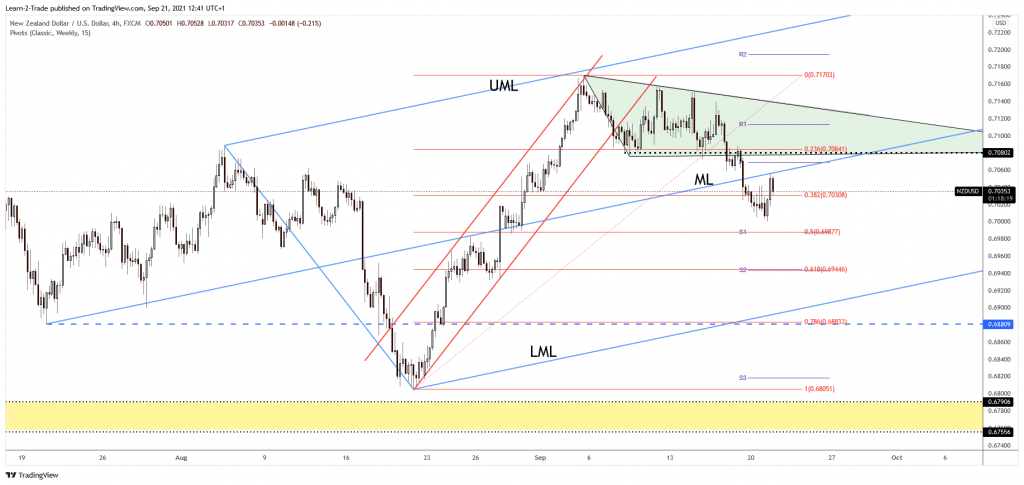

- The NZD/USD pair is trading in the red after retesting the median line (ML), which represents a dynamic resistance.

- The bias is bearish, so the price could come back down towards a 0.70 psychological level soon.

- A new lower low may activate a deeper drop towards the 61.8% retracement level.

The NZD/USD price analysis suggests a probability of a minor up wave. The pair rebounded in the short term as the USD was punished by the DXY’s sell-off.

-Are you looking for the best CFD broker? Check our detailed guide-

Technically, the Dollar Index was expected to correct lower after its strong rally. In the short term, the pair could only test the immediate resistance levels before resuming its sell-off. The DXY was into a temporary retreat. It may jump higher anytime. The NZD/USD pair may drop if the index rallies.

Fundamentally, the US Dollar could take the lead again as the US data have come in better than expected. Housing Starts was reported at 1.62M in August versus 1.55M expected and compared to 1.55M in July. In addition, the Current Account has come in at -190B versus -193B estimates and compared to -196B in the previous reporting period, while Building Permits rose from 1.63M to 1.73M, exceeding the 1.60M estimate.

New Zealand Credit Card Spending dropped by -6.3% in August compared to 6.9% growth reported in July. The GDT Price Index could be released today as well, but I’m not expecting anything around this indicator.

NZD/USD price technical analysis: May test mid-0.7000

Tomorrow, you should be careful around the FOMC. The Federal Reserve Statement, Economic Projections, and the Press Conference could shake the markets. From the technical point of view, the NZD/USD is still bearish as long as it stays below the ascending pitchfork’s median line (ML). It has retested this dynamic resistance (support turned into support), and now it could come back down towards 0.7000 immediate low. A new lower low could activate a deeper drop.

-Are you looking for forex robots? Check our detailed guide-

The next downside target is seen at the 50% retracement level, around the weekly S1 (0.6988). Stabilizing below the median line (ML) could announce a potential downside movement towards the 61.8% (0.6945) or down to the ascending pitchfork’s lower median line (LML). This scenario could take shape if the Dollar Index jumps towards new highs after the FOMC.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.