- NZD/USD drops to fresh two-week low amid bearish MACD.

- A fresh monthly low will favor declines to support-lines stretched from May and June 2019.

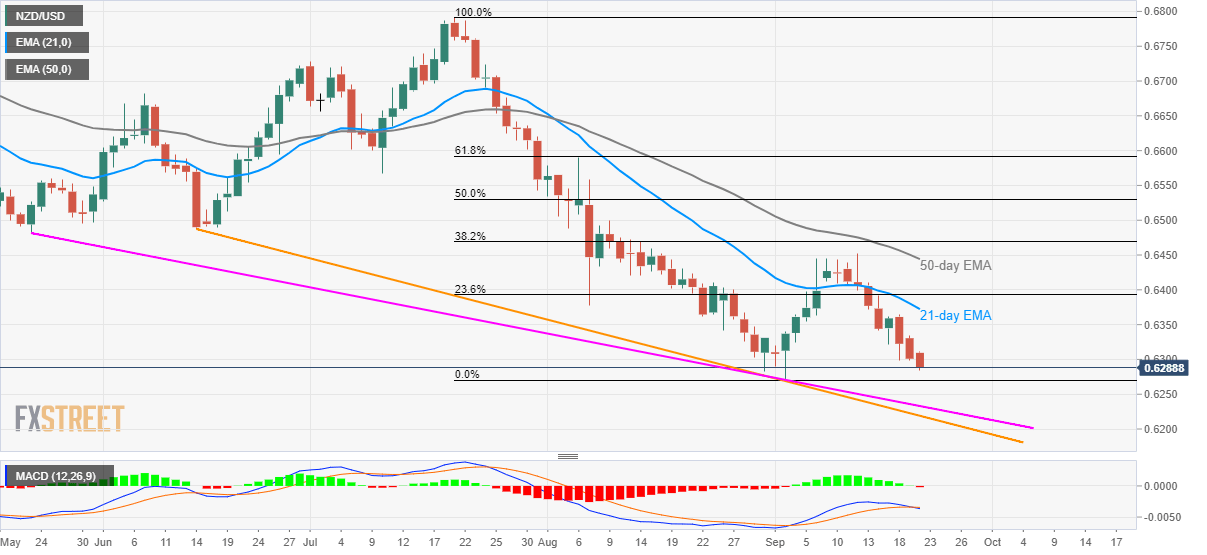

NZD/USD drops to a fresh two-week low, near to monthly bottom, while taking rounds to 0.6290 during early Friday.

With the 12-bar moving average convergence and divergence (MACD) flashing bearish signal, sellers are waiting for a break of current monthly low around 0.6270 in order target downward sloping trend-lines from June and May month bottoms, close to 0.6235 and 0.6220 respectively.

On the flip side, 0.6340 and 21-day exponential moving average (EMA) level of 0.6372 can restrict the pair’s near-term advances.

During the pair’s further rise beyond 21-day EMA, 23.6% Fibonacci retracement level of July-September declines, at 0.6395, and 0.6445 nearing 50-day EMA will be the key to watch.

NZD/USD daily chart

Trend: bearish