- NZD/USD drops to one-week lows as risk-off keeps the USD bid.

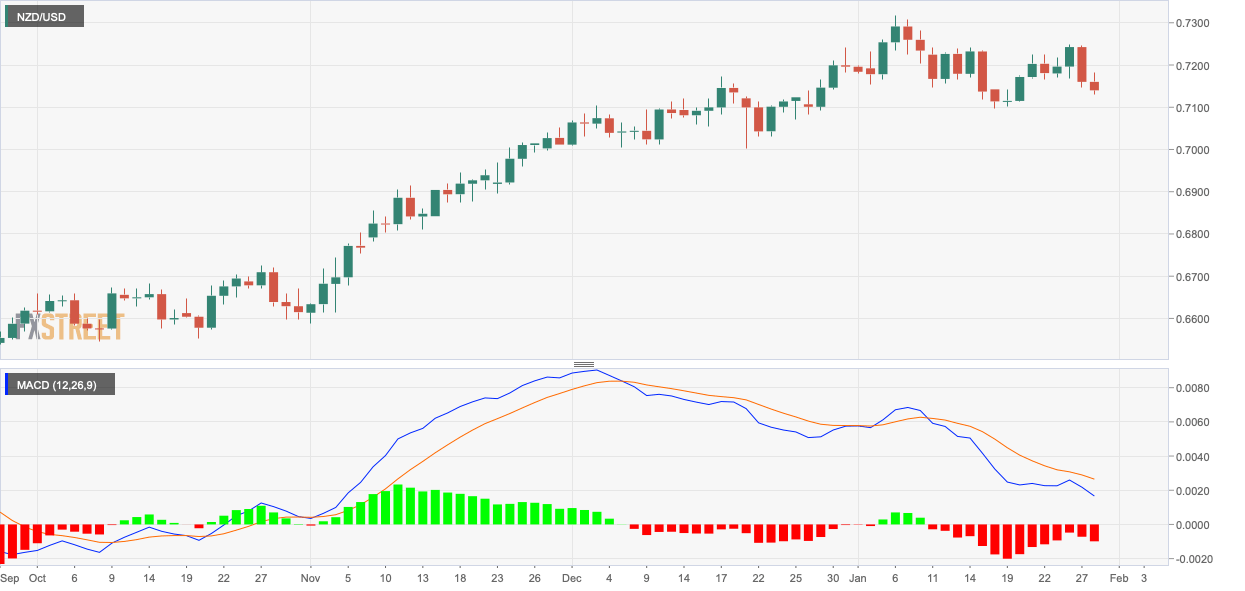

- The daily chart now shows a bearish pattern.

NZD/USD is trading near 0.7142 at press time, representing a 0.20% drop on the day. The currency pair fell by 1% on Wednesday as risk aversion on Wall Street boosted demand for the anti-risk US dollar.

Wednesday’s drop established a bearish lower high pattern on the daily chart, validating the price-negative reading on the daily chart MACD histogram, an indicator used to gauge trend strength and trend changes. The 14-day Relative Strength Index has just dipped into the bearish territory below 50.

As such, the pair looks set to test the Jan. 18 low of 0.7096. Acceptance below that level would signal a completion of the transition from the bullish higher lows, higher patterns to lower highs, lower lows setup, opening the doors for more substantial chart-driven selling pressure.

A close above the Jan. 26 high of 0.7248 is needed to confirm a reversal higher.

Daily chart

Trend: Bearish

Technical levels