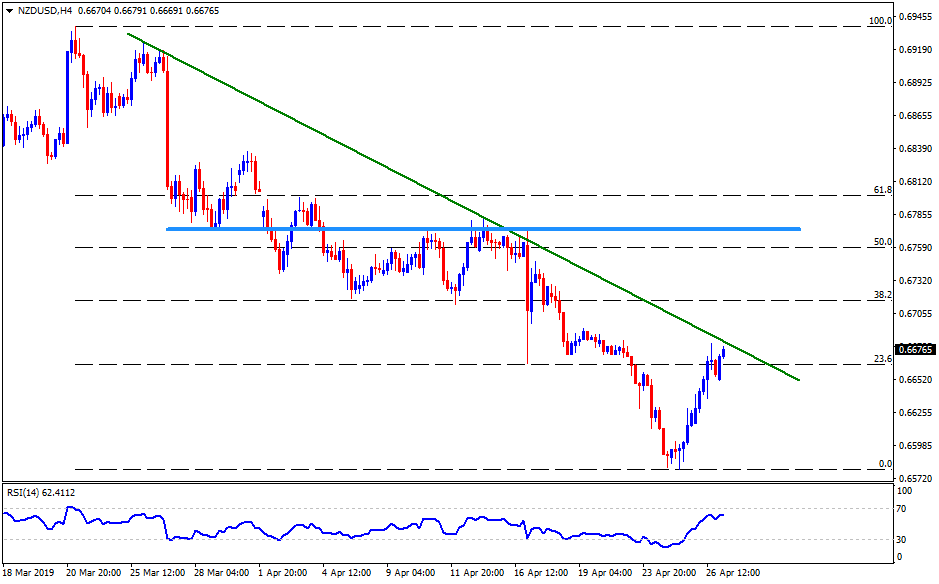

- A downward sloping trend-line stretched since late-March can challenge recent pullback.

- 0.6645 and 0.6630 can provide nearby supports.

Following its successful U-turn from 0.6580, NZD/USD presently confronts 5-week old trend-line resistance as it trades near 0.6680 on early Monday.

The pair needs to cross the 0.6685 resistance-line to validate the latest recovery and register further upside towards 0.620 and 0.6740 numbers to the north.

Though, 0.6775/80 horizontal area comprising multiple tops/bottoms marked during late-March and April could challenge buyers afterward.

Should prices rally past-0.6780, 61.8% Fibonacci retracement of March to April decline, at 0.6800, adjacent to 0.6830, can become buyers’ favorites.

On the downside, 0.6645, 0.6630 and 0.6600 can act as nearby supports for the quote prior to highlighting latest lows near 0.6580.

Additionally, 0.6510 and 0.6460 may appear on Bears’ radar if 0.6580 fails to disappoint them.

NZD/USD 4-Hour chart

Trend: Pullback expected