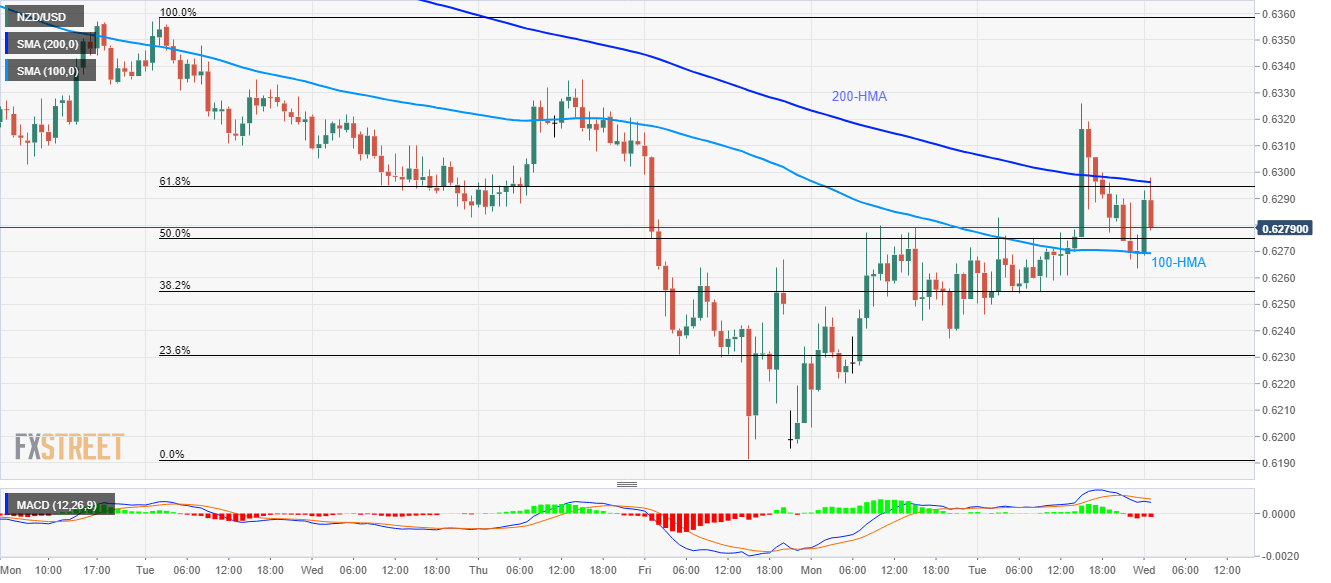

- NZD/USD fails to cross the key confluence comprising 200-HMA, 61.8% Fibonacci retracement.

- 100-HMA acts as the immediate key support amid bearish MACD.

Following the record low print of China’s Caixin Services PMI for February, NZD/USD declines 0.11% to 0.6280 during early Wednesday. In doing so, the pair takes a U-turn from 200-Hour Moving Average (HMA) as well as 61.8% Fibonacci retracement level of February 25-28 declines.

Read: China’s Caixin services PMI slumps to a record low of 26.5 in Feb, Aussie trims gains

That said, sellers are now targeting a drop to a 100-HMA level of 0.6270 whereas the monthly bottom near 0.6235 can restrict further downside.

It should also be noted that MACD conditions are supporting bears and hence any fall below 0.6235 might not refrain to challenge the recently flashed multi-month low around 0.6190.

On the upside, a sustained clearance of 0.6295/6300 resistance confluence can take aim at 0.6335 ahead of targeting an upward trajectory towards 0.6400 mark.

NZD/USD hourly chart

Trend: Pullback expected