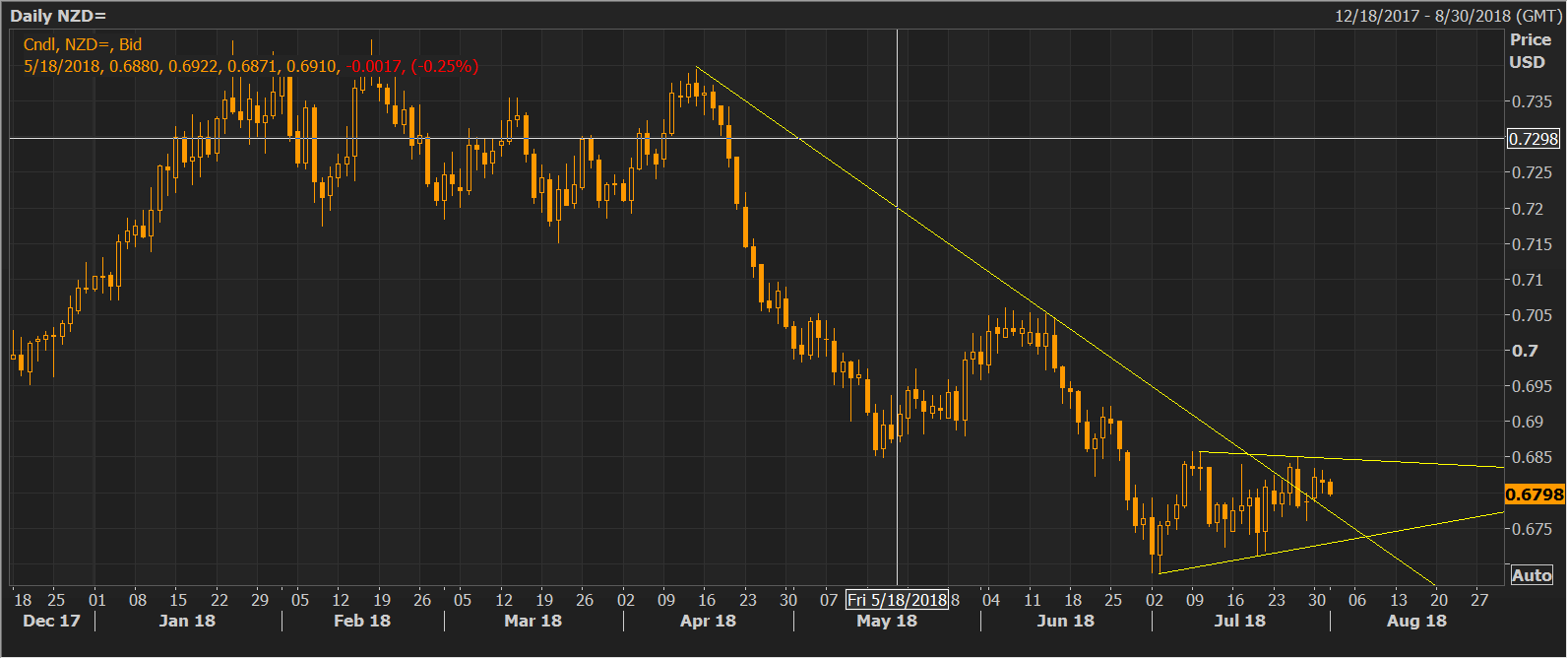

- The NZD/USD pair eroded the short-term falling trendline, confirming a bear-to-bull trend change, but has failed to entice buyers.

- Dismal New Zealand employment data and US-China trade war fears are likely playing a spoilsport.

The NZD/USD pair finds no takers despite having cleared a key falling trendline hurdle on Monday.

As of writing, the spot is trading at 0.68, having clocked a high of 0.6820 earlier today.

The kiwi dollar cleared the trendline sloping downwards from the April 13 high and June 14 high earlier this week, confirming a short-term bearish-to-bullish trend change. However, the follow-through has been less-than-impressive, likely due to dismal New Zealand data release.

The unemployment rate lifted to 4.5 percent in the three months ended June 30 from 4.4 percent in March, Statistics New Zealand reported earlier today. Meanwhile, private sector wage inflation rose 0.6 percent in the quarter for a 2.1 percent annual increase, in line with expectations.

However, that failed to put a bid under the NZD as the quarterly lift in wages was largely due to higher minimum wage after the government raised it on April 1 by 75 cents to $16.50 an hour.

Further, reports that the US is considering imposing higher tariffs on Chinese imports put focus back on the US-China trade war and likely weighed over NZD and other risk assets.

Daily chart

Indeed, the currency pair has cleared the falling trendline, but a bull reversal is seen happening only above the channel hurdle of 0.6848.

Key support: 0.6773 (falling trendline support), 0.6711 (July 19 low), 0.6687 (July 2low).

Key resistance: 0.6819 (session high), 0.6848 (channle hurdle), 0.6921 (June 25 high).