- NZD/USD bulls catch a breather around the intraday top.

- China data, risk-on mood favor buyers to confirm the bullish chart pattern.

- Pre-NFP trading lulls battles sustained trading above 200-SMA to confuse traders.

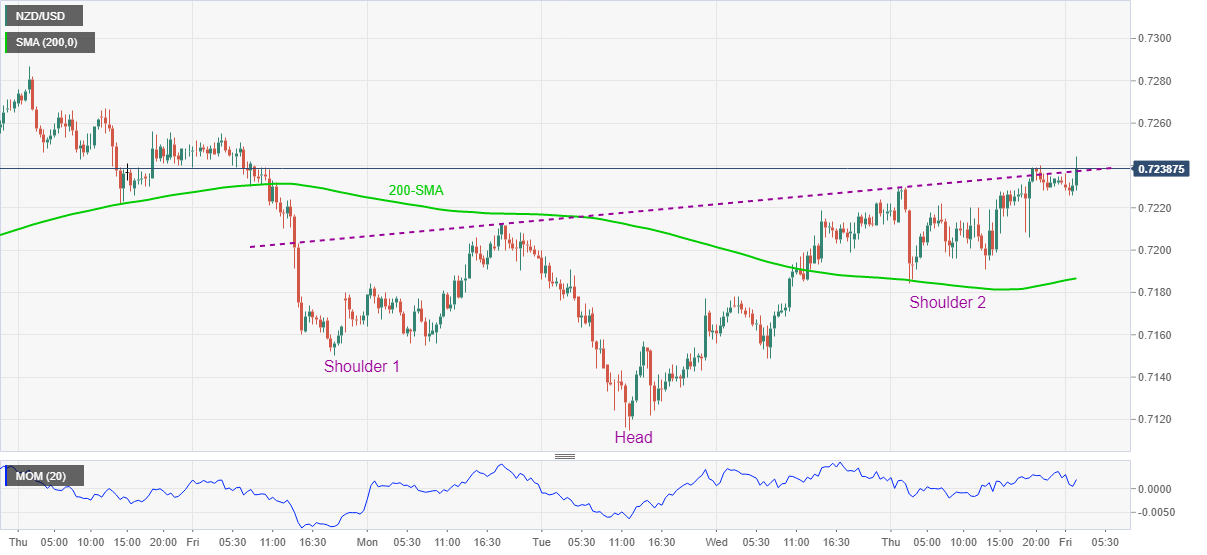

Having recently jumped to 0.7244, NZD/USD eases to 0.7238 while flirting with the neckline of a short-term head-and-shoulders bullish pattern during early Friday.

China’s upbeat Caixin Services PMI recently added extra strength into the pair’s trading beyond 200-SMA, which in turn joins upbeat Momentum on the 30-minutes chart to keep buyers hopeful.

Read: China’s Caixin Services PMI rises to 56.3 in April, AUD/USD nears 0.7800

However, a clear upside break of 0.7245 becomes necessary for the NZD/USD bulls before aiming at the theoretical target of 0.7375. During the run-up, April’s top near 0.7290 and March’s top near 0.7310 may offer intermediate halts.

Meanwhile, pullback moves could revisit the 0.7200 round-figure but the 200-SMA level of 0.7186 may challenge any further weakness.

Should NZD/USD prices slip below 0.7200, the monthly low around 0.7115 will be in the spotlight.

NZD/USD 30-minute chart

Trend: Bullish