- NZD/USD gains 1.75% this week as Greenback loses ground.

- The 10-year bond yield spread may continue to widen and support the NZD.

- Powell came up with a hawkish tone in Jackson Hole, but investors remained unmoved from their dollar sell-off positions.

- US NFP is the key event next week that may impact the pair.

The NZD/USD weekly forecast is bullish as the week records five straight days of gains in the week as Greenback loses ground across the board.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

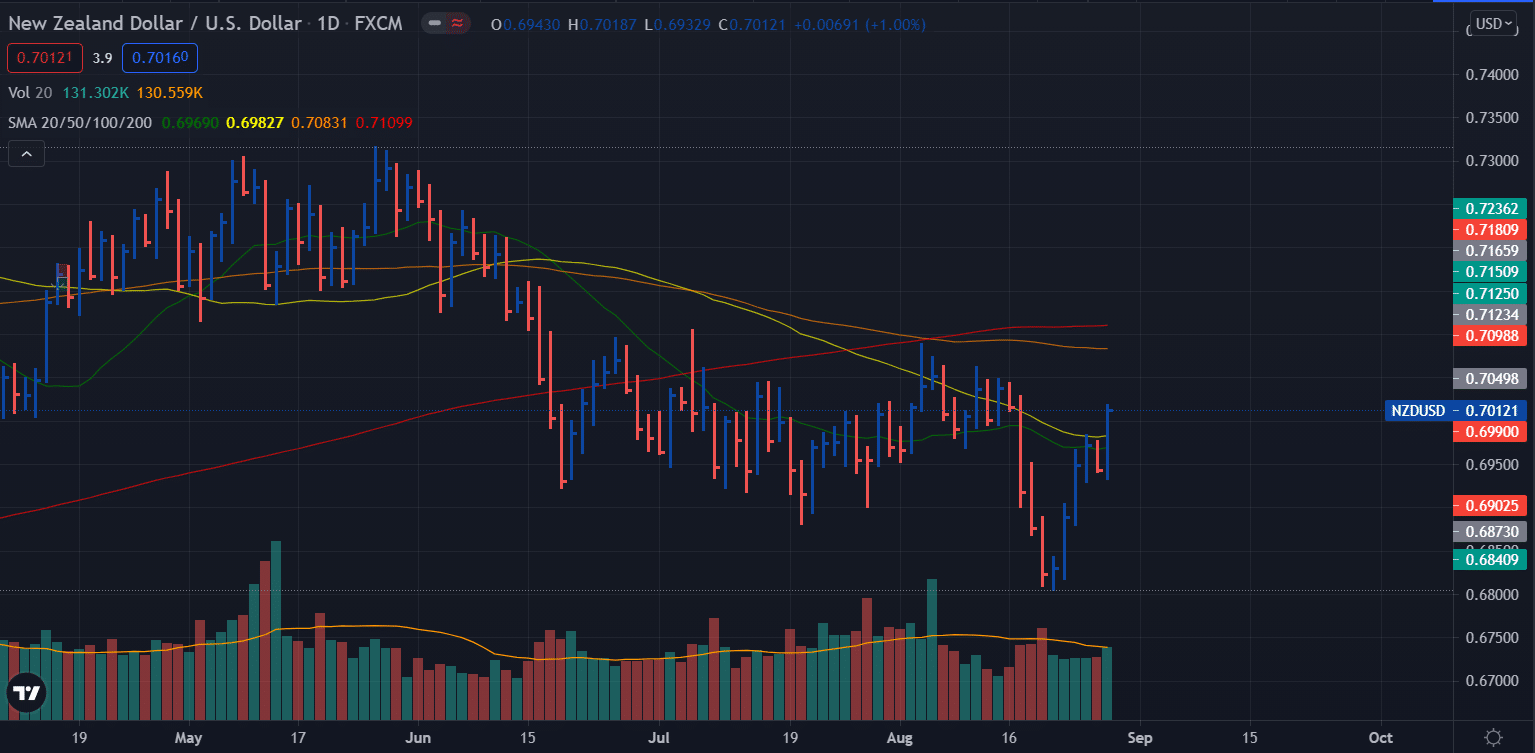

Over the past week, the NZD/USD pair has gained more than 1.75% against the US dollar, with the pair trying to get back above a key technical zone we have monitored for several months.

