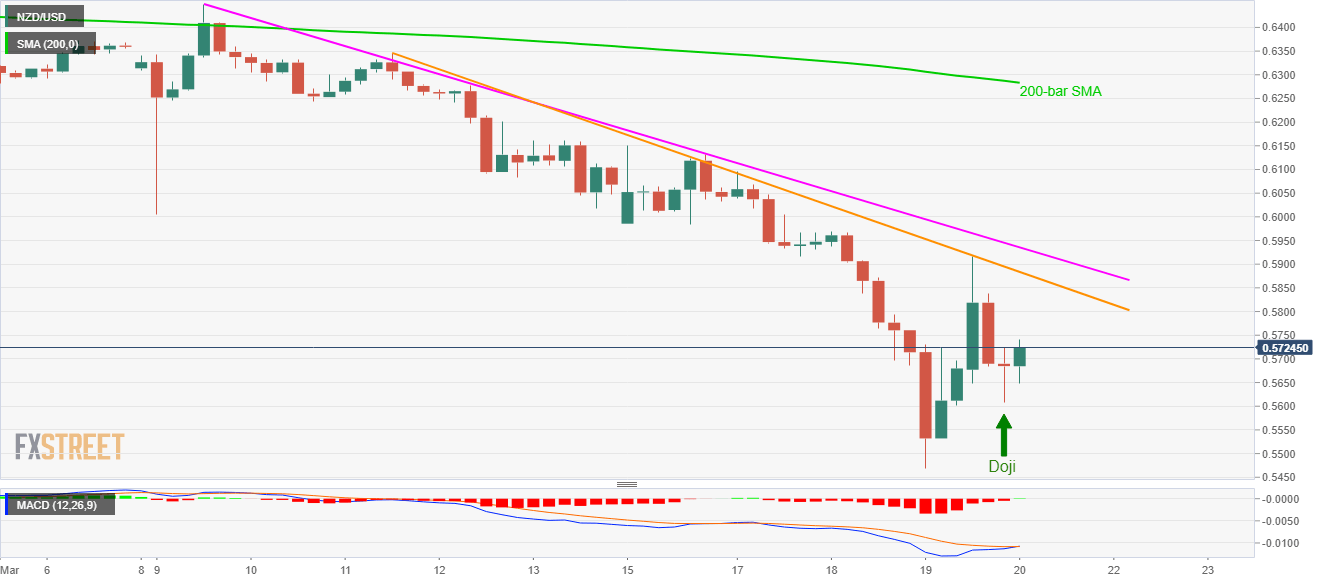

- NZD/USD extends the latest recovery following a bullish candlestick formation on the four-hour (H4) chart.

- The falling trend lines from the previous week hold the key to 200-bar SMA.

- Sellers will take entry below 0.5600.

With the bullish candlestick formation currently helping NZD/USD to recover early-day losses, the Kiwi par registers 0.08% of gains to 0.5730 amid the Asian session on Friday.

The quote is now expected to stretch the pullback towards the descending resistance trend lines drawn from March 09 and 11 near 0.5885 and 0.5935.

However, the pair’s successful upside past-0.5935 will not hesitate to challenge 0.6000 as well as a 200-bar SMA level of 0.6285.

Meanwhile, the pair’s dip below 0.5600 will negate the bullish candlestick formation and can open the door for its fresh drop towards the latest low near 0.5470.

It should also be noted that the 0.5500 mark can offer an intermediate stop between 0.5600 and 0.5470.

NZD/USD four-hour chart

Trend: Further recovery expected