- NZD/USD started the week with losses but gained traction later and closed the week in green.

- Dismal US data and falling yields helped the Kiwi.

- Market awaits RBNZ cash rate decision and statement next week.

The weekly forecast for the NZD/USD pair is bullish amid Dollar sell-off and probable rate hike by the RBNZ. The NZD/USD pair remains positive as the dollar continues to weaken ahead of the week. The yield on 10-year US Treasuries fell more than 1% on the day, and the US dollar index fell 0.52% to 92.51.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

As reported earlier, New Zealand’s PMI improved from 60.7 in June to 62.6 in July. The indicator turned out to be better than market expectations (56.6) but did not cause any market reactions.

The University of Michigan Consumer Sentiment Index dropped to its lowest level since 2011. The decline in investor confidence in Germany was accompanied by this. While we were expecting a drop, the magnitude of it surprised us.

A monetary policy announcement by the Reserve Bank of New Zealand will highlight next week’s calendar. RBNZ may have concerns about a fast-growing delta option, especially with Australia locked in and a 90% chance of a rate hike to come. With this in mind, New Zealand’s domestic economy looks set to enjoy a robust recovery. Labor market conditions have returned to pre-pandemic levels, property prices are rising, and inflation is rising globally. So, a rising NZD is likely if they are wandering with plans to do more. If they raise rates but are careful, the NZD could be sold despite tightening.

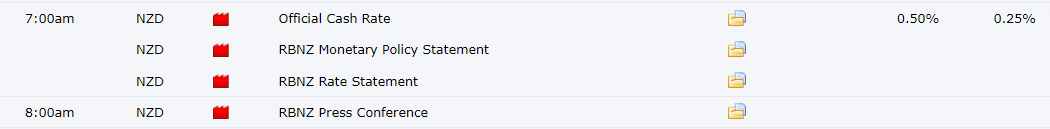

New Zealand’s key economic events during Aug 16-20

The official cash rate is followed by RBNZ’s policy statement and the meeting are key events next week. It looks highly probable that the RBNZ will raise rates. However, a policy statement is important to find the hawkish clues.

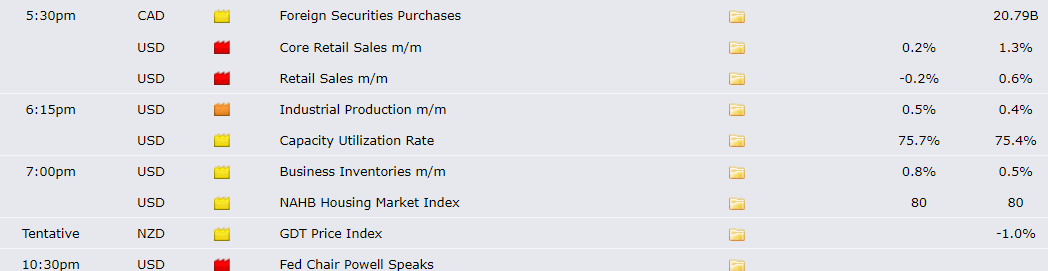

America’s key economic events Aug 16-20

The risks appetite and stocks will be closely monitored next week. In addition, the calendar is rife with event risk. US retail sales are expected to be the most important release for the dollar, along with the minutes of the recent FOMC meeting. Fed Chair Powell’s speech is due on Tuesday as well. However, not much is expected from the event. It is expected that costs will decline, and a decline could lead to a sharp sell-off.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

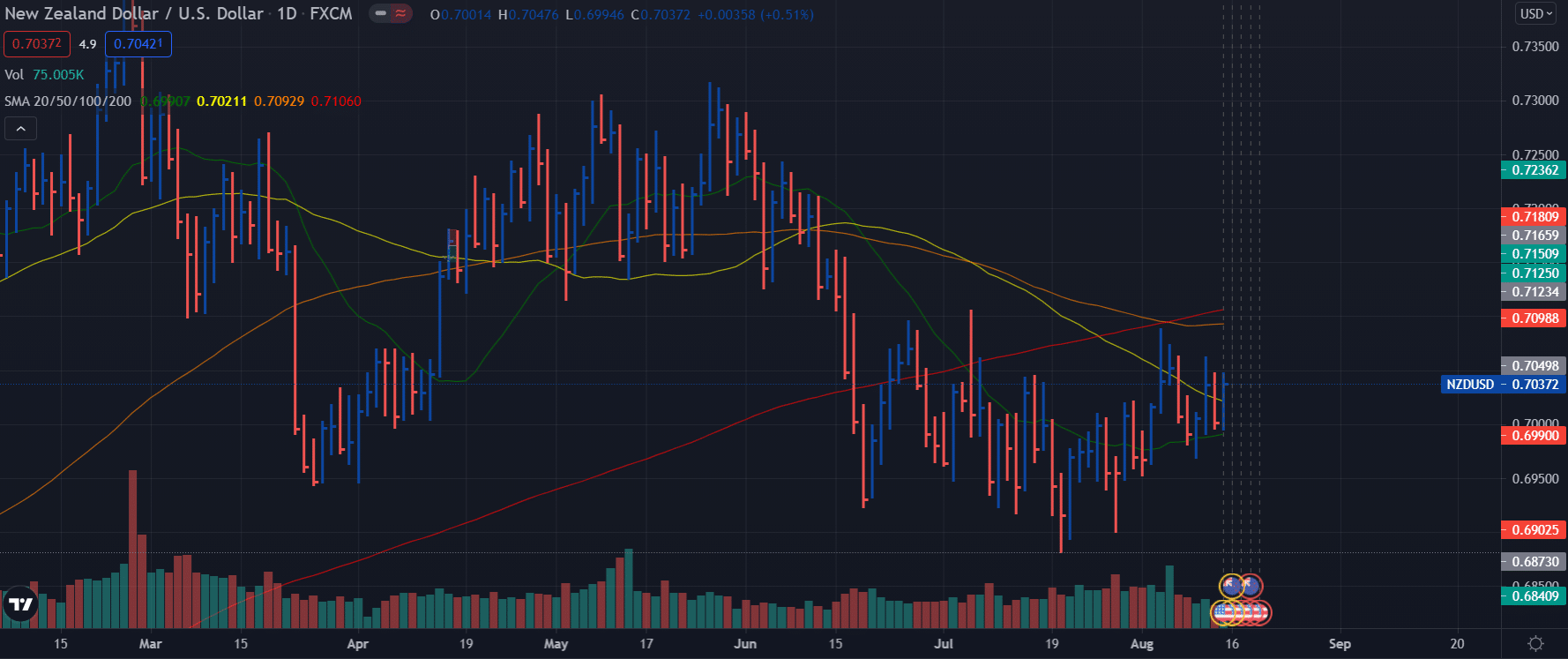

NZD/USD weekly technical forecast: Bulls may not be strong enough

The NZD/USD pair started rising from Tuesday and posted weekly highs at 0.7064. However, the pair saw ups and downs later and closed the week positively at 0.7037. The price managed to climb above the 20-day and 100-day SMAs. It is clear that bulls are quite active. However, the convergence of 50-day and 200-day SMAs on the upside may provide selling pressure on the pair. Overall, the price seems to stay rangebound and may not be able to find a clear bullish breakout unless a catalyst comes into the play.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.