- NZD/USD takes the bids near intraday high, reverses Friday’s losses.

- Normal RSi, ability to keep key technical breakout favor the bulls.

- Five-week-old support line adds to the downside filters.

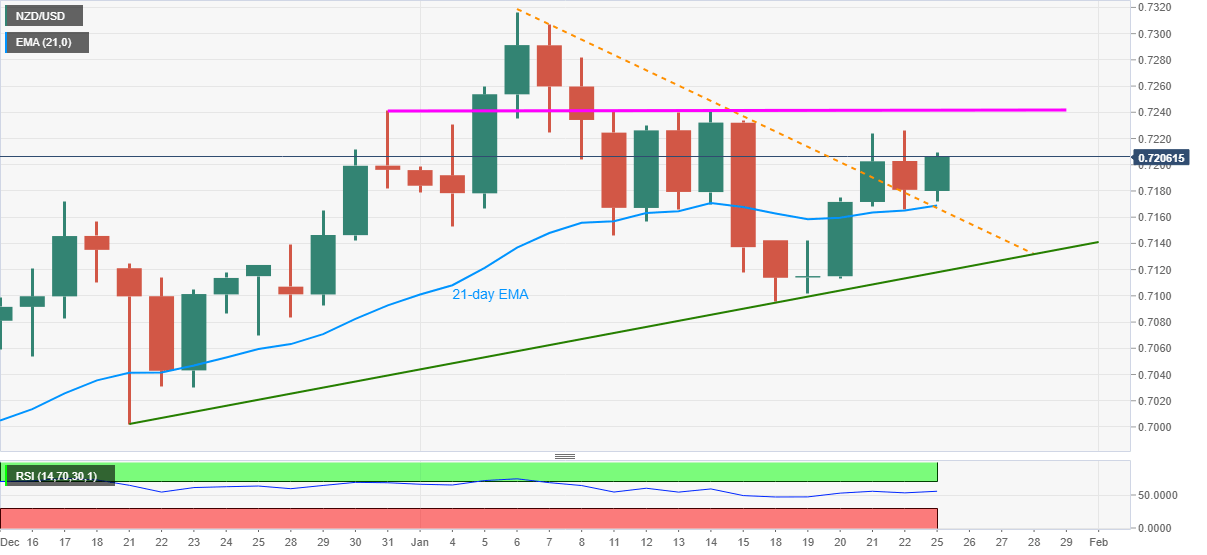

NZD/USD refreshes intraday top to 0.7209, currently up 0.37% on a day near 0.7207, during early Monday. In doing so, the quote extends bounce from the prior resistance line, now support, coupled with the 21-day EMA.

With the strong RSI conditions, not oversold, favoring the NZD/USD bulls to stay strong above 0.7170-65 support confluence, upside moves targeting a horizontal line since December 31, neat 0.7240, can’t be ruled out.

Should the pair buyers keep the reigns past-0.7240, the 0.7300 threshold can offer an intermediate halt before propelling the NZD/USD prices towards the monthly high, also the highest since April 2018, close to 0.7315.

Meanwhile, a downside break below 0.7240 needs validation from the 0.7200 round-figure to recall the short-term NZD/USD sellers.

Also acting as the key support is an upward sloping trend line from December 21, currently around 0.7115.

To sum up, NZD/USD is in an uptrend wherein the pullback has a limited downside gap before reaching important supports.

NZD/USD daily chart

Trend: Bullish