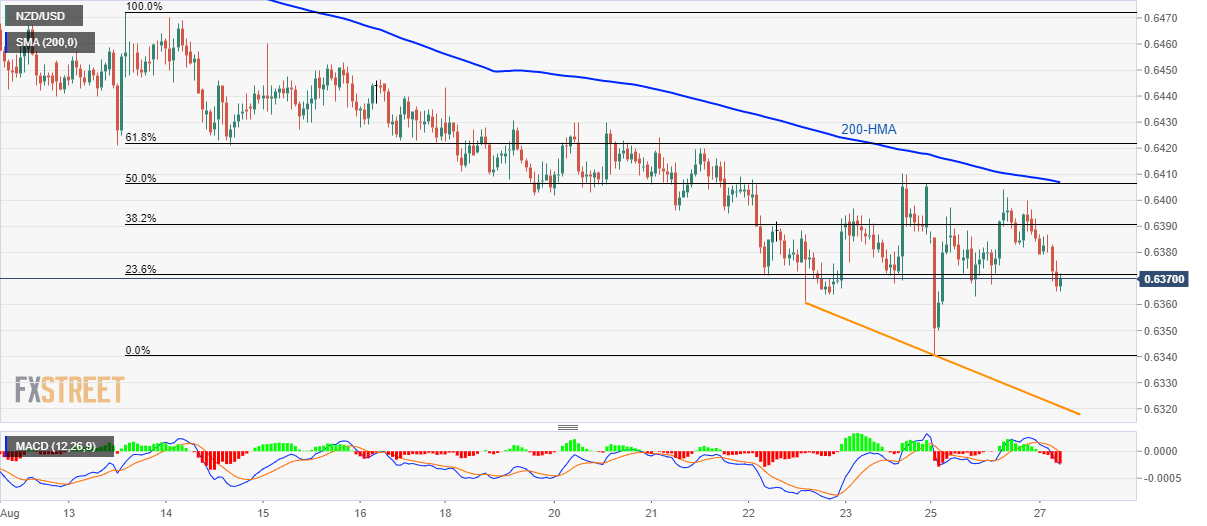

- NZD/USD slips below 23.6% Fibonacci retracement of its downpour since August 13.

- 200-HMA, 50% of Fibonacci retracement limits immediate upside.

Failure to hold recent recovery drags the NZD/USD pair to sub-23.6% Fibonacci retracement level while taking rounds to 0.6370, ahead of Tuesday’s European session opening.

The pair now aims to visit 0.6350 and Monday’s low near 0.6341. However, a downward sloping trend-line connecting Thursday’s low to latest bottom offers a rest around 0.6320.

Meanwhile, 0.6380 can act as immediate resistance during the pair’s pullback ahead of highlighting 0.6405/06 confluence including 200-hour moving average (HMA) and 50% Fibonacci retracement.

In a case where prices keep rallying beyond 0.6406, last week’s high near 0.6430 can lure buyers.

NZD/USD hourly chart

Trend: Bearish