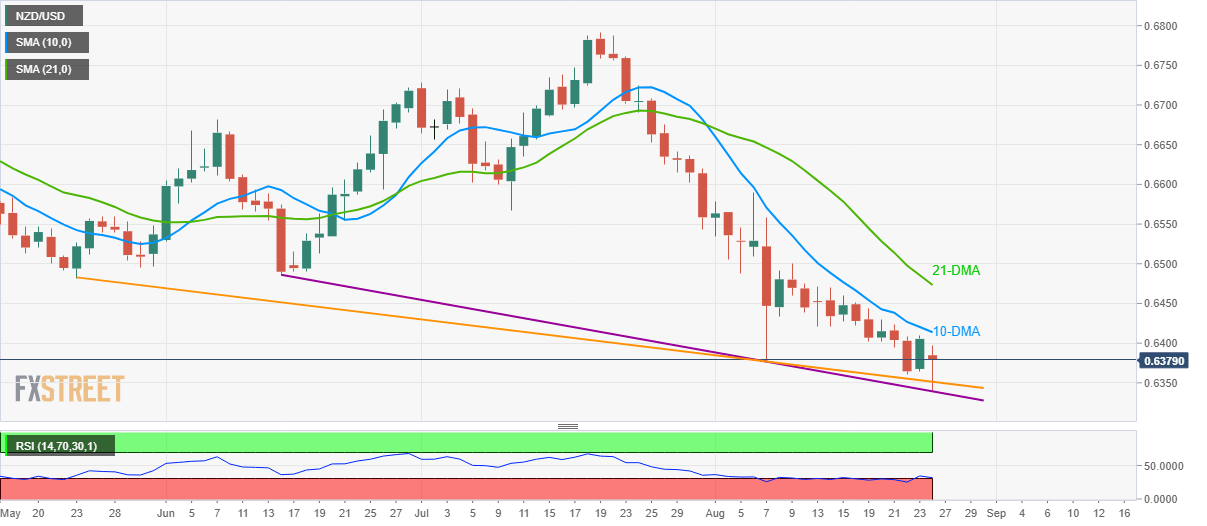

- The NZD/USD pair’s bounce off near-term key support-lines trails below 10-DMA.

- Oversold RSI conditions can please buyers till 21-DMA but May/June lows could disappoint them afterward.

Although the NZD/USD pair’s bounce off descending trend-lines from May and June calms the traders, the quote still remains beneath near-term key resistances as it takes the rounds to 0.6380 before the Monday’s European session begins.

Among them, 10-day simple moving average (DMA) at 0.6415 acts as immediate resistance ahead of 21-DMA level of 0.6475.

It should, however, be noted that 0.6480/90 area comprising lows marked in May and June becomes the tough nut to crack for the bulls.

On the downside, pair’s declines below 0.6340 open the door for fresh declines to September 2015 bottoms surrounding 0.6240.

While oversold conditions of 14-bar relative strength index (RSI) favors the pair’s pullback, nearby DMAs and May/June lows can keep prices capped.

NZD/USD daily chart

Trend: Bearish