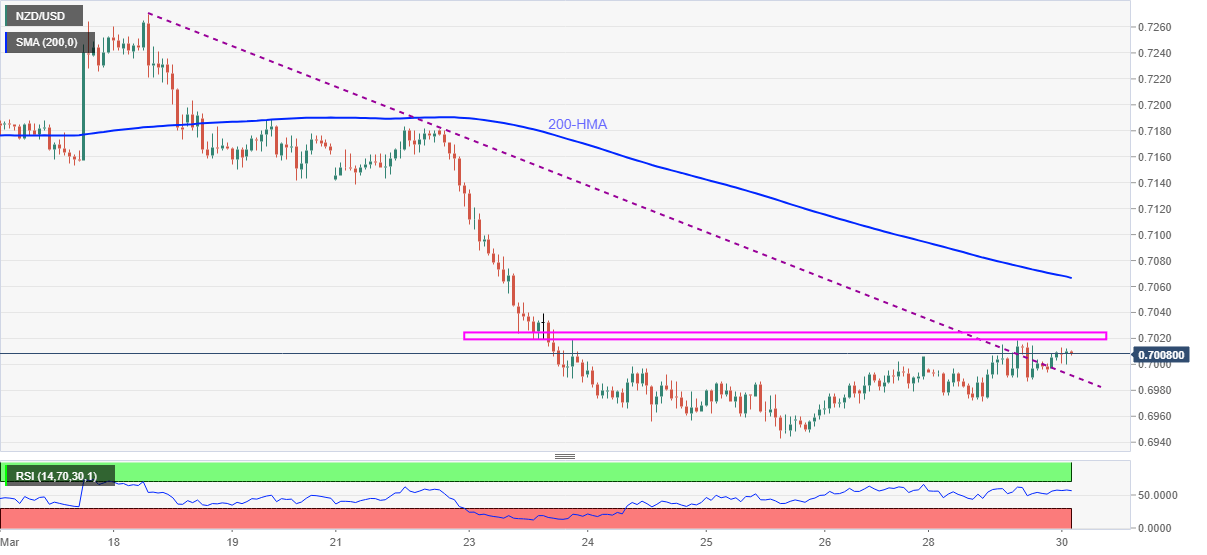

- NZD/USD struggles to justify upside break of one-week-old falling trend line despite upbeat RSI.

- Horizontal area since last Tuesday restricts immediate upside before 200-HMA.

NZD/USD holds 0.7000, up 0.18% intraday around 0.7010 by the press time of early Tuesday. In doing so, the kiwi pair extend the upside break of a short-term falling resistance line, now support, towards a one-week-old hurdle.

Given the upbeat RSI and sustained break of a descending trend line from March 18, NZD/USD is likely to cross an immediate horizontal resistance around 0.7020-25.

However, the 200-HMA level of 0.7066 and the 0.7100 threshold can test the NZD/USD buyers targeting the previous week’s top surrounding 0.7185.

Alternatively, 0.6970 can test the pullback moves before directing them to the multi-day lows, flashed last week, around 0.6940.

Should NZD/USD bears keep the reins past-0.6940, November 12, 2020 top near 0.6915 and the 0.6900 round-figure will be the key ahead of highlighting September 2020 peak close to 0.6800.

NZD/USD hourly chart

Trend: Further recovery expected