- NZD/USD maintains a bullish outlook for the week.

- Although the Greenback regained some strength, Kiwi still seems buoyant.

- Improve risk appetite keeps lending support to the NZD/USD.

The NZD/USD weekly outlook maintained its buying tone during the weak. Although it retreated slightly and posted fresh weekly lows at 0.6880 area in the first half of the week.

After a slight decline, the NZD/USD pair could recover its positive momentum on the last day of the week and reached a four-day high at 0.6989. As evidenced by the generally positive tone in equity markets, risk appetite was seen as a key factor supporting the riskier Kiwi.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Meanwhile, concerns about the economic impact of the proliferation of the Delta option are pushing demand for the secure US. In addition, the rise in US Treasury yields supported the Dollar. This, in turn, is holding back the growth of the NZD/USD pair, at least for now.

Therefore, it would be prudent to wait for subsequent buying and only then bet on the retracement extension from 0.6880 (the lowest level since November 2020). Market participants are now eagerly awaiting US economic performance, including PMI data for meaningful trading momentum.

This, along with the yield on US bonds, affects the dynamics of the US Dollar. Going forward, traders will consider risk appetite to look for short-term opportunities in the NZD/USD pair.

The Dollar ends the trading week with a slight strengthening against the opening price on Monday. Throughout the week, the American currency made versatile fluctuating movements against the backdrop of emerging and fading intentions of market participants to take risks. At the same time, at the moment, the market’s attention will now shift to the upcoming meeting of the US Federal Reserve System next week.

Risk appetite among investors recovered as strong Wall Street numbers helped investors regain some of the confidence, they had lost over earlier fears that the Delta variant of the coronavirus could derail the global economic recovery.

–Are you interested to learn about forex robots? Check our detailed guide-

What to watch next week for NZD/USD?

The economic calendar for the next week reveals some low tier NZD data that may not leave a significant impact on the NZD/USD outlook. However, the Dollar side has some key events to watch. It includes CB consumer confidence data due on Tuesday. The market is expecting no major change in the numbers. However, any surprise can trigger volatility in the market.

Next, we have the US federal funds rate along with the FOMC statement. Although there are no chances of any change in the rates, the tone of FOMC matters a lot. If the Fed hints of any rate hike sooner, the Greenback can gain strength.

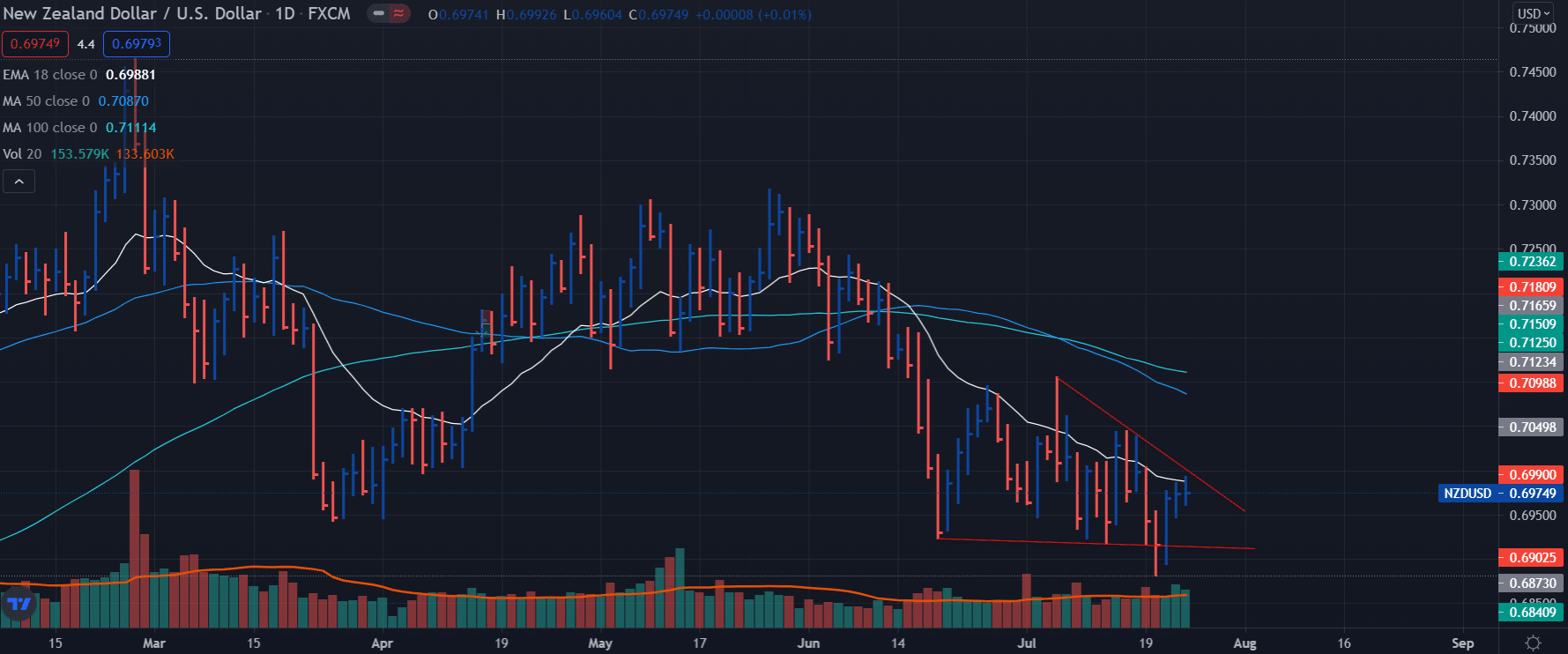

NZD/USD weekly technical outlook: Bulls boiling for a breakout

The NZD/USD pair has been squeezed in a narrow triangle on the daily chart. The 18-day EMA is keeping a lid on the gains. The 50 and 10 DMAs are also pointing down. However, the pair has a tendency to breakout of the triangle as the volume is rising with a price rise. Hence, the higher probability lies in a bullish breakout.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.