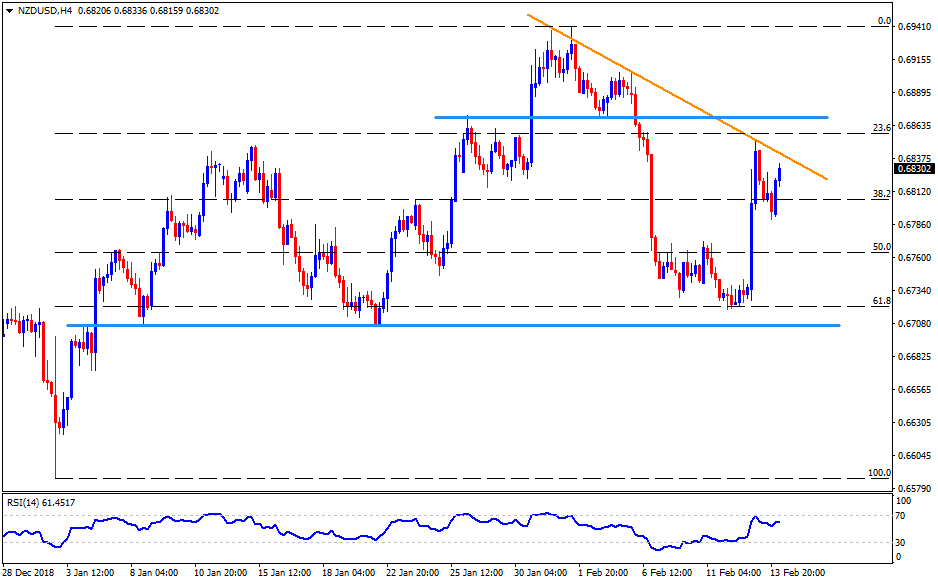

- The NZD/USD pair again heads to two-week-old trend-line resistance, at 0.6845 now, during early Thursday.

- Should the pair manage to cross 0.6845, the horizontal line connecting late-January highs to early February lows, at 0.6870, may gain buyers’ attention.

- During the additional upside past-0.6870, 0.6900 and the month’s high near 0.6945 can be targeted if holding long positions.

- In case prices fail to hold recent recovery, 0.6785 and 0.6770 can provide nearby supports ahead of highlighting the 61.8% Fibonacci Retracement level of 0.6720 and the 0.6705 horizontal support.

- If bears continue dominating price sentiments past-0.6705, 0.6670 and 0.6650 might offer intermediate halts during the plunge to 0.6620 and then to 0.6585.

NZD/USD 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 0.6832

Today Daily change: 37 pips

Today Daily change %: 0.54%

Today Daily Open: 0.6795

Trends:

Daily SMA20: 0.6806

Daily SMA50: 0.679

Daily SMA100: 0.6727

Daily SMA200: 0.6754

Levels:

Previous Daily High: 0.6853

Previous Daily Low: 0.6727

Previous Weekly High: 0.6907

Previous Weekly Low: 0.6729

Previous Monthly High: 0.694

Previous Monthly Low: 0.6516

Daily Fibonacci 38.2%: 0.6805

Daily Fibonacci 61.8%: 0.6775

Daily Pivot Point S1: 0.673

Daily Pivot Point S2: 0.6665

Daily Pivot Point S3: 0.6604

Daily Pivot Point R1: 0.6856

Daily Pivot Point R2: 0.6918

Daily Pivot Point R3: 0.6982