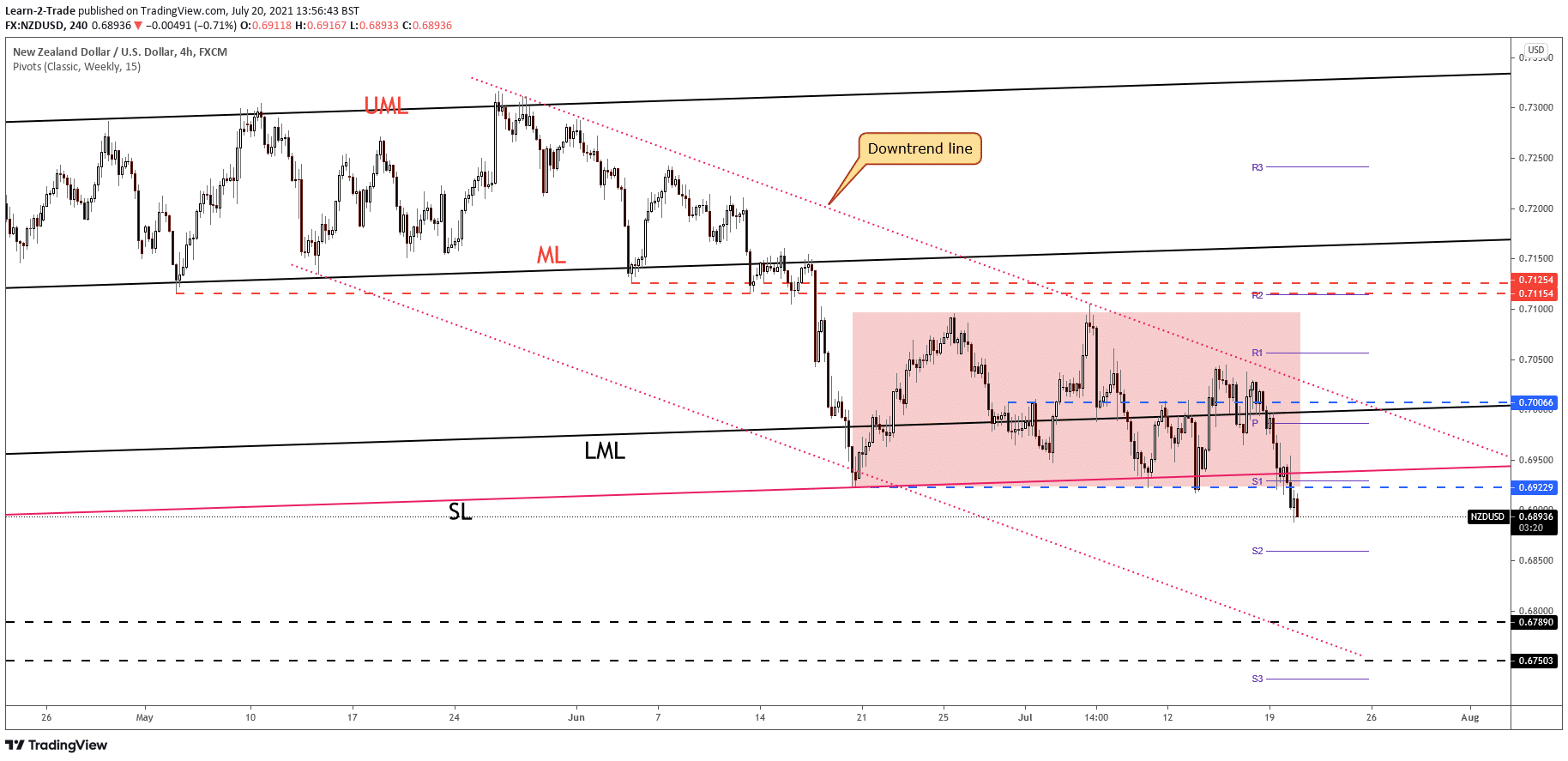

The NZD/USD price is trading in the red right now at 0.6893, and it could hit fresh new lows soon as the DXY rallies. The pair has escaped from a narrow range signaling a downside continuation. Technically, the outlook was bearish as the price is trapped within a down channel pattern.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The Greenback resumed its appreciation even if the US data came with mixed numbers. For example, the Building Permits dropped unexpectedly from 1.68M to 1.60M, even if the analysts have expected to see a potential growth to 1.69M.

The USD found bids from the Housing Starts. As a result, the economic indicator increased from 1.55M to 1.64M, exceeding the 1.59M estimate.

NZD/USD price technical analysis: More fall on cards

The NZD/USD price dropped further after failing to test and retest the down trendline. The aggressive breakdown through 0.6922 static support validated more decline. Technically, the next downside target is seen at the S2 (0.6859) level.

