- Good economic results in New Zealand drive a small recovery for the pair.

- The week closes with a downward trend after the rise of the DXY.

- Fed announcements weakened the US Dollar and allowed an uptrend.

The NZD/USD weekly analysis gives a mix sentiment. The stronger Greenback keeps the Kiwi under pressure ahead of key events.

During the week, the NZDUSD pair continued with a lateral movement and still does not show firm signs of recovery from the fall suffered last June. Even so, it managed to increase its price above the levels with which it closed last week but without ever exceeding the peak of that week. This upward price is due to the good news from New Zealand and the weakening of the US Dollar, mainly attributed to the weak position of the Fed.

–Are you interested to learn more about buying cryptocurrencies? Check our detailed guide-

This price stability can be attributed to the fact that traders have already reflected on the latest trade data from New Zealand. In addition, the strong local and international demand generated after the opening of the economy is causing a strong recovery of the New Zealand economy.

New Zealand’s statistics agency reported record growth in exports to levels of NZ $ 6 billion in June. This represents an increase of 17% over last year. Growth was driven mainly by timber and logs exports due to demand from the housing construction sector in most countries.

Additionally, imports showed good signs. New Zealand imported more than 5700 million New Zealand dollars in June, leaving a trade surplus of more than 261 million New Zealand dollars.

In addition to having a good month of June, the entire second quarter saw an increase in exports to levels of 17.2 billion NZD.

All these factors, along with the weakening of the US dollar after the Federal Reserve announced that it will not change interest rates, caused a slight recovery in the middle of the week. However, this Friday, with the DXY rising to levels close to 92.00, the NZD / USD pair started a small downward trend.

Important events for next week

For the next week, there are important events for the NZDUSD pair. Mainly on the US dollar side. Probably the most important will be the release of the unemployment rate, which was mentioned by the Fed president as an important indicator for raising interest rates in the future.

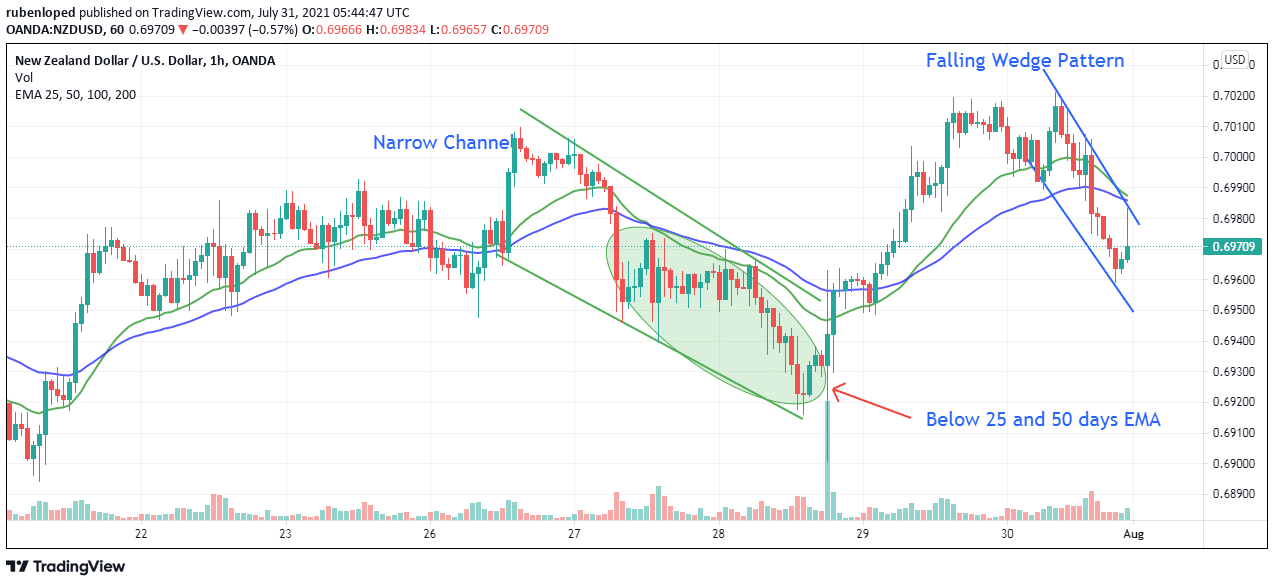

NZD/USD technical analysis: Falling wedge pattern predicts uptrend

The NZDUSD remained with a narrow margin hovering near the lower limits of the channel, even crossing below the 25 and 50 days EMA. This performance predicted a downward trend. However, after the Fed’s press conference and the publication of New Zealand’s good economic results in the second quarter, the trend began to reverse. As a result, the NZ dollar gained ground against the US dollar.

–Are you interested to learn more about forex robots? Check our detailed guide-

However, on the last day of the week, the trend reverted again. The latter moves appear to form a falling wedge pattern where the pair’s value stays at the top of the figure, which predicts an upward breakout.

NZD/USD next week forecast

It is expected that for the next week, the NZDUSD will consolidate its levels with a small upward trend, possibly exceeding the 0.7000 barrier, although the most probable levels are between 0.6930 and 0.6975.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.