- Traders gave little importance to mixed trade data from New Zealand.

- Immediate resistance-lines continue pleasing bears.

Despite April month trade data, the NZD/USD pair remains little changed at 0.6525 during early Friday.

April month trade data from the Statistics New Zealand flashed mixed readings and couldn’t entertain the Kiwi traders much.

The headline trade balance declined to $-5.480 billion versus $-5.465 billion forecast and $-5.710 billion (revised) prior on a yearly basis whereas growing to $433 million against $4 million MoM forecast and $922 million previous readouts.

Further, the exports rose beyond $5.35 billion expected to $5.55 billion and against $5.60 billion previous (revised) while the imports increased to $5.11 billion versus $4.90 billion expected and $4.78 billion upwardly revised prior.

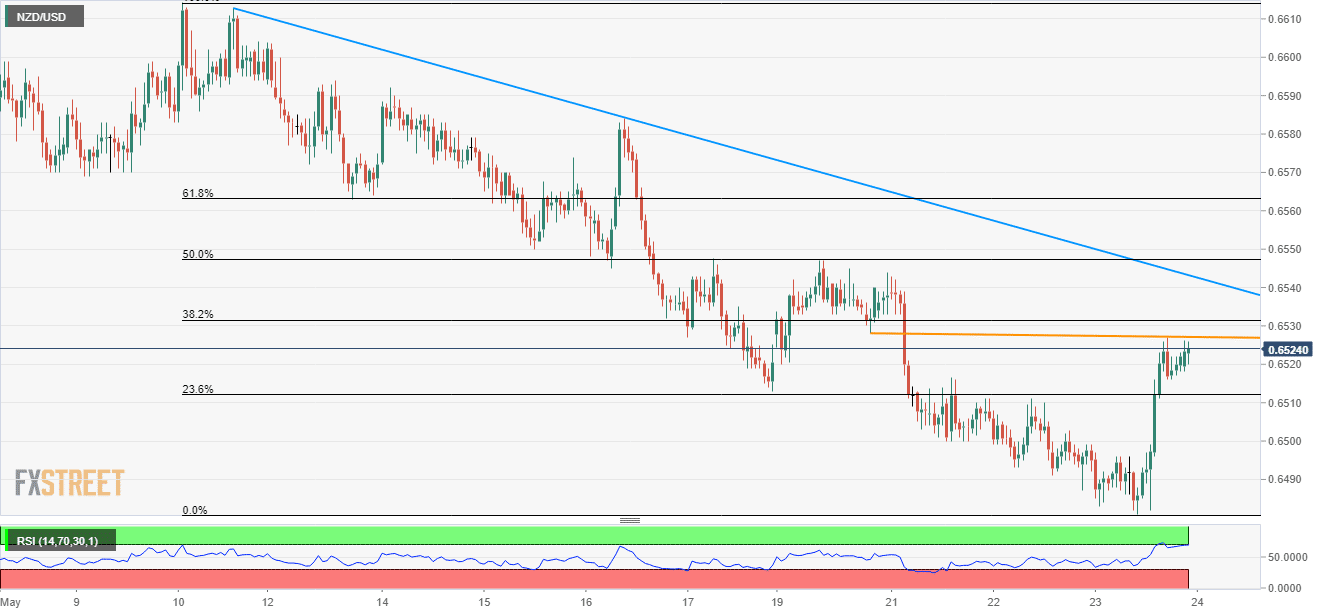

The horizontal-line connecting May 20 low to May 23 high around 0.6530 seems immediate resistance for the pair, a break of which can escalate the pair’s recovery to a downward sloping trend-line since May 10, at 0.6545 now.

In a case prices rally beyond 0.6545, 61.8% Fibonacci retracement of its current-month decline at 0.6565 and 0.6700 could lure buyers.

On the downside, 23.6% Fibonacci retracement around 0.6515 and 0.6500 seem nearby support for the quote before it can revisit 0.6480 marks.

During the pair’s further declines under 0.6480, October 2018 low near 0.6425 could become bear’s favorite.

It should also be noted that 14-bar relative strength index (RSI) is near to overbought region and also favor the sellers.

NZD/USD hourly chart

Trend: Bearish