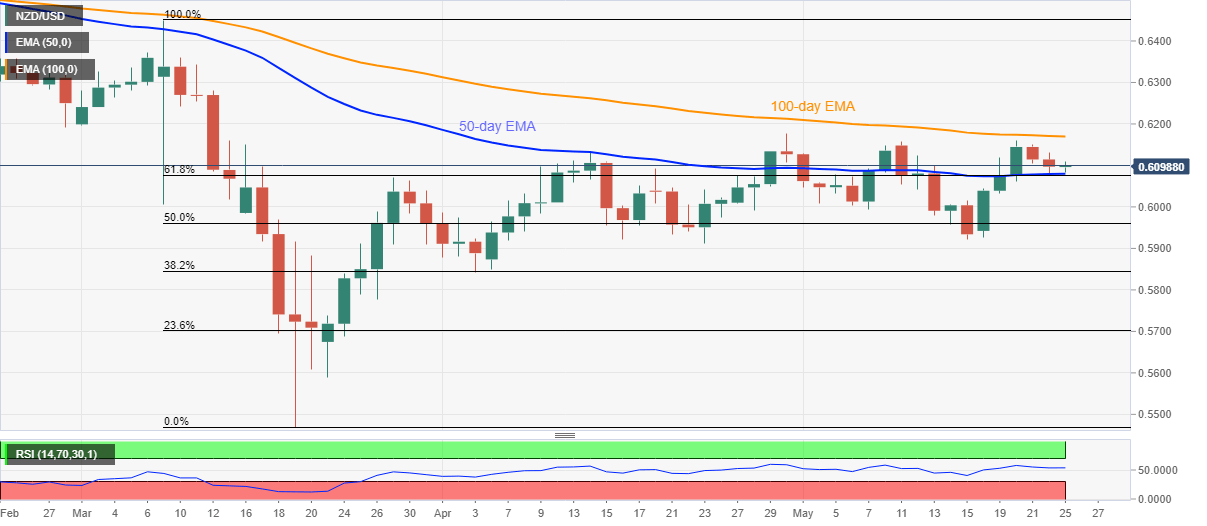

- NZD/USD struggles for a clear direction below 100-day EMA.

- 50-day EMA, 61.8% Fibonacci retracement limits immediate downside.

- April top adds to the upside barrier.

NZD/USD again attempts recovery towards 0.6100 while bouncing off 0.6083 during Monday’s Asian session. Even so, the pair stays below 100-day EMA after the recent two-day losing streak.

While the pair’s repeated failures to break 100-day EMA keeps the sellers hopeful, a clear downside below 0.6080/75 support confluence, comprising 50-day EMA and 61.8% Fibonacci retracement of March month fall, becomes the key for fresh entry.

If at all the NZD/USD prices slip below 0.6075, 0.6000 could gain the bears’ attention ahead of the monthly low near 0.5920.

Alternatively, an upside clearance of a 100-day EMA level of 0.6170 could propel the quote towards April month high nearing 0.6175/80.

NZD/USD daily chart

Trend: Sideways