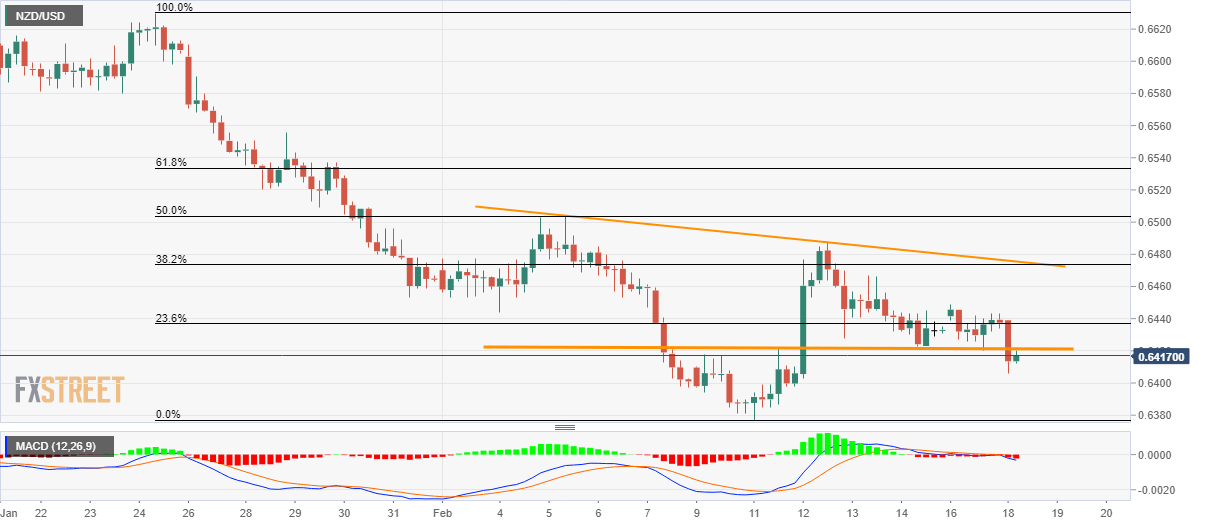

- NZD/USD registers decline for the fourth day in a row after Wednesday’s Dragonfly Doji.

- A fortnight-long descending trend line guards the immediate recovery, 0.6400 can offer intermediate halt to the monthly bottom.

NZD/USD seesaws around 0.6415 while heading into the European open on Tuesday. Even so, the pair stays below short-term horizontal support.

As a result, sellers can take aim at the monthly lows near 0.6375 during the further declines, as indicated by the bearish MACD. However, the 0.6400 round-figure can offer an intermediate halt.

If at all NZD/USD prices keep declining below 0.6375, November month bottom surrounding 0.6315 and 0.6300 could become the bears’ favorites.

Alternatively, the pair’s pullback moves beyond 0.6420 support-turned-resistance needs to cross the two-week-old falling trend line, at 0.6475 now, to challenge the monthly top close to 0.6500.

NZD/USD four-hour chart

Trend: Bearish