- NZD/USD is still bullish in the short term despite the most recent decline.

- Making a valid breakout through the median line (ML), NZD/USD could register a broader growth.

- The traders are waiting for the US data and for the Fed Chair Powell speech before taking action.

The NZD/USD price dropped a little in the short term after reaching a confluence area. It’s traded at 0.6950 at the moment of writing. The traders are waiting for the US data and for the FED Chair Powell Speaks before taking action. The Dollar Index is trapped within a minor range. Only a valid breakout from this pattern could bring fresh opportunities.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

In the short term, the NZD/USD pair could still rise after the last minor decline. Technically, a temporary decline was somehow expected after its last swing higher. However, surprisingly or not, the USD has gained a little even if the US Prelim GDP has increased only by 6.6%. In contrast, the Unemployment Claims indicator has risen unexpectedly to 353K in the previous week.

The Fed Chair Powell remarks about the economic outlook at the Jackson Hole Economic Policy Symposium could bring high volatility and sharp movements. Also, the Revised UoM Consumer Sentiment, Personal Spending, Personal Income, and the Core PCE Price Index could bring life to the NZD/USD pair.

NZD/USD Price Technical Analysis: 0.6922 As Key Level!

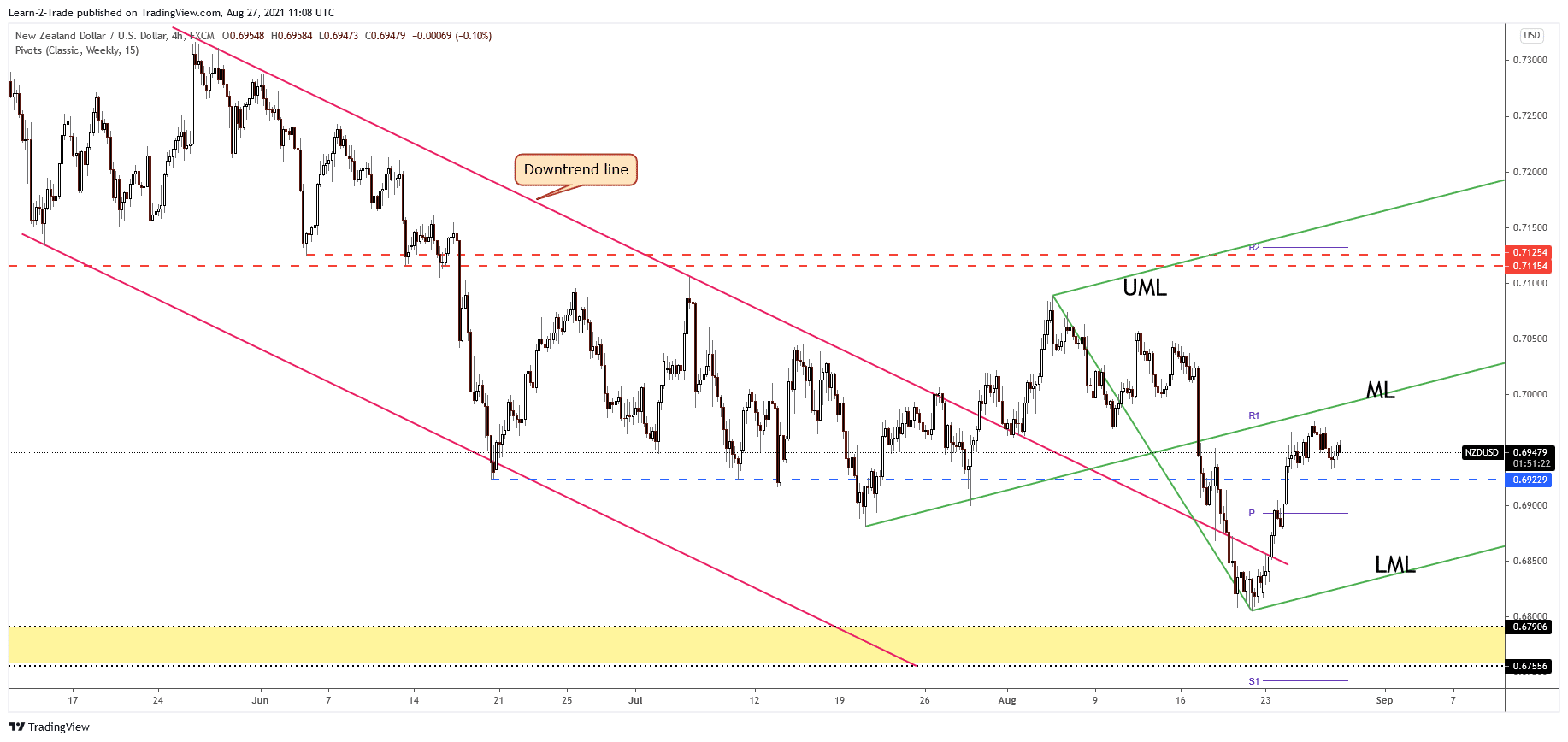

The NZD/USD pair has found temporary resistance at the ascending pitchfork’s median line (ML). The confluence area formed at the intersection between the median line (ML) with the R1 (0.6981) stopped the upwards movement.

–Are you interested to learn more about making money in forex? Check our detailed guide-

A temporary decline was somehow expected. The price could try to attract more bullish energy, more buyers before jumping higher. 0.6922 level is seen as static support. Staying above it could signal that the NZD/USD could come back towards the median line (ML). An important upwards movement could be activated by a valid breakout through the median line (ML).

It could come back towards the weekly pivot point (0.6893) if the Dollar Index comes back towards the 93.19 and 93.43 resistance levels.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.