- NZD/USD bulls are struggling to extend the upside.

- Bears will be seeking a phase of distribution as stretched net-long positioning is off-set.

NZD displays an asymmetric net-long positioning (according to CFTC data). It was the lowest percentage gain in net positions at +0.8% for the week ending 8 December

However, it has added a net positioning change for the year of +28% with the latest positioning at +17%, the highest of the dollar bloc, by some margin compared to the Aussie which is at just +6%.

Speculators have continued to add bearish bets on the dollar, mostly due to optimism about the global recovery as vaccines are rolled out in major economies.

USD net shorts can still increase before aggregate positioning reaches the -18% lows seen in late September and revamped hopes over US fiscal stimulus package were contributing to lift market sentiment in recent weeks as well.

However, NZD’s overstretched positioning may have started to curb more NZD appreciation on the spot market for negative rates have now been fully priced out.

The net-long positioning of the kiwi could entice some long-covering which would be expected hamstring the spot market.

The following is a top-down analysis that illustrates where the next opportunity could come in the spot market.

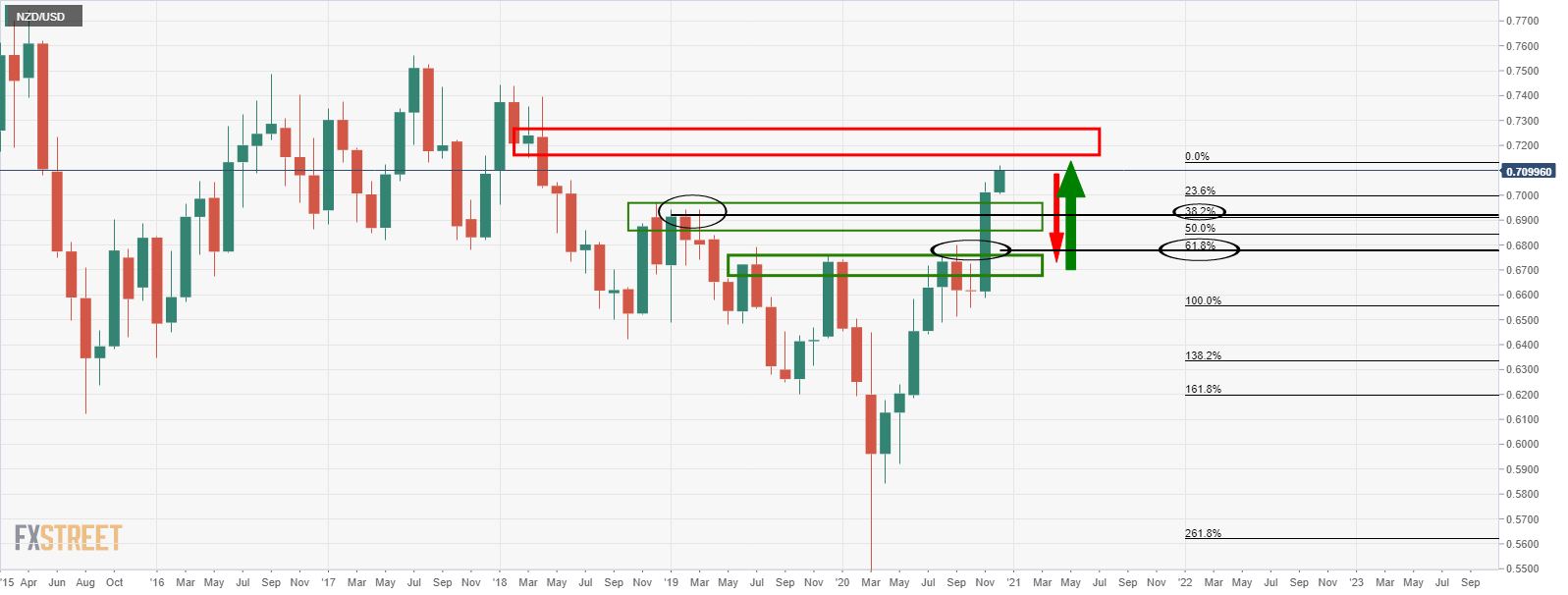

Monthly chart

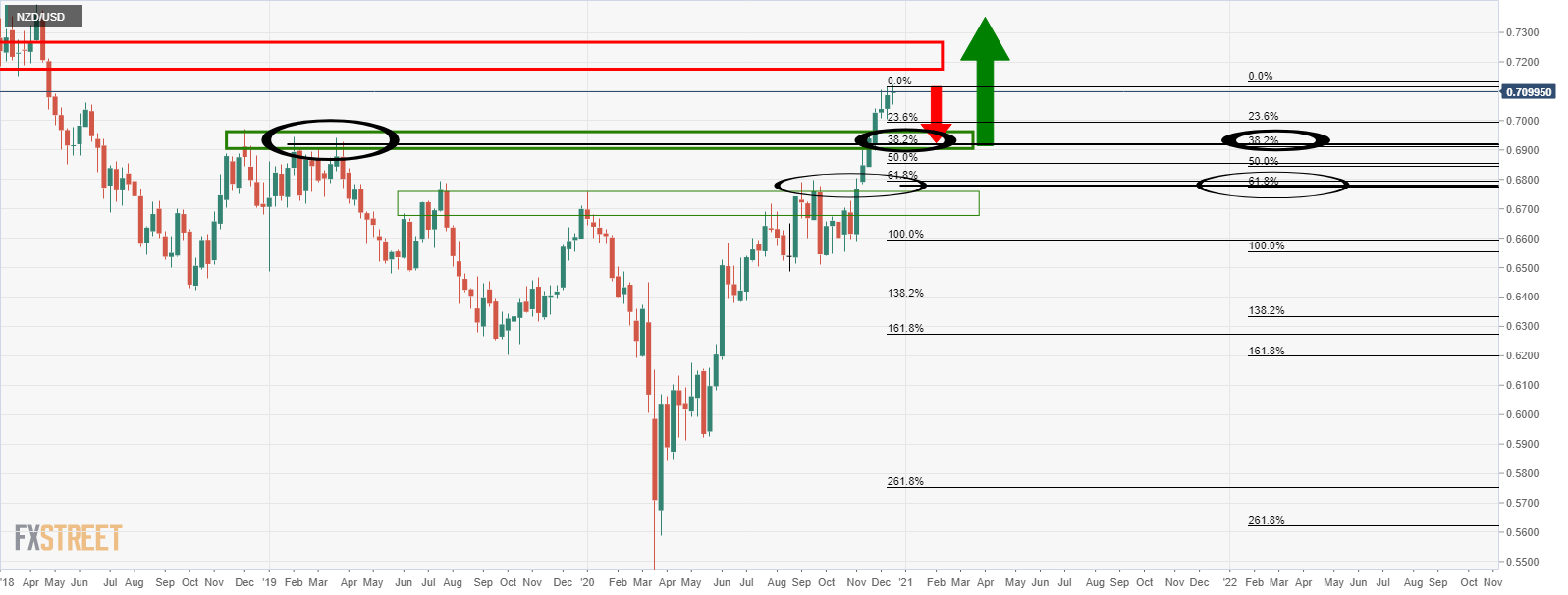

Weekly chart

We are seeing a confluence on the weekly chart which offers an extra layer of conviction to the initial downside target.

