- NZD/USD benefits from New Zealand Finance Minister Robertson’s comments.

- Sustained trading above 61.8% Fibonacci retracement can recall buyers.

- A confluence of 100-HMA, weekly resistance line become the key.

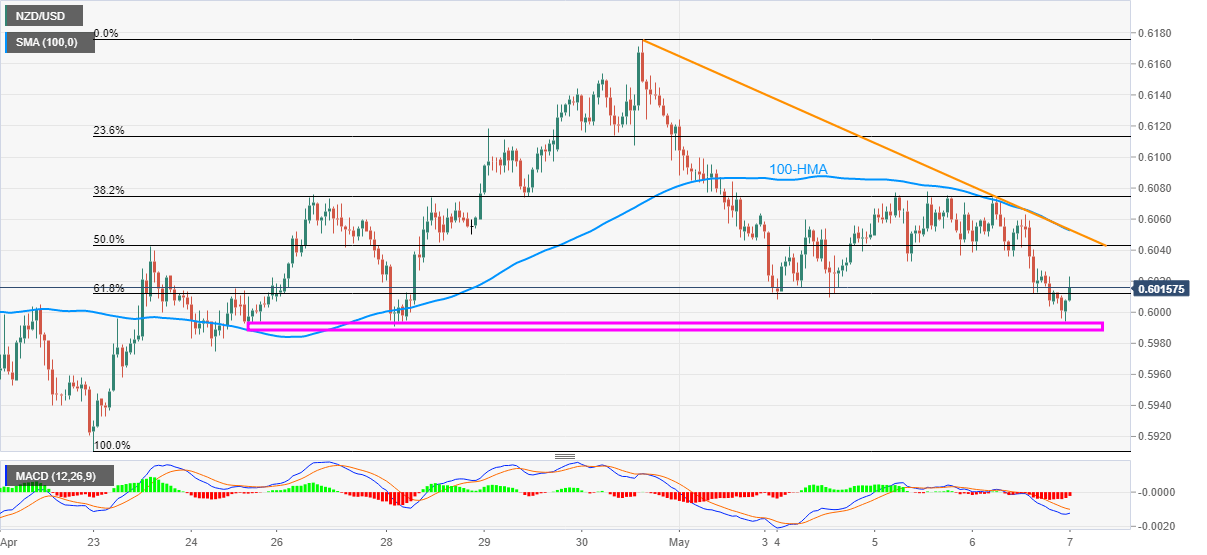

While bouncing off seven-day low, NZD/USD takes the bids to 0.6020 as markets in Tokyo open for Thursday. In doing so, the kiwi pair pierces 61.8% Fibonacci retracement of its April 23-30 upside.

Read: New Zealand Finmin Robertson: New Zealand will remain among least-indebted of peer nations

Given the sustained break of the key Fibonacci retracement, the quote is extending the recoveries to 50% Fibonacci retracement level of 0.6045.

However, a confluence of 100-HMA and a downward sloping trend line from April 30, around 0.6050/55, will question the buyers afterward.

On the downside, sellers could look for entries below a horizontal area comprising lows since late-April 24, around 0.5990, which in turn could recall 0.5960 on the charts.

NZD/USD hourly chart

Trend: Further recovery expected