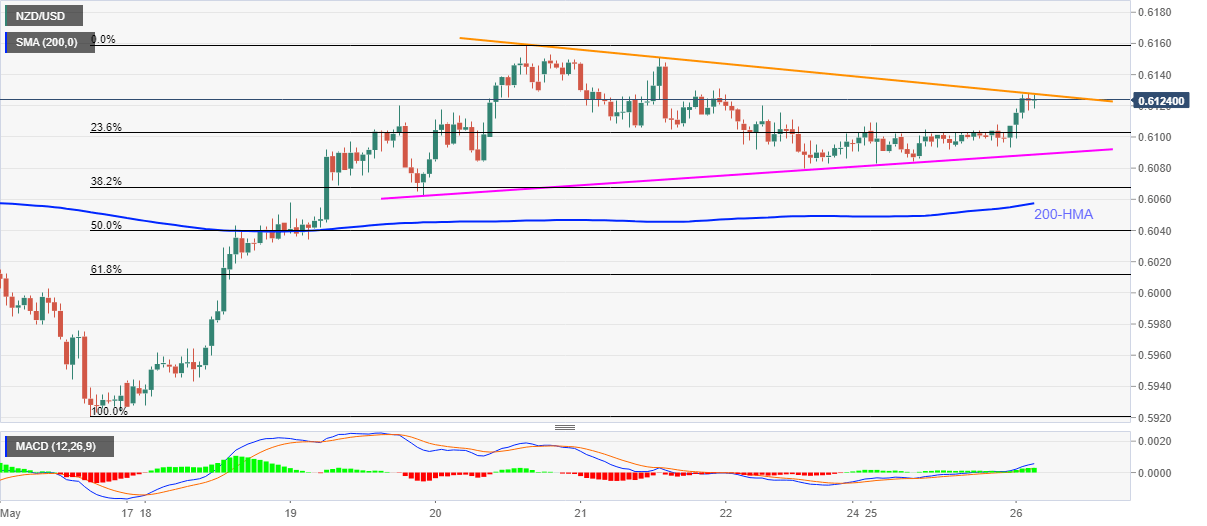

- NZD/USD steps back from a four-day-old descending resistance line.

- Weekly support line can offer immediate rest ahead of 200-HMA.

- Bulls remain cautious unless clearing 100-day EMA.

NZD/USD drops to 0.6120 amid the initial trading session on Tuesday. Although the recent risk-on sentiment keeps the Antipodeans light, a short-term falling trend line triggers the Kiwi pair’s latest declines.

Considering the strength of the trend line resistance, the quote might revisit an ascending trend line from May 19, at 0.6089 now.

However, 200-HMA near 0.6055, could chain the NZD/USD bears below the weekly support line, if not then the return of 0.6000 can’t be ruled out.

On the upside, a clear break above the said resistance line, at 0.6130, can refresh the monthly top near 0.6160.

Though, the 100-day EMA level on the daily chart, around 0.6170, will remain as the strong upside barrier holding keys for further run-up towards 0.6200 round-figure.

NZD/USD hourly chart

Trend: Pullback expected