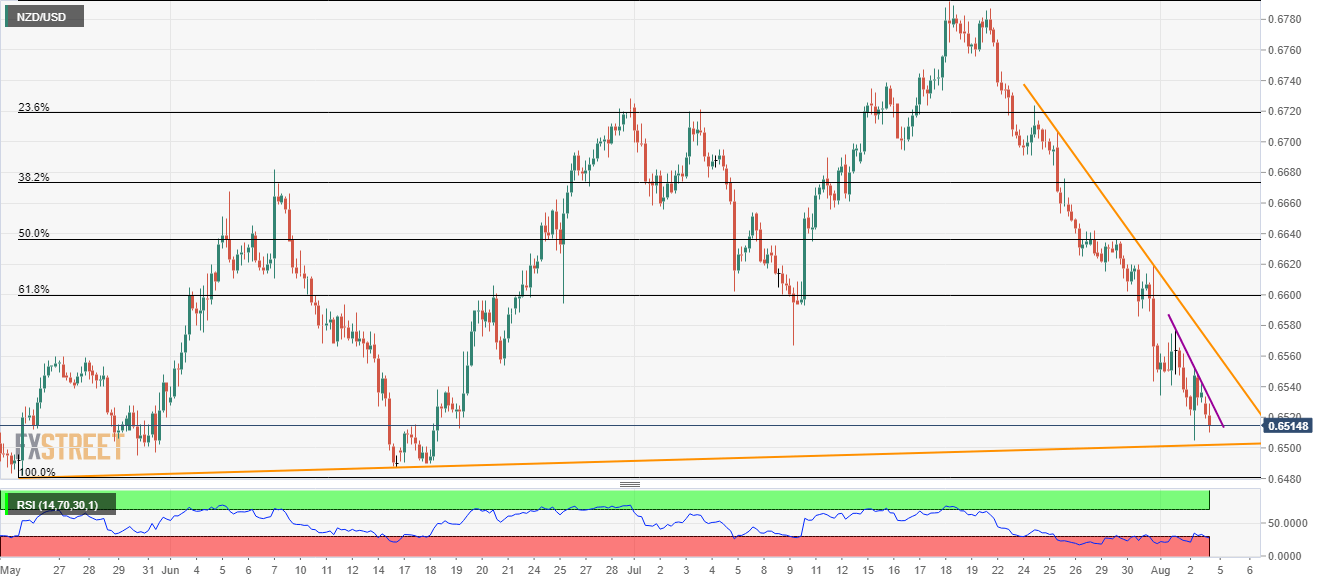

- Multiple downward sloping trend-line portrays NZD/USD weakness.

- 10-week old support-line grabs bears’ attention.

In addition to a two-day long descending trend-line, the NZD/USD pair’s sustained trading below a resistance-line stretched since late-July also portrays its weakness as the quote seesaws near 0.6510 during early Monday.

With this, 10-week old upward sloping trend-line near 0.6500 becomes an immediate concern for sellers ahead of watching over the May month low of 0.6481.

However, pair’s further declines could be confined by oversold levels of 14-bar relative strength index, if not then October 2018 bottom surrounding 0.6425 can please the bears.

On the contrary, 0.6533 and 0.6570 are two trend-line resistances that can hold the pair’s short-term upside confined.

In a case prices rally beyond 0.6570, 61.8% Fibonacci retracement of May – July upside, at 0.6600.

NZD/USD 4-hour chart

Trend: Bearish