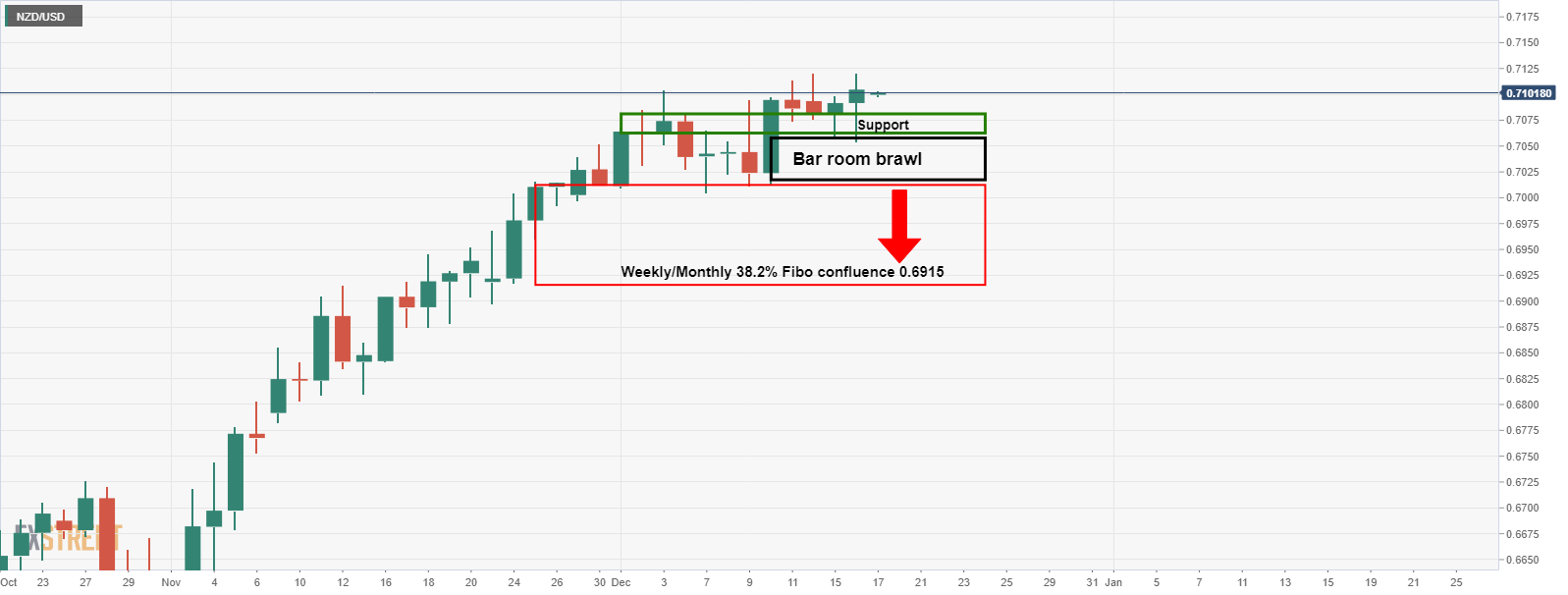

Daily chart

As illustrated, the daily chart remains bullish.

The barroom brawl, on a break of support, would likely be where the speculators will start to distribute the kiwi and only then would there be a higher probability trading opportunity towards the weekly 38.2% target.

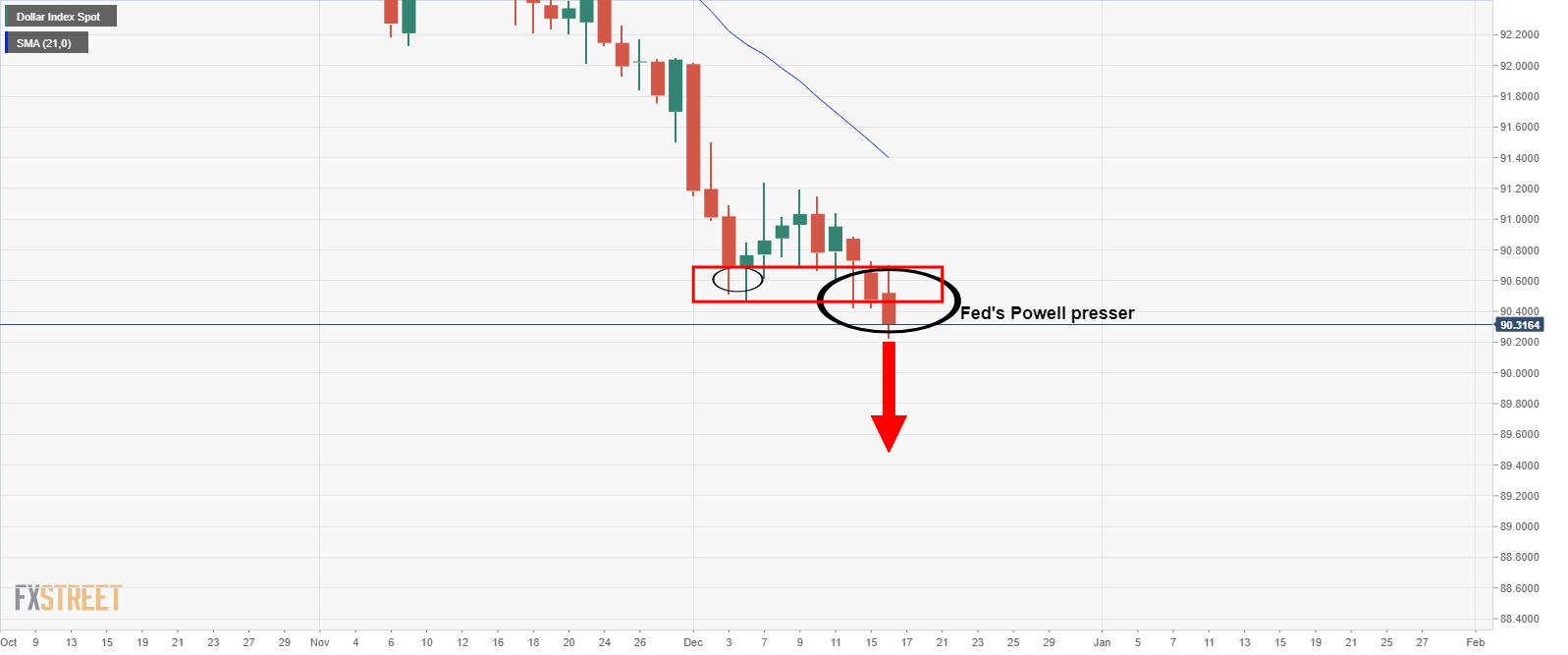

DXY daily chart

The dollar is sinking into the abyss, so it will take some hugely bullish fundamentals to pull it out.