In all directions, the NZD/USD has been affected decisively by the 10-year yield differential between NZ and the US. Bond purchases increased, and yields dropped as a result of the Jackson-Hole result. NZD’s direction can be influenced when one side of the equation experiences a decline.

Chair Powell and other FOMC officials, however, changed their voice in a relatively hawkish way. Powell acknowledged that significant progress has been made toward meeting the Fed’s price stability requirements, along with further improvement in the labor market.

Specifically, Powell suggested that if the economy grows as expected this year, it might be a good idea to taper asset purchases. In any case, stocks didn’t care at all about Powell’s wording, as investors clung instead to his pledges to continue maintaining favorable financial conditions.

The Fed chair commented on the possibility of more harm than good from proactive responses to inflationary pressures, noting that the shift to an average inflation target from last year is well suited for the current situation.

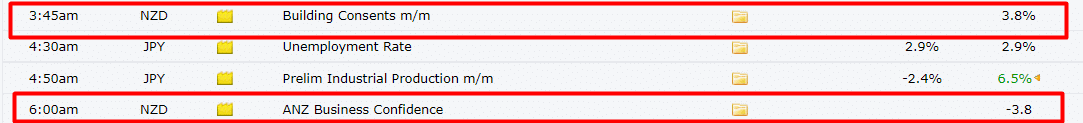

Key data from New Zealand during August 30 – September 03

There is no significant data from New Zealand next week. On Tuesday, we have building consent and ANZ business confidence data releases. However, no major impact is expected on the volatility.

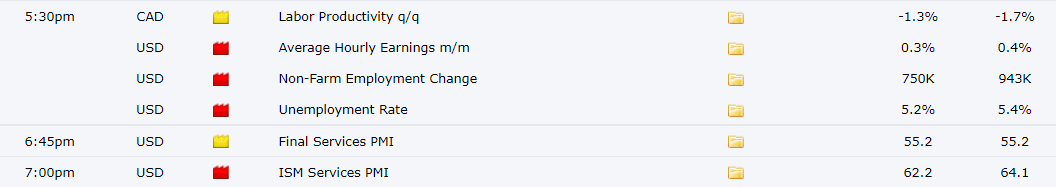

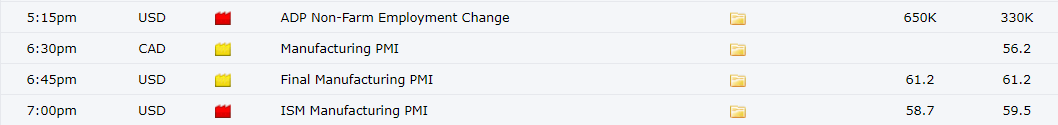

Key data from the US during August 30 – September 03

The most important event next week in US NFP which is expected to decline to 750k as expected to 943k jobs created in July. The ADP nonfarm employment numbers are expected to rise to 650k against 330k reading of July. ISM PMIs for manufacturing and services are also expected next week that may provide some impetus to the market.

–Are you interested to learn more about making money in forex? Check our detailed guide-

NZD/USD weekly technical forecast: Key SMAs to support

This week, the NZD/USD pair maintained a continuous 5-day winning streak, rising back above the 0.7000 mark on Friday while closing the week. The pair managed to close above the 20-day and 50-day moving averages. The next upside target lies at 0.7080 (100-day moving average) ahead of 0.7110 (200-day moving average).

On the flip side, the pair has a support zone at 0.6950-70 (confluence of 20/50 day moving averages). Furthermore, the swing lows at 0.6900 and 0.6800 can provide support.

Although the pair has a tendency to retrace the weekly gains next week, it may continue the upside as a path of least resistance lies above the 0.7000 mark.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.