- The strength of the US dollar slows the uptrend of the NZD/USD pair.

- The Kiwi is seen as a risky currency as concerns about delta variant grow.

- According to Fed authorities, there could be changes in monetary policy later this year or early 2022.

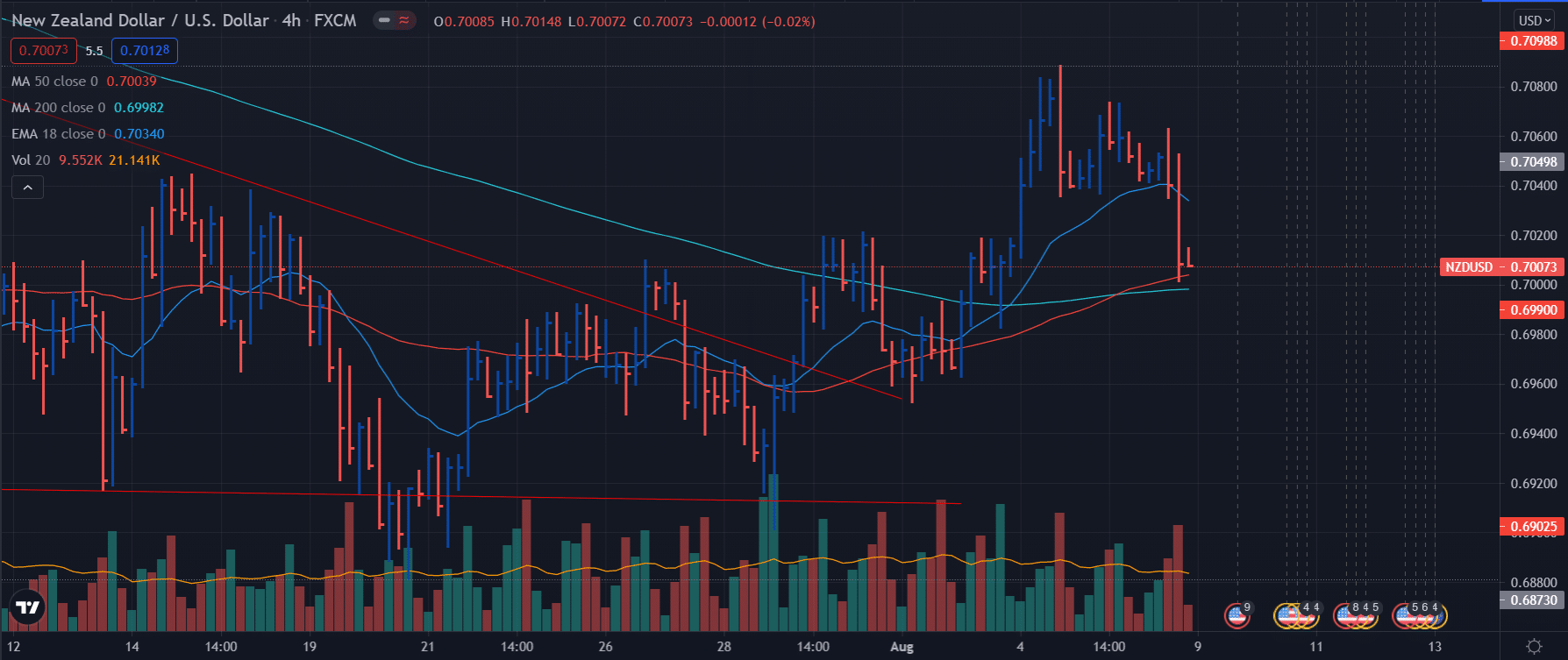

The weekly forecast of the NZD/USD pair is neutral after a fall on Friday. The pair closes the week with a drop that cuts a streak of growth during the week but still remains above 0.7000. The fall was triggered by the release of strong non-farm payrolls figures in the United States for July.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Global concerns about the spread of the delta variant that threatens to slow down the global economic recovery negatively affected the Kiwi, which is seen as a risky currency. On the other hand, the US dollar was strengthened by expectations of an increase of interest rates for next year and a sharp rise in US Treasury yields.

Fed Vice President Richard Clarida said that in 2022 the necessary conditions could exist for an increase in the interest rates and pointed out movements to reduce the purchase of bonds at the beginning of next year or even at the end of this year.

Even so, investors were cautious and avoided making aggressive bullish movements waiting for the US labor results that had not been published at the moment. Now that the positive results are known, an even greater strengthening of the US dollar is expected, with which the price of the NZD/USD pair can see more decline.

Upcoming Events

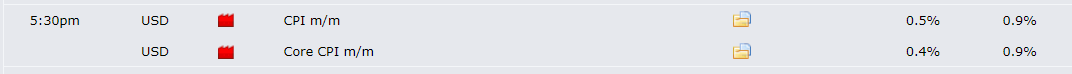

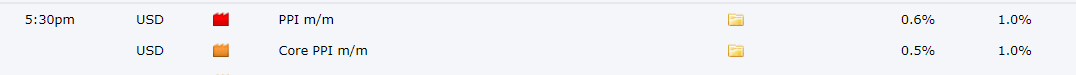

During the coming week, special attention should be paid to events related to the inflationary behavior of the currency during July. The consumer price and producer price index will be published next week. It is important to remember that the CPI is one of the aspects that the Fed authorities are monitoring to decide on a future change in their monetary policy.

–Are you interested to learn more about forex signals? Check our detailed guide-

NZD/USD weekly technical forecast: 200-day SMA to cap gains

Given the break of the 200-day SMA level, the context seems to favor bearish traders. However, at the end of the week, the NZD/USD pair closed just above 0.7000. The moving averages are still pointing for an uptrend. So, we should wait for a test of the resistance zone at 0.7145.

NZD/USD forecast next week

The main scenario of the NZD/USD for the coming week is an unsuccessful attempt to break above the 0.7145 resistance level and then rebound and fall below 0.7000 level. However, if the fall does not occur, this means a sign of strength for the pair that would be accompanied by a strong rise towards a resistance level at 0.7145.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.