- Higher than expected current account balance falls short to please buyers amid lesser that forecast current account to GDP ratio.

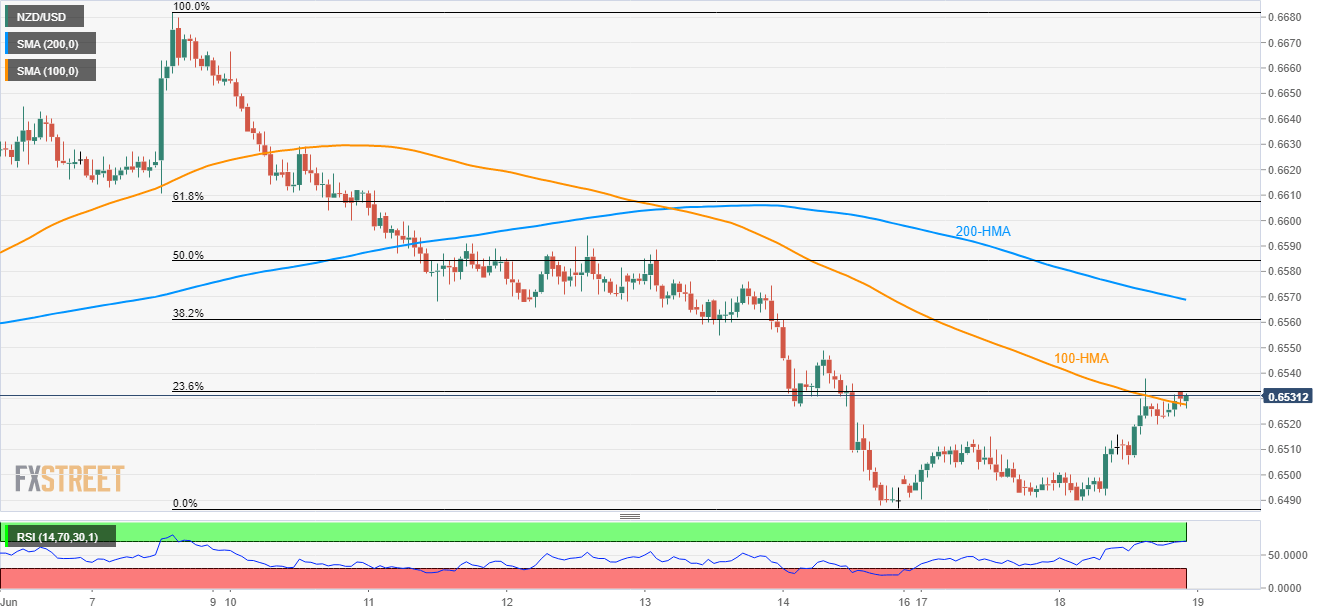

- Overbought RSI indicates pullback but 100-HMA holds the downside capped.

The NZD/USD pair showed little reaction to first quarter current account data while trading near 0.6530 during early Tuesday.

The Q1 2019 current account balance grew past $0.526 billion forecast and $-3.256 billion prior to $0.675 billion. However, the decline in the current account – GDP ratio to -3.6% versus -3.5% expected capped the Kiwi traders’ optimism.

The pair struggles between a small area occupied by the 100-hour moving average (HMA) and 23.6% Fibonacci retracement of its 12-day decline.

While an upside clearance of 0.6533 can propel the pair towards 0.6550 and then to 200-HMA level of 0.6570, 0.6515 and 0.6500 may entertain sellers past-0.6525 break.

Considering overbought conditions of 14-bar relative strength index (RSI), chances of its pullback are brighter. In that case, the latest low surrounding 0.6487 and May month bottom around 0.6480 seem the key for bears.

Alternatively, an upside break of 0.6570 might not refrain from calling 0.6600 and 61.8% Fibonacci retracement level of 0.6608 back to the chart.

NZD/USD hourly chart

Trend: Pullback expected