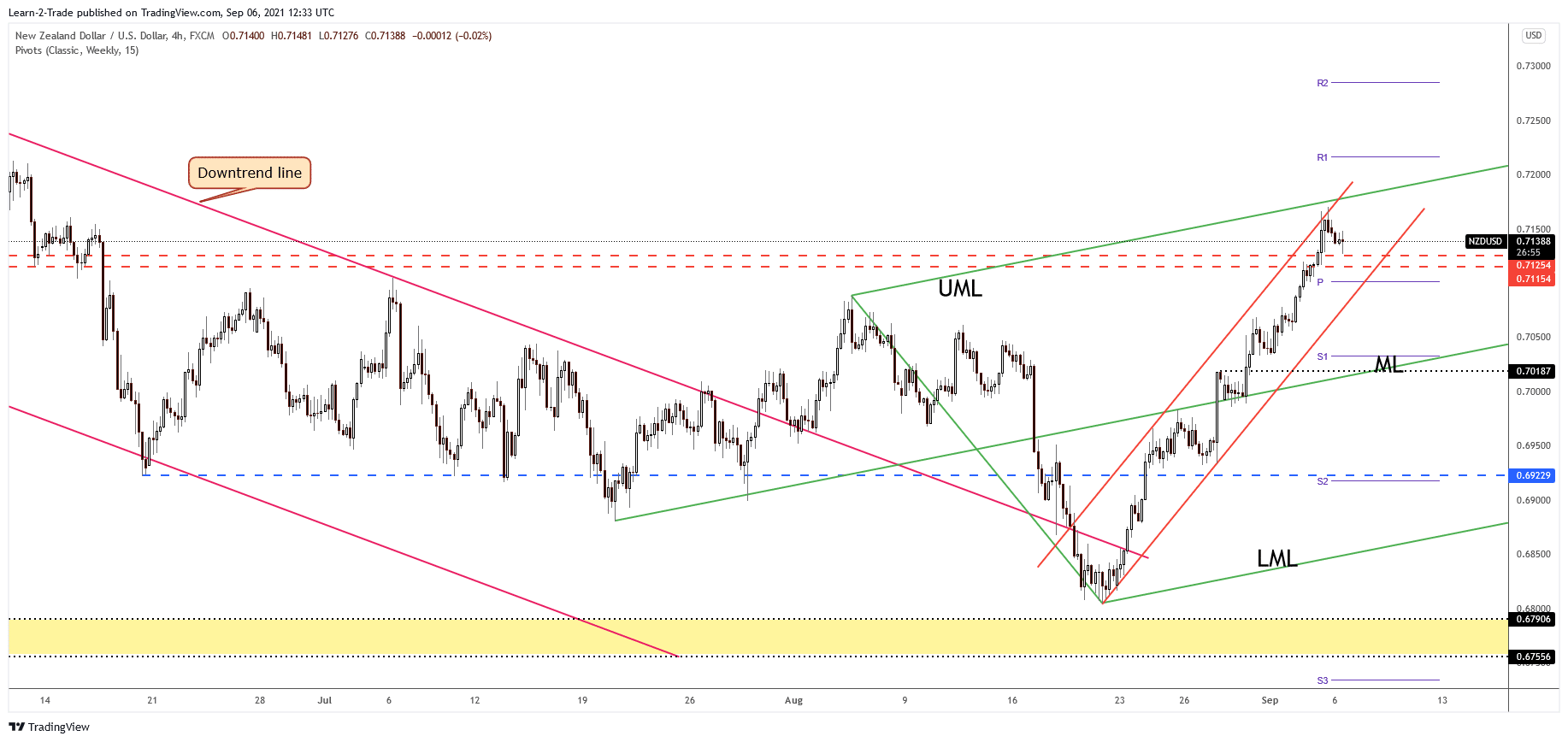

- The NZD/USD retreated, but the bias is bullish, so the price could increase soon.

- The bias is still bullish as long as it stays within the ascending channel’s body.

- A larger upwards movement could be validated by a valid breakout above the upper median line (UML).

The NZD/USD price dropped a little in the short term after reaching a dynamic resistance. Technically, the price was somehow expected to fall after its strong upwards movement. It could test and retest the immediate support levels before jumping higher.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The outlook is bullish, so the NZD/USD pair could resume its growth after the current decline. Moreover, the Dollar Index has rebounded after Friday’s sell-off. That’s why the greenback has appreciated versus its rivals.

As you already know, the US Dollar has taken a hit from the US Non-Farm Employment Change, which reported only 235K jobs in August, far below the 750K estimate and compared to 1053K in July. Also, the ISM Services PMI dropped from 64.1 points to 61.7 points below 61.9 points expected. So naturally, the USD traders were disappointed by these poor figures. Still, the Dollar Index has found support after its massive drop, and right now, it has risen to test and retest the near-term resistance levels before dropping again.

The New Zealand ANZ Commodity Prices was released in the early morning, and it has dropped by 1.6% versus 1.4% decline registered in the last reporting period.

NZD/USD price technical analysis: Minor retreat within up channel

The NZD/USD price reached the up-channel’s upside line, where it has found resistance. It has registered two false breakouts above it, signaling a temporary decline. 0.7125 – 0.7115 is seen as a support zone (resistance has turned into support). Technically, the bias is bullish as long as it stays within the up-channel’s body, above the uptrend line.

–Are you interested to learn more about forex signals? Check our detailed guide-

The current decline could help us to catch new upside movements. The ascending pitchfork’s upper median line (UML) is seen as an upside target. A valid breakdown through the uptrend line and below the weekly pivot point (0.7101) level could invalidate a further upward movement. On the other hand, a minor consolidation above the immediate support levels could bring new long opportunities. A new higher high and a valid breakout through the upper median line (UML) could signal an upside continuation.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.