- NZD/USD pair plummeted this week as risk sentiment remained deteriorated.

- FOMC meeting minutes and COVID in NZ put more weight on the Kiwi.

- RBNZ refrained from increasing the OCR that further fueled the bears.

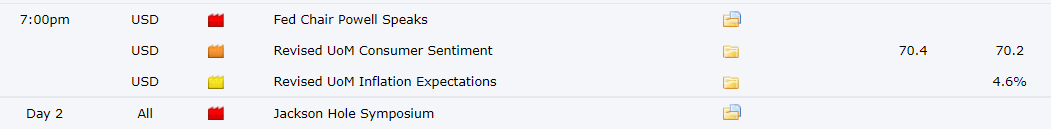

- Next week, the entire focus of the market lies on Jackson Hole Symposium.

The weekly forecast for the NZD/USD pair is strongly bearish after it posted a fresh multi-month low amid prevailing risk-off sentiment, Delta variant cases in the country and Fed tapering.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

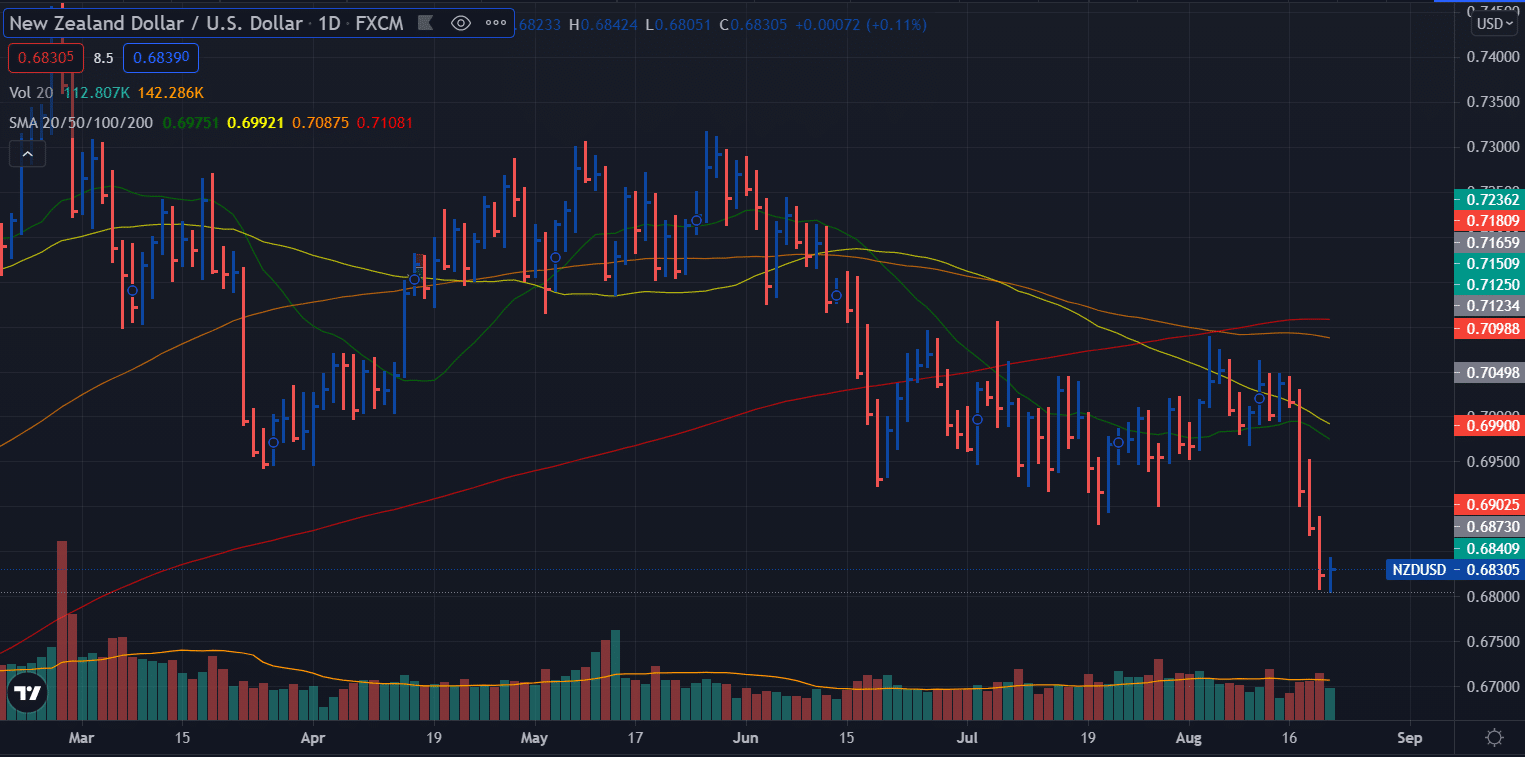

The NZD/USD pair started the week positively from 0.7038 but could not hold on to the previous week’s gains and fell to the fresh yearly lows near the 0.6800 area. The week closed at 0.6830, with a net loss of 208 pips after a slight gain on Friday.

