- NZD/USD holds onto recovery gains from August 2015 lows marked on Friday.

- China’s Caixin Manufacturing PMI dropped to the record low following footsteps of the official readings flashed during the weekend.

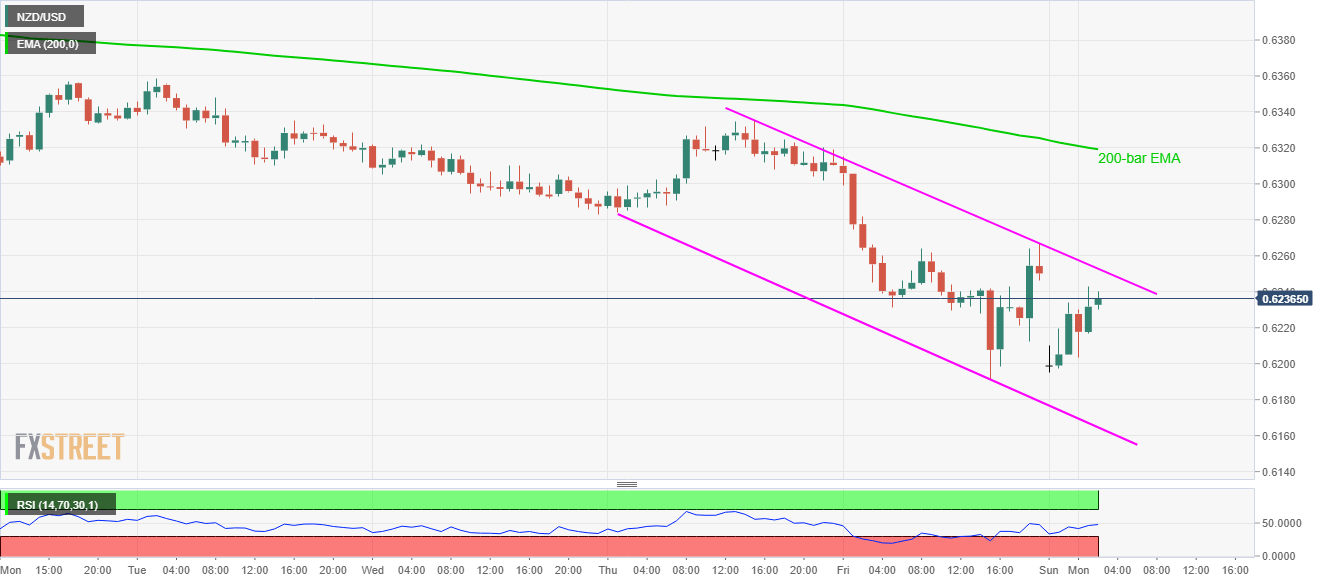

- Buyers will look for entry beyond the immediate trend channel’s resistance-line, sellers can target the year 2015 low.

NZD/USD fills the early-day gap while portraying the recovery to 0.6235 during the early Monday. The pair’s latest moves paid a little heed to China’s record low figures of private activity gauge.

Read: Caixin China PMI Mfg (Feb): 40.3 (est 46, prev 51.1)

However, the quote remains inside a short-term falling trend channel that needs confirmation of further upside with a break of 0.6255 immediate resistance.

In doing so, buyers can target 0.6285 and 200-bar EMA level of 0.6320 during the pair’s further recovery.

Alternatively, Friday’s low near 0.6190 and the said channel’s support line around 0.6165 can offer nearby supports during the pair’s fresh declines.

If at all the bears dominate below 0.6165, the year 2015 bottom close to 0.6145 will be in focus.

NZD/USD hourly chart

Trend: Bearish