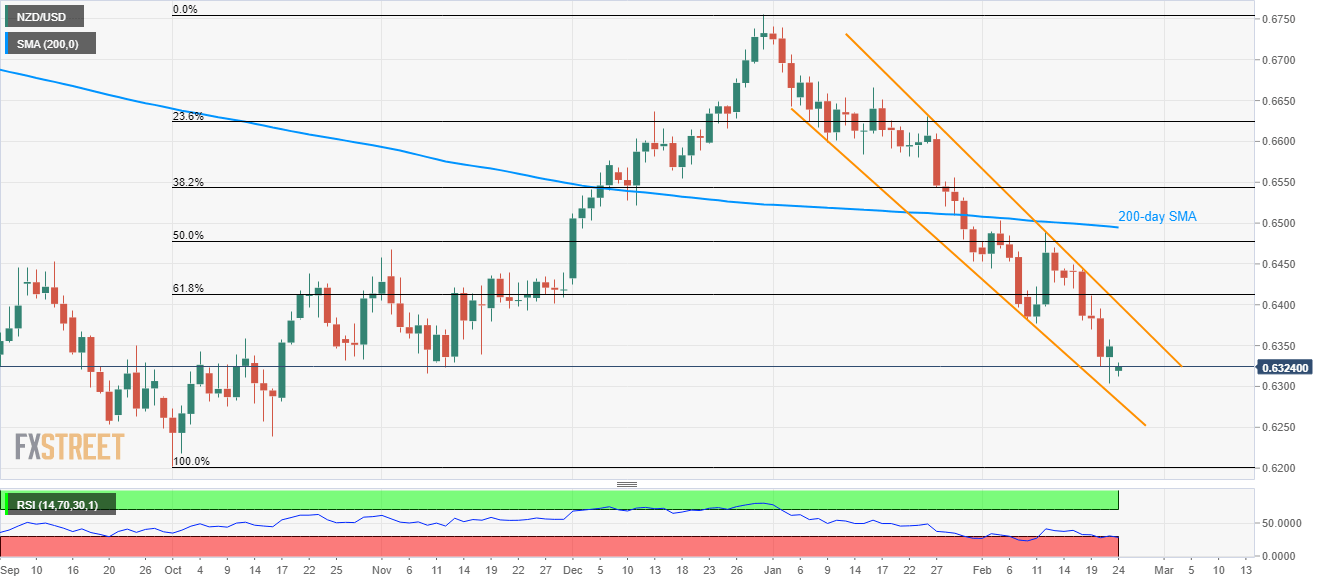

- NZD/USD struggles around four-month low inside the six-week-old descending trend channel.

- The bearish pattern’s support line holds the key to October 2019 lows.

- The channel’s upper line, 61.8% Fibonacci retracement limit the pair’s near-term declines amid oversold RSI.

- Comments from New Zealand PM and downbeat data joined coronavirus to please the bears.

NZD/USD remains on the back foot, down 0.40% to 0.6325, by the press time of early Monday. In doing so, the pair remains inside a short-term falling trade channel.

While downbeat Retail Sales and Credit Card Spending from New Zealand (NZ) earlier dented the NZD/USD pair amid coronavirus fears, comments from the NZ PM Jacinda Ardern recently weigh on the prices.

Even so, the formation’s support line around 0.6280 and 0.6240 can question further selling while RSI conditions are overbought.

If at all the bears refrain to respect RSI and dominate below 0.6240, October 2019 low near 0.6200 will be on their radars.

On the upside, the said channel’s resistance and 61.8% Fibonacci retracement level of October-December 2019 upside, respectively around 0.6400 and 0.6415, can limit the pair’s pullbacks.

NZD/USD daily chart

Trend: Bearish