- NZD/USD fails to cheer upbeat China data, steps back from intraday high.

- China’s NBS Manufacturing PMI, Non-Manufacturing PMI flashed strong readings in March.

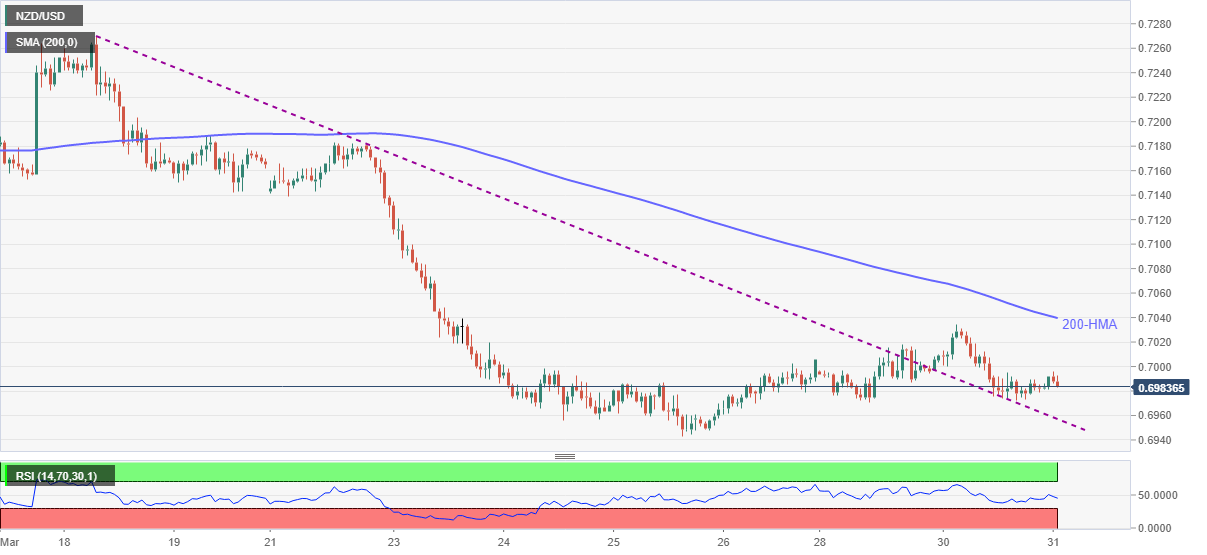

- Sustained trading below 200-HMA, downbeat RSI favor sellers.

Having initially refreshed intraday top to 0.6996 on China data, NZD/USD eases to 0.6986 during Wednesday’s Asian session. In doing so, the kiwi pair trims intraday gains while staying below 200-HMA. Also suggesting the return of the pair bears is the downbeat RSI line.

It’s worth mentioning that China’s NBS Manufacturing PMI rose past-51.2 forecast to 51.9, versus 50.6 prior, whereas Non-Manufacturing PMI crossed 51.4 previous reading and 52.6 market expectations with 56.3 level.

However, a clear break below the immediate support line around 0.6955, previous resistance from March 18, becomes necessary for the NZD/USD sellers to take entries.

It should be noted that the kiwi pair’s declines past-0.6955 will not only challenge the monthly low near 0.6945 but also direct bears towards the early November 2020 tops near 0.6915.

On the flip side, NZD/USD run-up beyond the 200-HMA level of 0.7040 will target the 0.7100 threshold ahead of the March 22 low near 0.7140.

Overall, NZD/USD remains on the back foot despite upbeat activity figures from the key customer China.

NZD/USD hourly chart

Trend: Further weakness expected