- The NZD/USD is sidelined around 0.68, having created a big bearish outside-day candle on Thursday.

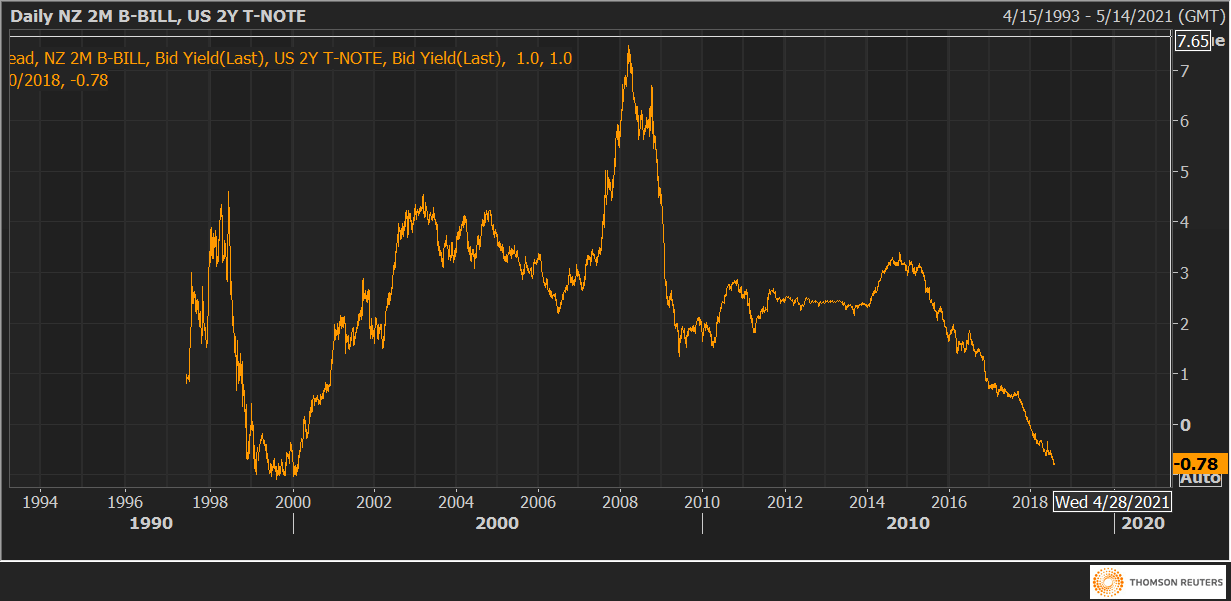

- The yield differential continues to drop in the NZD-negative manner.

The NZD/USD pair is currently trading at 0.68 and could feel the pull of gravity as the spread between the New Zealand and US bond yields continues to drop.

The currency pair has created a narrowing price range (or pennant pattern) since July 3

The Kiwi dollar had picked up a bid in the first half of the last week, raising prospects of a bullish pennant breakout. However, Thursday’s bearish outside-day candle poured cold water over the optimism generated by the pair’s recovery from 0.6714 (July 19 low).

This should not come as a surprise as the yield differential is falling in the USD-positive manner. For instance, the 2Y NZ-US yield spread has dropped more than 20 basis points this month and currently stands at -0.78. Meanwhile, the 10Y NZ-US yield spread has hit a 2.5-month low of -0.20.

Looking ahead, the currency pair will likely continue tracking the yield differential and CNY exchange rate.

NZD/USD Technical Levels

Resistance: 0.6801 (5-day moving average), 0.6851 (July 26 high), 0.6873 (50-day moving average).

Support: 0.6862 (previous day’s low), 0.6714 (July 19 low), 0.6688 (July 3 low).

Two-year spread