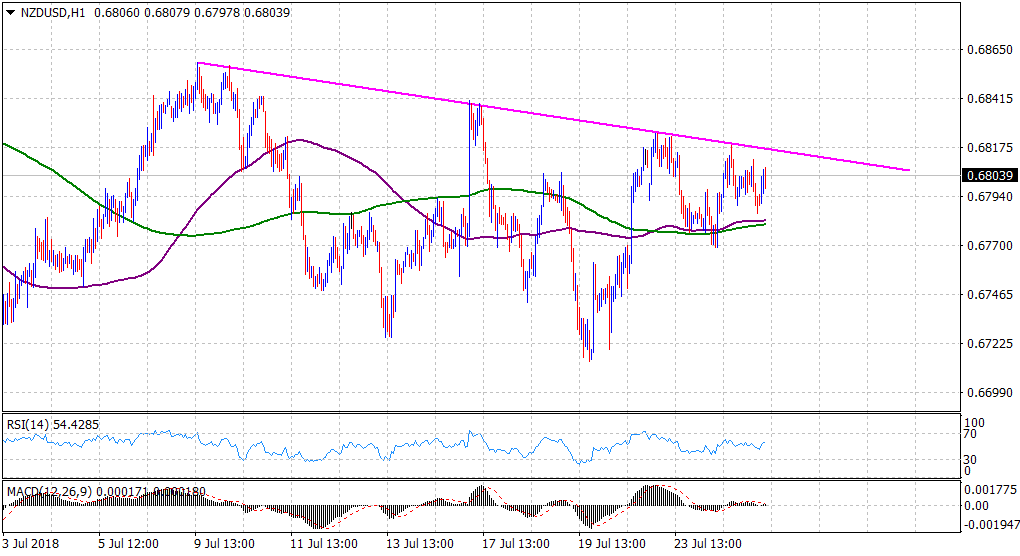

“¢ The pair’s overnight bullish momentum stalled near an important resistance, marked by over two-week old descending trend-line held since the early part of this month.

“¢ Technical indicators on the 1-hourly chart have struggled to gain any meaningful positive momentum and hence, it would be prudent to wait for a convincing breakthrough the mentioned barrier before positioning for additional gains.

“¢ Sustained weakness below 100/200-hour SMA confluence region would negate prospects for any further up-move and pave the way for a fall back towards the 0.6700 neighborhood.

Spot rate: 0.6804

Daily Low: 0.6786

Daily High: 0.6812

Trend: Bullish only above trend-line resistance

Resistance

R1: 0.6818 (descending trend-line hurdle)

R2: 0.6859 (monthly high set on July 9)

R3: 0.6900 (round figure mark)

Support

S1: 0.6780 (200-period SMA H1)

S2: 0.6747 (S2 daily pivot-point)

S3: 0.6720 (last Friday’s swing low)