- NZD/USD fails to hold on to the recovery gains.

- RBNZ Governor Adrian Orr defies calls of negative interest rates after 0.75% cut.

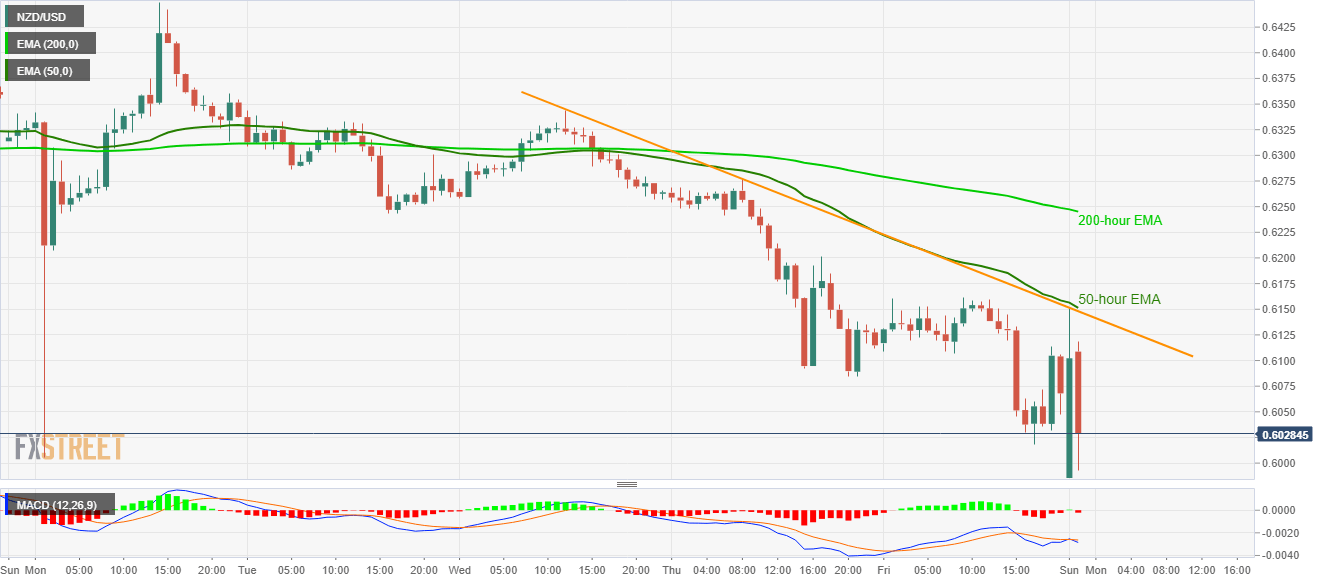

- 50-hour EMA, a three-day-old falling trend line restricts immediate upside.

NZD/USD drops to 0.6000, after the early-day rise to 0.6151, during the initial Asian session on Monday.

The pair initially cheered the Federal Reserve’s surprise moves to ignore the RBNZ’s 0.75% rate cut. However, the recent decline takes clues from Governor Adrian Orr who turns down the odds of any further moves in the interest rates to the south.

Read: Breaking: RBNZ’s Orr: Not contemplating negative interest rate at this point, Kiwi drops

That said, the pair’s U-turn could also be attributed to its failure to cross 50-hour EMA and a downward sloping trend line since March 11, 2020.

The pair currently drops toward May 2009 lows, surrounding 0.5830, on the conditional trading below 0.6000 mark.

Should NZD/USD manages to cross 0.6000, followed by a sustained rise past-0.6150 immediate resistance confluence, 200-hour EMA near 0.6245 could lure the buyers.

NZD/USD hourly chart

Trend: Bearish