July’s FOMC meeting minutes released on Wednesday stated the Fed’s plan to curtail the asset purchase program by the end of the year. They also showed the intent to raise the rates, but the timeline for the rate hike is not clear. Although divided as the concerns for inflationary pressure, slow recovery and unemployment still hovering around the heads. Moreover, the spread of Delta variants worldwide can keep the Fed a little cool to hike the rates.

The next week’s important event in Jackson Hole Symposium and Fed is expected to reveal its strategy to cut the quantitative easing

COVID fears in New Zealand

The New Zealand dollar plunged this week as the first Delta variant case was found in Auckland, which resulted in the immediate lockdown. Later, few more cases were found in Wellington as well. However, it is estimated that the infection will see a rise in the country, and as a result, economic recovery will be slowed down.

RBNZ’s changed stance

RBNZ was expected to raise the OCR by 25 bp, but the Delta variant case found a day before left the central bank in a perplexing situation. As a result, the bank left the rates unchanged that further weighed on the currency. However, the central bank is still positive about the NZ economy and may raise the OCR in its next meeting.

Is Jackson Hole really worth all the hype?

In the past, investors have viewed the Federal Reserve as a convenient reason to announce economic strangulation. As a result, past economic symposiums have often served as a venue to showcase key policy developments.

The Fed has been swaying right, left, and center lately, which has led to increased concerns about how the markets will be treated during the event on August 26-28. The minutes of the July FOMC meeting showed the policymakers were split over the timing and pace of the reduction even though they agreed that a cap needed to be implemented quickly.

Key data releases from New Zealand during Aug 23-27

- Core retail sales q/q: The figures are due on Tuesday. It is expected that the number will decelerate to 1.9% against the previous reading of 3.2%. It will be no surprise if the market meets expectations.

- Retail sales q/q: Retail sales are expected to slide to 2% against the previous reading of 2.5%. This is a gauge of market sentiment, and downbeat data may exacerbate selling.

- Trade balance: The trade balance is expected to drop to 100M against the previous figures of 261M.

Key data releases in the US during Aug 23-27

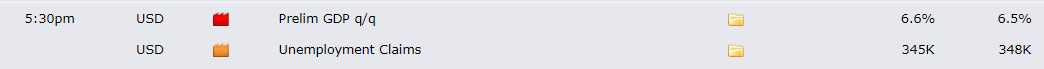

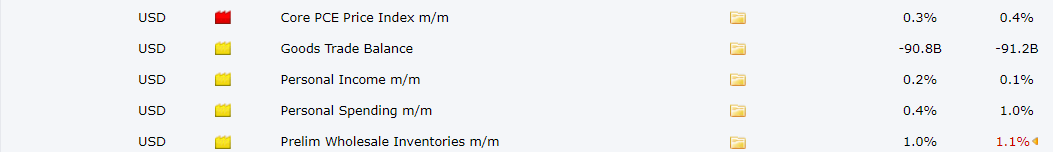

- Prelim GDP q/q: GDP is a primary gauge for economic health. The number is expected to slightly rise to 6.6% against the previous quarter’s reading at 6.5%. Upbeat figures will strengthen the odds of tapering/rate hikes.

- Unemployment claims: The weekly unemployment claims are likely to decrease to 345k against the previous week’s reading at 348k.

- Core PCE price index m/m: This is one of the most observed indicators to gauge the inflation and economic health of the US. The previous reading was quite dismal that had sent the dollar down. Coming reading for July is expected to slide further to 0.3%. However, any surprise (upbeat figures) can provide further support to the rising Greenback.

- Fed Chair Powell speaks: Investors will look for further clues about tapering and rate hikes on Friday.

- Jackson Hole Symposium (Aug 26-28): The three-day event is the most important release next week. Fed is likely to outline the plan for tapering in the symposium.

NZD/USD weekly technical forecast: 0.6800 looks vulnerable to hold

The NZD/USD pair pierced below the key 20 and 50 days moving averages. Meanwhile, the pair remained capped by 100 and 200 days moving averages last week. The pair has plummeted towards the 0.6800 area with the rising volume. The Friday was seen as a breather as the pair recovered 20-30 pips. However, the volume was too low, which means that the market participants are not yet ready to enter long positions.

–Are you interested to learn more about forex signals? Check our detailed guide-

The bears can aim for 0.6800 ahead of 0.6740 followed by 0.6680. On the upside, the pair may aim or 0.6900 followed by 0.6945 and then 0.7000. However, bulls need to sustain beyond the 0.7000 mark to shift the bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.