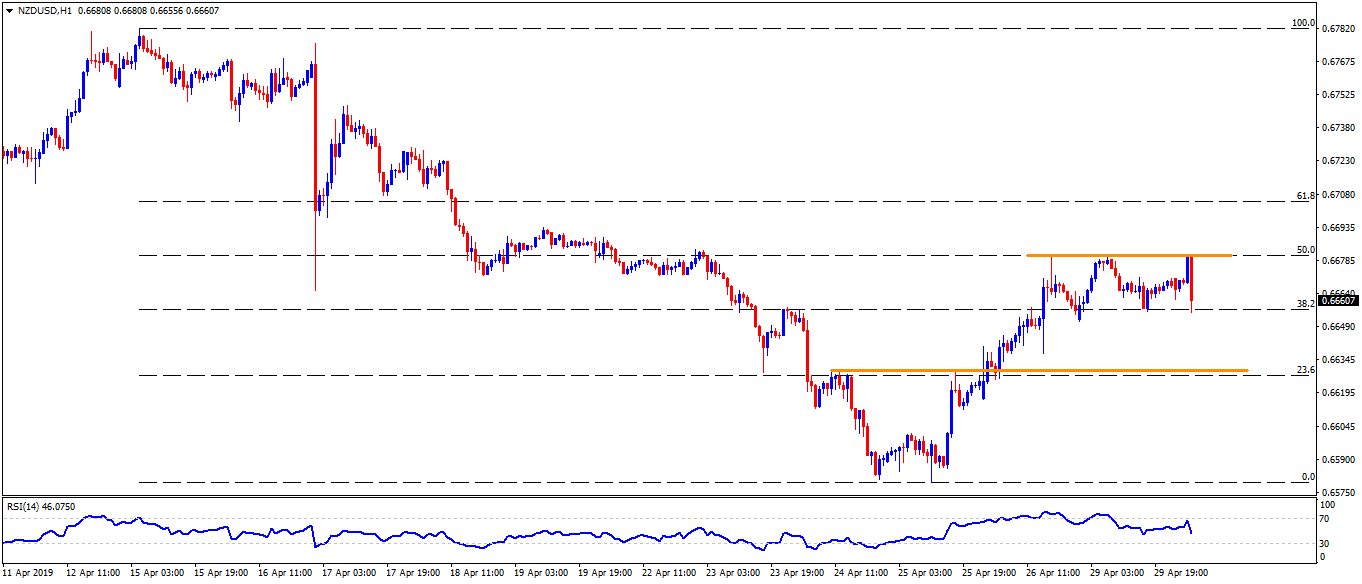

- Sluggish prints of China’s official PMI drag the Kiwi pair from nearby resistance comprising 50.0% Fibo.

- 0.6630 horizontal-support in focus ahead of China’s Caixin manufacturing PMI.

The NZD/USD pair took a U-turn from 50% Fibonacci retracement of current month declines after China’s official manufacturing and non-manufacturing purchasing manager index (PMI) data came in weaker than expected and prior.

The Kiwi pair presently trades near 0.6660 with horizontal support at 0.6630 grabbing market attention ahead of China’s Caixin manufacturing PMI data.

Given the private industry survey also follows the official figures and lag behind 51.0 forecasts versus 50.8 prior, prices may even challenge 0.6630 horizontal support and drop towards 0.6600 round-figure.

Additionally, 0.6580 can entertain sellers after 0.6600 breaks.

On the flipside, sustained break of 0.6685 resistance can trigger a recovery in direction to 0.6700 and 0.6730 numbers to the north.

Assuming buyers’ capacity to conquer 0.6730, 0.6750, 0.6770 and 0.6785 may flash on buyers’ radar.

NZD/USD hourly chart

Trend: Pullback expected