The NZD/USD price has shown strong oversold signs lately. So, an upside movement is expected if the Dollar Index resumes its corrective phase. The price action has announced exhausted sellers. That’s why we could search for long opportunities.

–Are you interested to learn more about forex robots? Check our detailed guide-

The pair has escaped from a major down channel, but we still need confirmation before taking action. NZD/USD is trading in the red at 0.7003. May be it tries to retest the 0.7 psychological level before jumping higher.

Personally, I believe that NZD/USD buyers are waiting for a bullish spark before going long. The US data published today could lift the pair if the economic figures disappoint. The Core PCE Cost Index reflecting the change in the price of goods and services is expected by specialists to increase by 0.6% versus 0.5% in the former reading period.

The revised UoM consumer sentiment could remain unchanged at 80.8 for the second month in July, while the Chicago PMI may drop to 64.2 from 66.1 points. Also, the personal income and personal spending indicators could bring some volatility as well.

NZD/USD price technical analysis: Key levels to watch

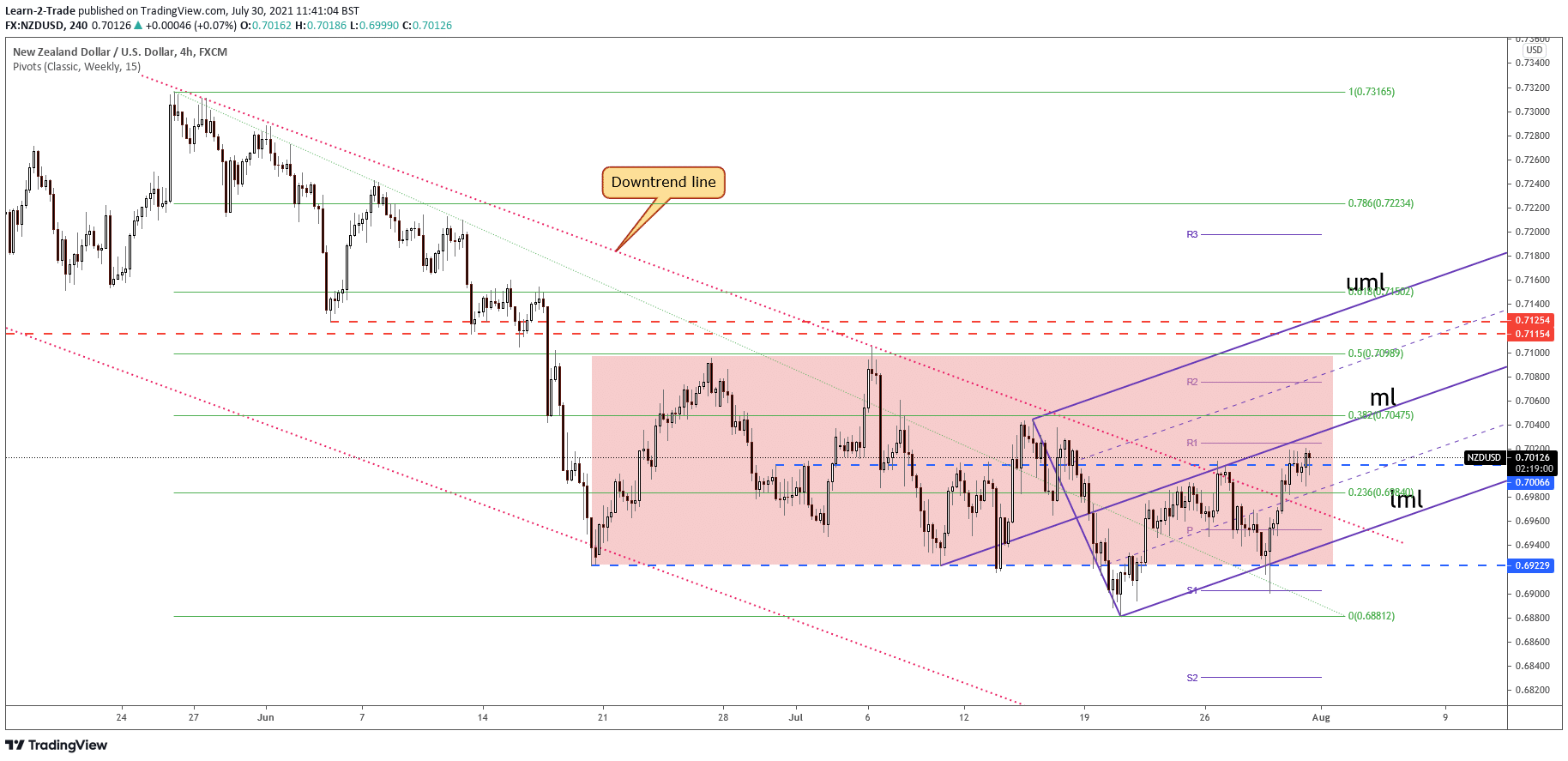

The NZD/USD pair is somehow expected to resume its growth after registering a false breakdown with great separation through the lower median line (LML) and below 0.6922 static support. Also, yesterday’s breakout through the downtrend line signaled an upside reversal.

It has increased within the ascending pitchfork’s body, so the bias remains bullish as long as it stays above the lower median line (LML). Therefore, the median line (ml) is seen as the immediate upside target.

Making a valid breakout through it and registering a fresh new high could validate the upside reversal. Also, the 38.2% retracement level is seen as an upside obstacle as well. The pair drops right now as the DXY has managed to increase a little.

The NZD/USD pair could come back to test and retest the immediate support levels before jumping higher. A minor decline is understandable after the most recent rally. In the short term, temporary consolidation could help us to identify a great buying opportunity.

–Are you interested to learn more about buying cryptocurrencies? Check our detailed guide-

Technically, jumping and stabilizing above the median line (ml) and beyond the 38.2% retracement level indicates further growth.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.