- The Greenback was punished by the US inflation, even if the figures have come mixed.

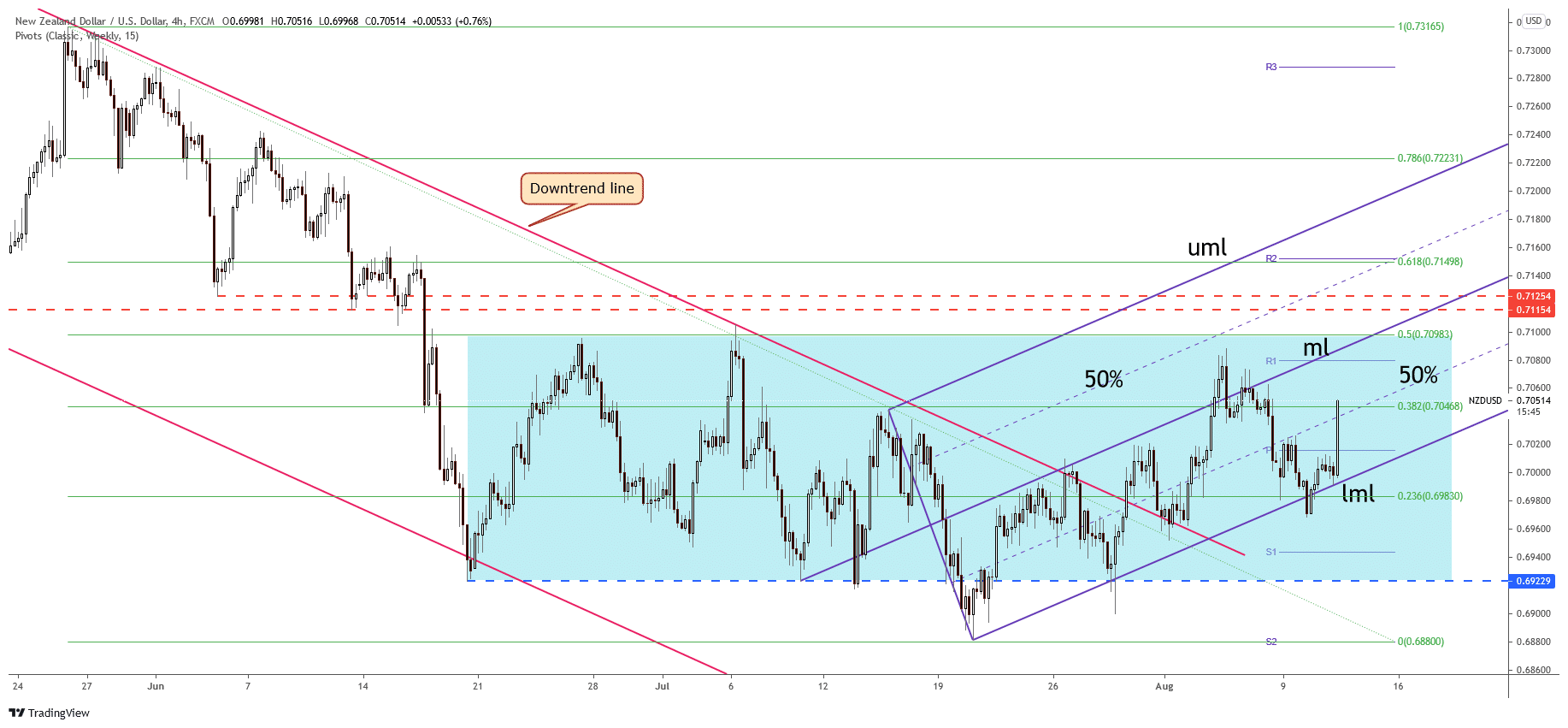

- NZD/USD is still bullish as long as it stays within the ascending pitchfork’s body, above the lower median line (LML).

- A larger growth could be activated by a valid breakout through the 50% retracement level.

The NZD/USD price rallied in the last minutes signaling strong buyers. The Dollar Index plunged after the US inflation data release, so USD’s depreciation is natural. However, the pair maintains a bullish bias despite the most recent decline. It has come down only to retest the support levels before jumping higher.

–Are you interested to learn more about crypto signals? Check our detailed guide-

The US Consumer Price Index, CPI increased by 0.5% in July as expected, less than the 0.9% growth registered in June, while the Core CPI has increased only by 0.3%, versus 0.4% estimate.

The Kiwi has taken full control again in the short term. Some poor US data reported on Thursday and Friday could punish the Greenback. The pair is trapped within a range pattern. An upside breakout may signal a bullish reversal.

Tomorrow, the US is to release the PPI, Core PPI, and Unemployment Claims. These economic figures could bring more action on NZD/USD.

NZD/USD price technical analysis: Bulls to get back dominance

As you can see on the H4 chart, the NZD/USD pair is still trapped between the 50% retracement level, 0.7098, and the 0.6922 level. It’s traded at 0.7041 level and is pressuring the 38.2% retracement level.

NZD/USD has found support below the ascending pitchfork’s lower median line (LML) again. It has printed a false breakdown with great separation through the confluence area formed at the intersection between 23.6% and the lower median line (LML).

In the short term, the bias is bullish as long as NZD/USD stays within the ascending pitchfork’s body. If the pair resumes its growth, the median line (ml) and the weekly R1 (0.7079) are seen as upside targets.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Technically, it was expected to increase after making a valid breakout through the downtrend line. An upside breakout above the 50% retracement level from the current range may announce a bullish reversal, a strong upwards movement.

Only a valid breakdown below the lower median line (LML) could invalidate the bullish scenario and could offer us a potential short opportunity.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.