“¢ Sliding US bond yields exert some pressure on the USD and helps the pair to regain traction.

“¢ Bullish commodity prices underpin commodity-linked currencies and remain supportive.

“¢ Traders now look forward to Wednesday’s NZ trade balance data for some fresh impetus.

The NZD/USD pair caught some fresh bids on Tuesday, with bulls now making a fresh attempt to build on the momentum beyond the 0.6800 handle.

With investors still digesting the US President Donald Trump’s criticism over the Fed’ monetary policy tightening, retracing US Treasury bond yields exerted some downward pressure on the US Dollar and helped the pair to regain positive traction.

Meanwhile, a positive tone around commodity space, which tends to underpin demand for commodity-linked currencies – like the Kiwi, provided an additional boost and further collaborated to the pair’s bid tone through the early North-American session.

Today’s US economic docket, featuring the second-tier releases of flash manufacturing and services PMIs, is likely to pass unnoticed. Hence, traders are likely to take cues from NZ trade balance data, due for release during the early Asian session on Wednesday.

Technical Analysis

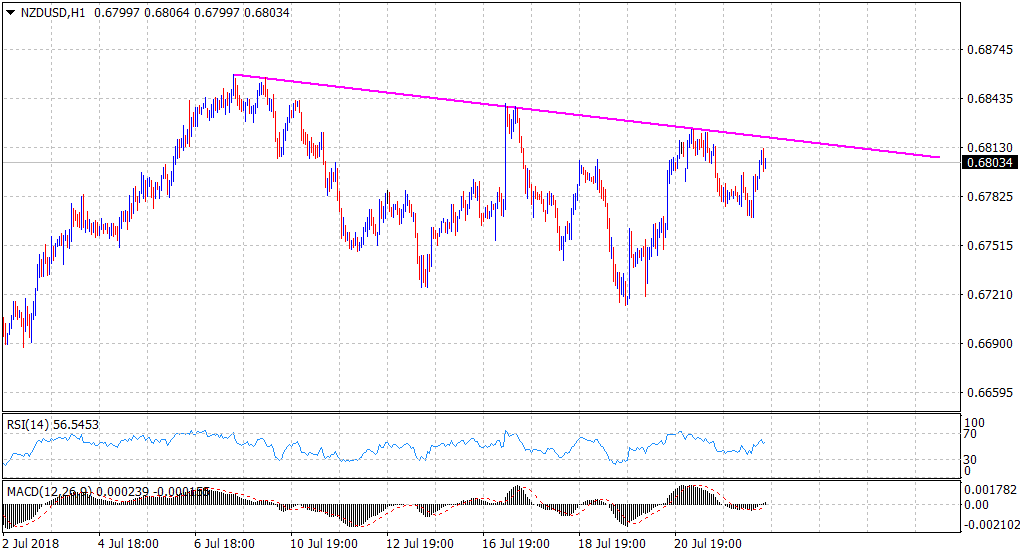

The pair has now moved closer to previous session’s multi-day tops and is also nearing a resistance marked by a two-week-old descending trend-line.

With technical indicators on the 1-hourly chart trying to gain positive momentum, a convincing breakthrough the mentioned barrier should pave the way for any further near-term appreciating move.

Spot rate: 0.6803

Daily Low: 0.6769

Trend: Turning bullish

Resistance

R1: 0.6825 (descending trend-line hurdle)

R2: 0.6859 (monthly high set on July 9)

R3: 0.6900 (round figure mark)

Support

S1: 0.6769 (current day swing low)

S2: 0.6747 (S2 daily pivot-point)

S3: 0.6720 (last Friday’s swing low)