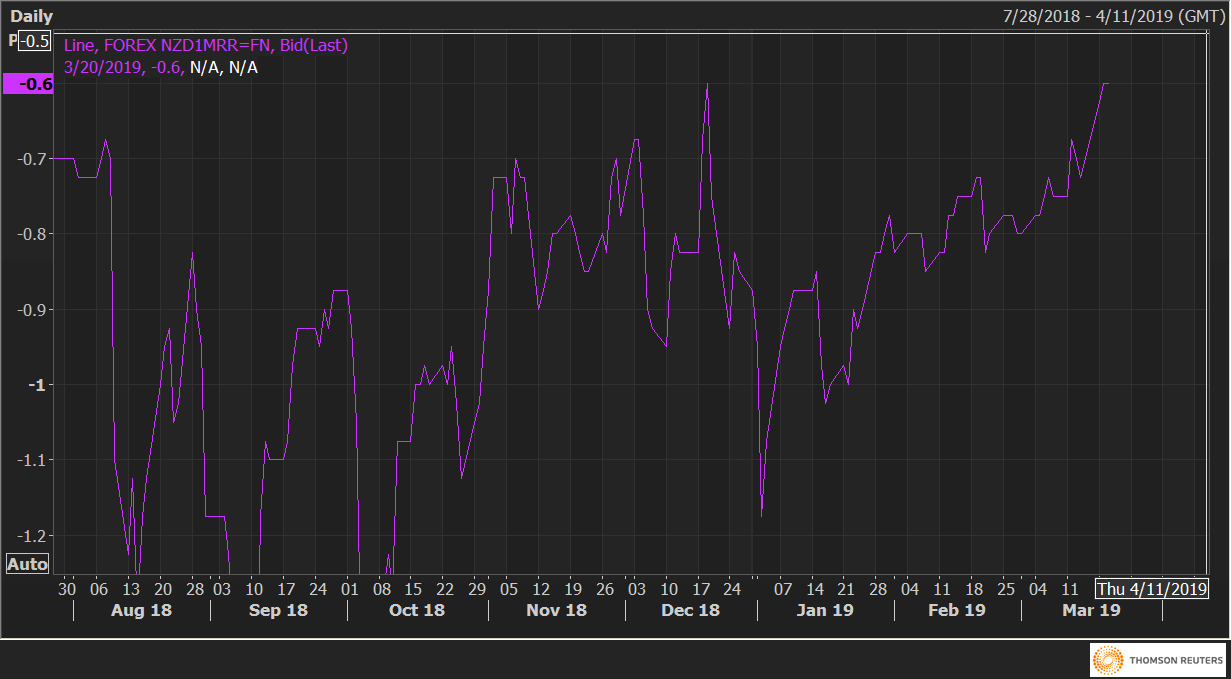

The one-month 25 delta risk reversals on NZD/USD (NZD1MRR), the gauge for calls to puts, is currently trading at -0.6, the highest level since Dec. 19.

While the negative number indicates that the implied volatility premium for NZD puts (bearish bets) is still higher than that for calls, the bearish bias is now weakest in three months.

Notably, the value of the bearish bets has dropped sharply in the last 2.5-month, as indicated by the recovery in risk reversals from -1.2 to -0.60.

The demand for the put options would fall even further if the Fed keeps rates unchanged as expected later today and its dot plot shows a rate hike pause for the rest of the year.

NZD1MRR