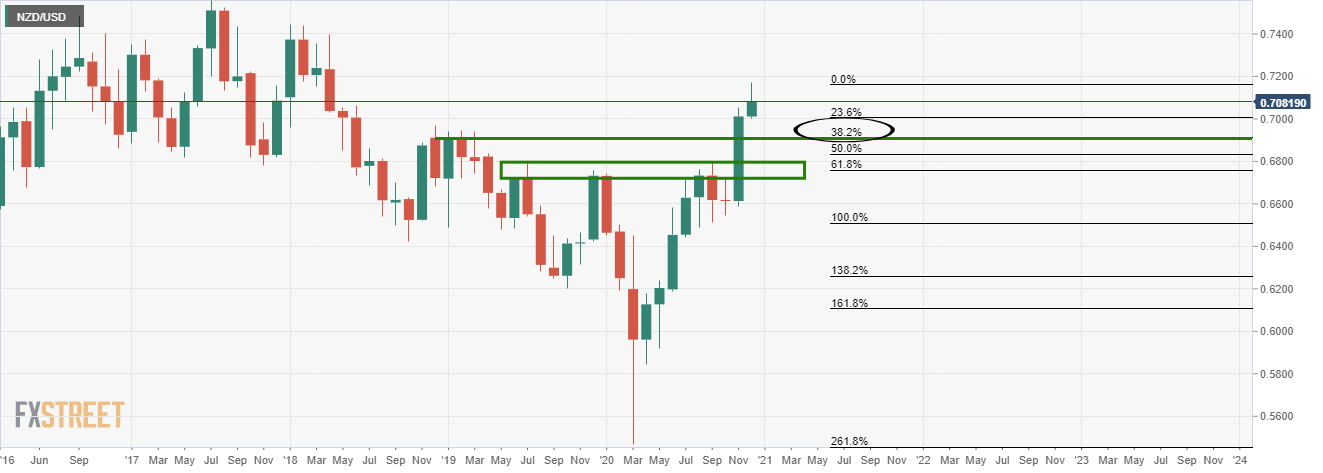

Monthly chart

While the price is bullish above the old resistance, the pair needs a correction and the 38.2% Fibonacci lines-up with old resistance looking left.

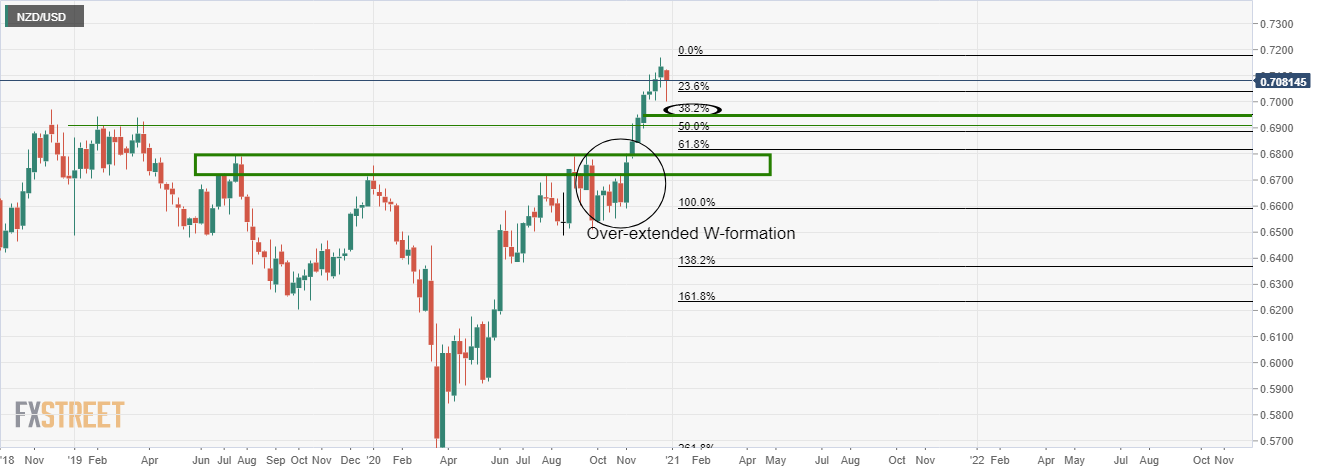

Weekly chart

The weekly W formation is an extended impulse that needs to correct.

The weekly 38.2% is located in line with old structure looking left, slightly higher up than the monthly target.

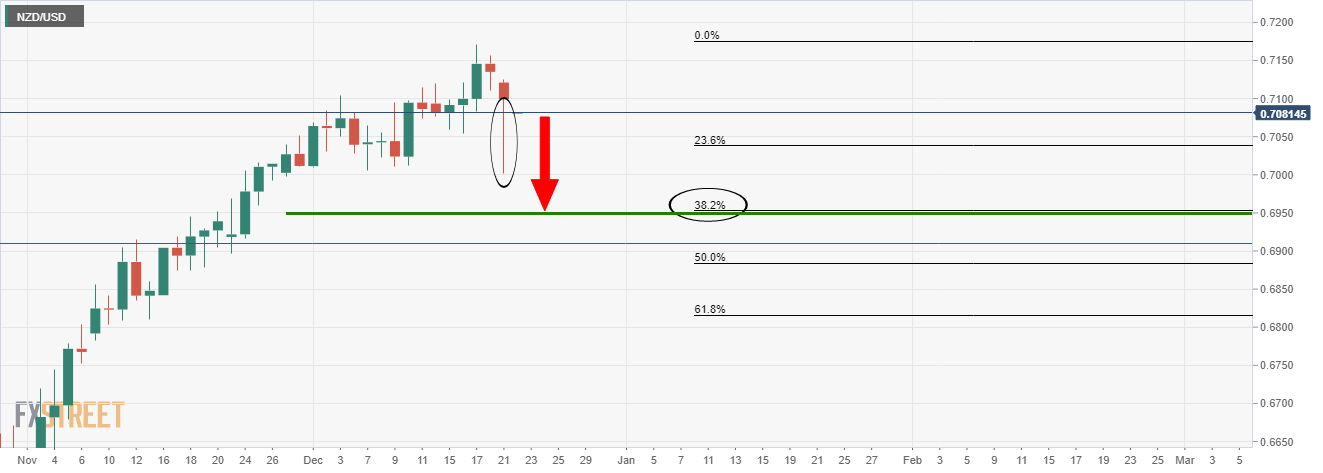

Daily chart

The daily wick would be expected to be filled in.

4-hour chart

A stop-loss, SL, would be placed above the structure and recent highs with a target to the weekly 38.2% Fibo for a 1:3 risk to reward probability.