- NZD/USD recovers after China’s Caixin Manufacturing PMI beat the forecast.

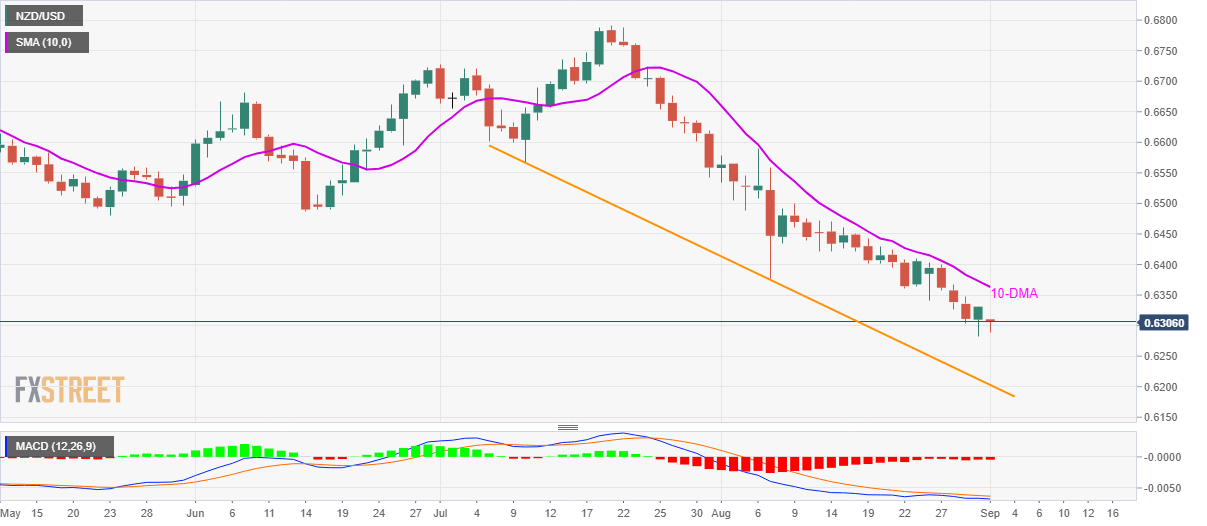

- Prices keep trailing 10-DMA with falling trend-line since early-July offering key downside support.

NZD/USD recovers early-day losses as it trades near 0.6306 during Monday’s Asian session.

China’s August month Caixin Manufacturing Purchasing Managers’ Index (PMI) surged to five-month high as it grew beyond 49.8 forecasts to 50.4.

Despite pair’s latest uptick, prices are less likely to be termed strong, not even for a short-term, as 10-day simple moving average (DMA) level of 0.6364 holds the quote confined, which if broke could trigger fresh upside to August 07 low of 0.6378 and then to 21-DMA near 0.6414.

On the downside break of the latest low surrounding 0.6283, prices can slip further south to a falling trend-line stretched since July 10, at 0.6200.

It should also be noted that 12-bar moving average convergence and divergence (MACD) is showing likely reversal of the bearish signal and can propel prices on the break of immediate resistance.

NZD/USD daily chart

Trend: bearish