- NZD/USD stays bid around weekly top amid upbeat fundamentals.

- After upbeat NZ Q4 jobs report, China Caixin Services PMI grew more than expected in January.

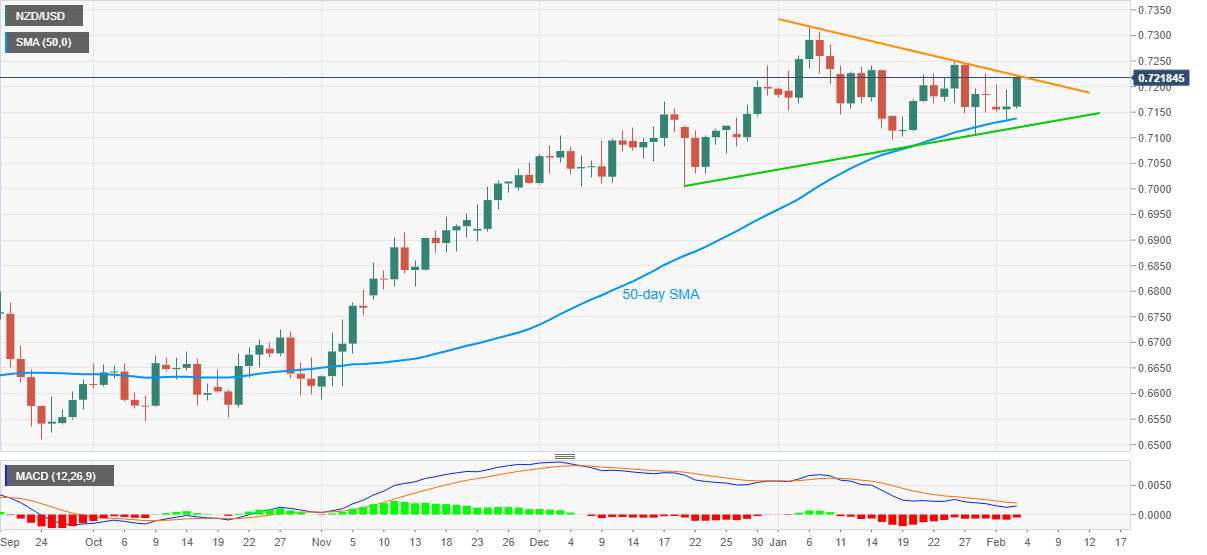

- Bulls attack monthly resistance line, six-week-old support line becomes key for sellers’ entry.

NZD/USD refreshes the weekly top to 0.7218, up 0.80% intraday, during early Wednesday. In doing so, the kiwi pair stretches its run-up following the strong employment data at home. Also recently helping the bulls is China’s upbeat activity number for January.

Read: China’s services sector grows at slowest pace in nine months

While a downward sloping trend line from January 06 probes the NZD/USD buyers around 0.7220, receding strength of bearish MACD signals and sustained trading beyond 50-day SMA keeps the bulls hopeful.

Though, January 26 top near 0.7250 is likely an extra filter to the north-run targeting the previous month’s top of 0.7316.

Meanwhile, a downside break of 50-day SMA, at 0.7137 now, needs to close below an ascending support line from December 21, currently around 0.7120, to convince NZD/USD sellers.

Should the quote drops below 0.7120 daily, December’s bottom close to the 0.7000 psychological magnet will gain the market’s attention.

Overall, NZD/USD is up for the rise targeting to refresh multi-month top marked in January.

NZD/USD daily chart

Trend: Bullish