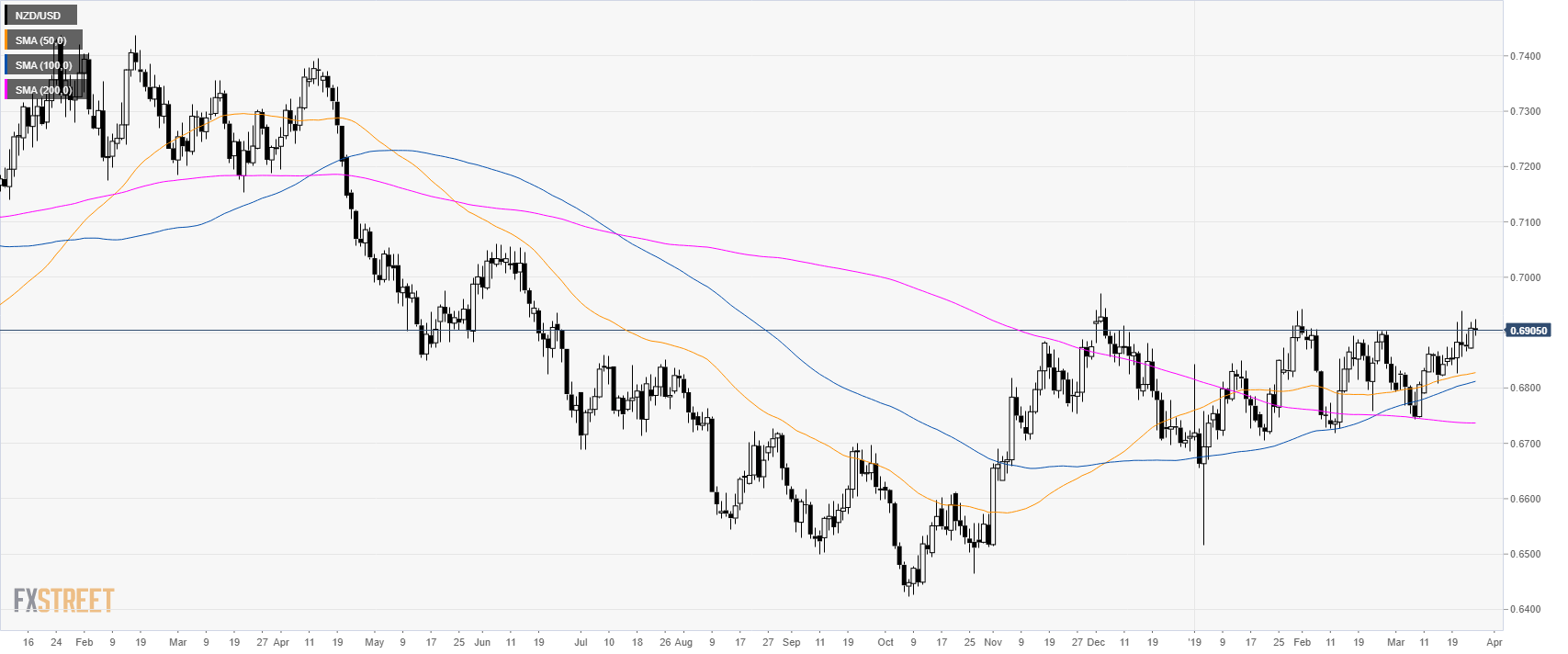

NZD/USD daily

- NZD/USD is trading in a bull trend above its main simple moving averages (SMAs).

- The Reserve Bank of New Zealand (RBNZ) will release its interest rate decision at 1.00 am GMT this Wednesday. The event can lead to high volatilty on NZD-related pairs.