The major downside target is at the down channel’s support, downside line. The Dollar Index has managed to reach a fresh new high of 93.16 level. DXY’s further growth could force Greenback to dominate the currency market again.

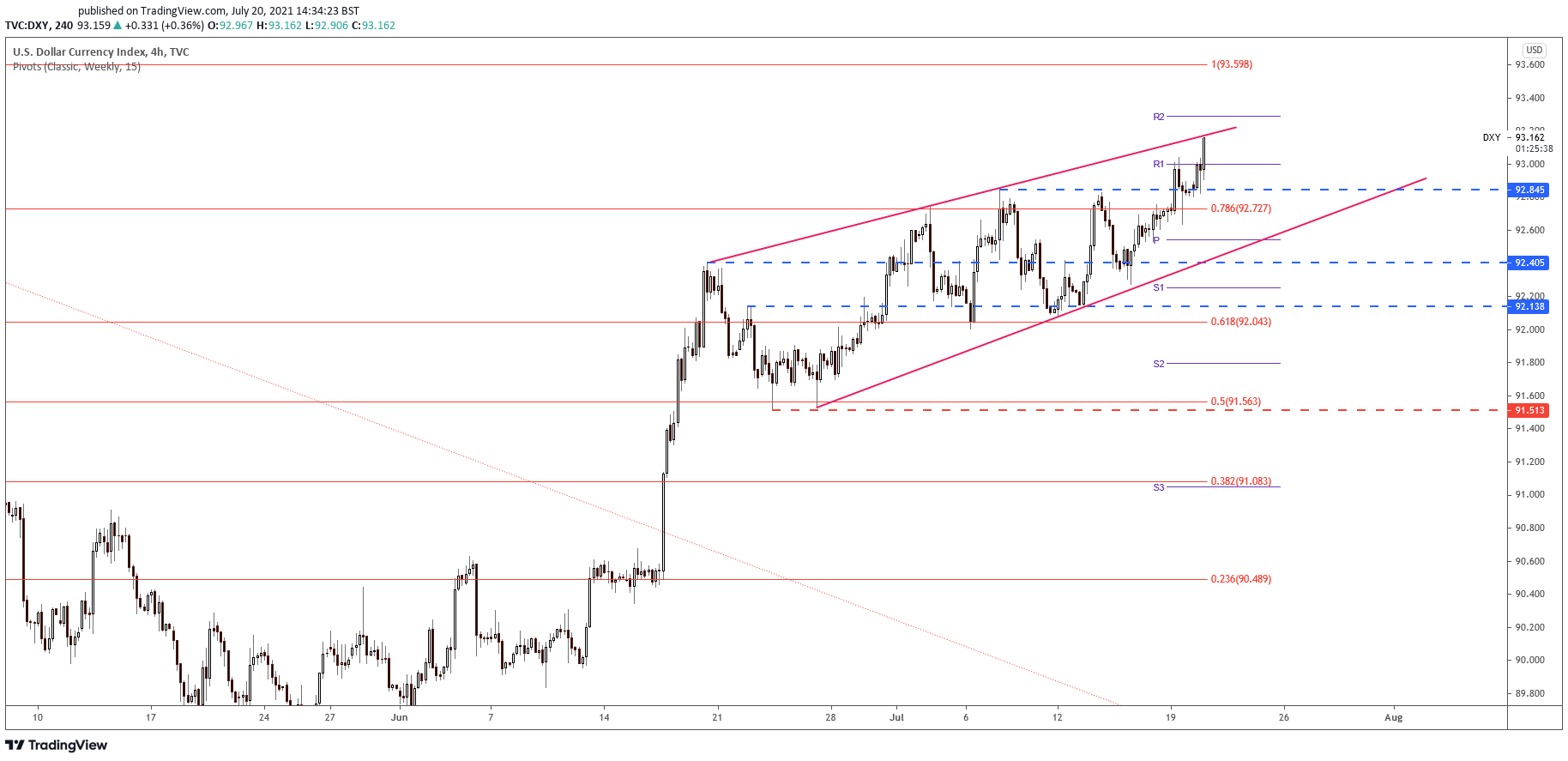

DXY technical analysis: Rally to continue

The US Dollar Index rallied is ready to hit the rising wedge’s resistance, upside line. However, the index has signaled further growth after registering a false breakdown with great separation below the 78.6% retracement level.

The valid breakout through 92.84 signaled further growth, at least towards the upside line, dynamic resistance. So, technically, the bearish divergence was invalidated signaling more gains ahead. Also, its failure to retest the uptrend line signaled that DXY could jump higher.

–Are you interested to learn about forex robots? Check our detailed guide-

USD could increase further as long as DXY grows. Only a potential downside movement from the dynamic resistance could signal Greenback’s depreciation versus its rivals.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.