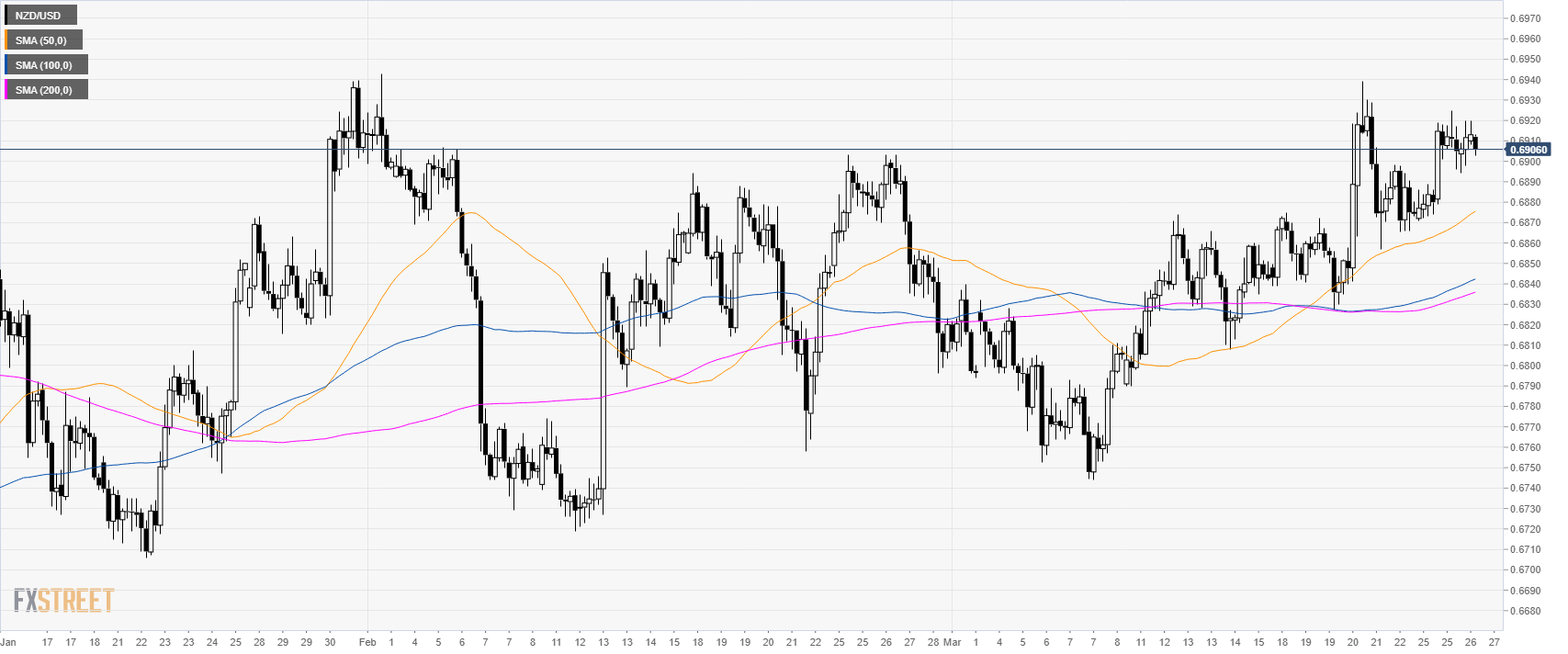

NZD/USD 4-hour chart

- NZD/USD is trading above its main SMAs suggesting a bullish bias in the medium-term.

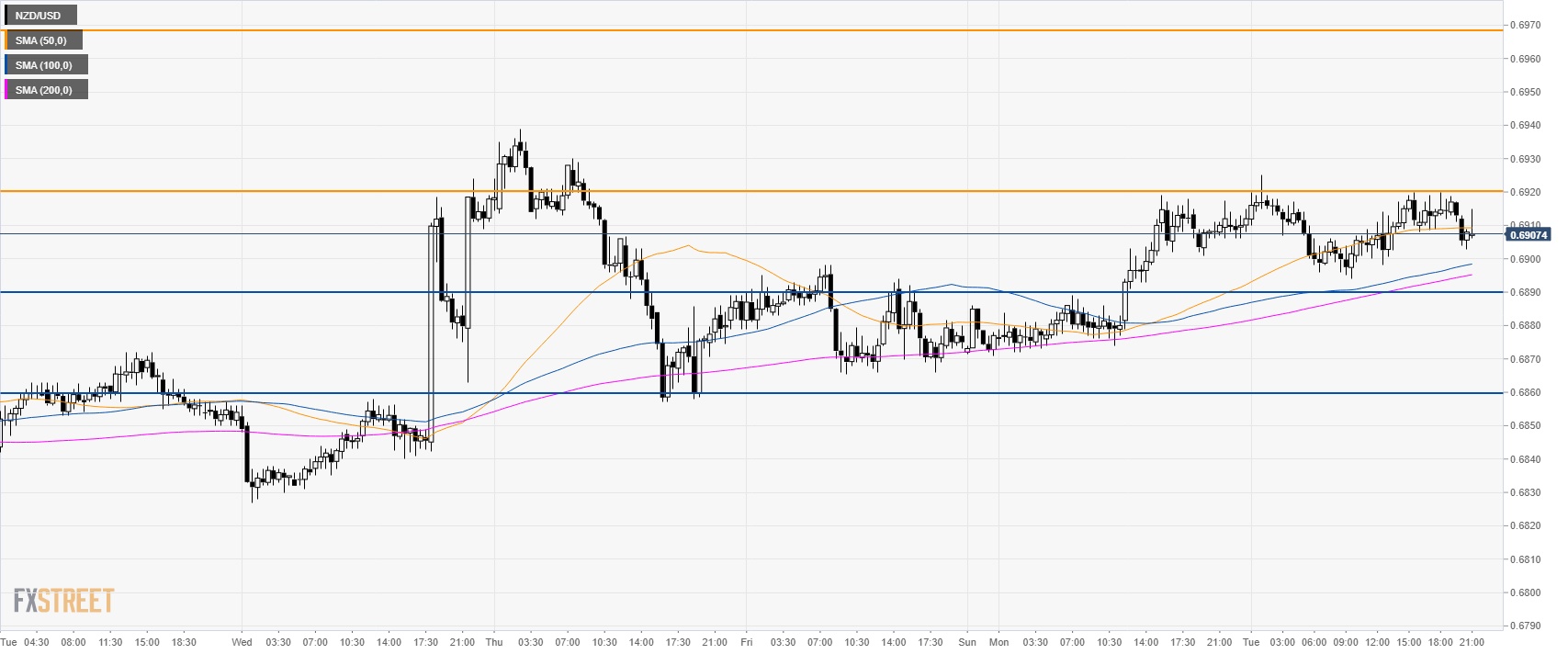

NZD/USD 30-minute chart

- NZD/USD is trading between its 50 and 100 SMA suggesting a consolidation in the short-term.

- 0.6920 is a strong resistance. If breached 0.6970 comes into play.

- Looking down, 0.6890 and 0.6860 are seen as immediate supports following the RBNZ.

Additional key levels